Multiple rigs drill for oil in the Permian Basin. (Source: GB Hart/Shutterstock.com)

When it comes to generating free cash flow, finding optimal spacing dynamics between wells has the potential to add millions of dollars to the financial coffers of oil companies.

Though there is no magic number of steps—or rather feet—to take in each basin, given varying geologies and completion methods, the up-spacing trend that surfaced a few years ago appears to have taken root in the Permian Basin for some operators, according to Bernadette Johnson, vice president of strategic analytics for Enverus.

The trend has evolved amid continued pressured on oil companies to generate free cash flow as they cope with challenges posed by lower demand due to the global coronavirus pandemic and oil price volatility. Focus remains on perfecting well performance and improving economics to boost bottom lines as activity picks up following a dismal 2020.

Numerous variables such as geology along with drilling and completion techniques and timing factor into well performance as well, but spacing designs are a key piece of the puzzle, Johnson told attendees of the AAPG Global Super Basins virtual conference on Jan. 25.

During the conference, she dove into the economics to illustrate the impact of spacing using three potential development scenarios: four wells per section with 1,491-ft spacing, eight wells per section with 691-ft spacing and six wells per section with 865-ft spacing. The 30 wells were completed by Noble Energy, which has since been acquired by Chevron Corp., in Reeves County, Texas, in May 2018.

At $55/bbl oil and $2.30 gas, “with the 691-foot spacing program, you get an NPV of about $5.6 million. That’s a good thing,” Johnson said. “That’s an IRR about 35%. That’s a solid well. A lot of operators would love to have that one.”

However, slighter wider spacing—at 865 ft—more than doubles the NPV and pushes the IRR to 65%. “What this means for free cash flow is meaningful,” Johnson said.

“If there were eight wells per section at 691-foot spacing, it would have generated about $223.8 million [worth] of free cash flow. But with six wells per section instead—a little bit wider spacing—now it’s $474 million,” she explained. “So, choosing to space a little bit wider section, six instead of eight, potentially added $250 million of free cash flow to Noble’s Reeves County assets.”

Economics highlight the importance of spacing, if the resources are present, combined with completion design, the timing of drilling and ultimately, free cash flow, Johnson said. “This is the dynamic that we’re going to see operators employing going forward.”

Several operators have already seen the benefits of wider spacing. Occidental Petroleum Corp., for example, up-spaced significantly between 2018 and 2019 and saw a positive impact on produced oil per perforated foot, Johnson pointed out.

Noble, which also saw gains, was among the companies that grew their undeveloped potential by wine-racking, or staggering wells—another dynamic unfolding, she said.

However, wider spacing doesn’t always result in the highest EURs. But it may be more economic. Location, even within a basin, matter.

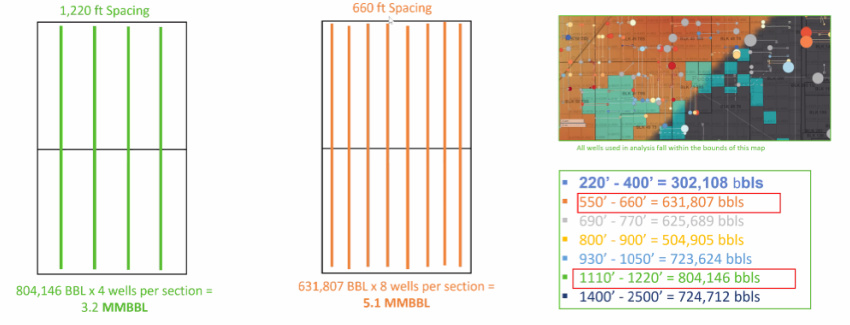

She used seven distinct buckets of primary [nearest neighbor] horizontal distances to generate type curves to assess production trends based on spacing, normalizing wells to 10,000-ft lateral length, 2,500 lbs/ft of proppant and 60 bbl/ft of fluid.

Wells with spacing between 550 and 660 ft produced more than those with spacing of 690 to 900 ft.

“In the old world, an operator probably would have down spaced to the 660 level. … We would have drilled about eight wells in that section. We would have gotten about 5.1 million barrels of resource,” Johnson said. “But in the new world, why are we seeing that wider spacing? Why are we seeing these up-spacing trends? A lot of it has to do with the net.”

She countered, if four wells are drilled instead, you only get 3.2 million barrels.

“Think of it like this, 60% more production for 100% higher costs. Why would you drill twice as many wells for only 60% more production?” she asked. “That’s the challenge, and that’s what we’re seeing operators dig into and the choices that they’re making. That has dramatic implications for free cash flow.”

Another challenge lies in the geology and the timing of drilling. Spacing trends vary not only by basin, but within a particular basin. Tighter spacing, for instance, may be ideal for certain places in a basin based on how much development has already occurred in the area. In some cases, child wells may outperform parent wells given timing and latest generation completion techniques.

Given variability within basins, details are a must when evaluating spacing trends, according to Johnson. She also pointed out areas in the more mature Eagle Ford where tighter spacing yielded better results.

“It really takes getting within a field level, within an operator, specifically within a field to understand what those basic dynamics truly are and what the impact of spacing is versus completion design, how well they’re targeting zone, who the operator is,” she said. “All those things, geology, first and foremost, really matter.”

Recommended Reading

BWX Technologies Awarded $45B Contract to Manage Radioactive Cleanup

2024-03-05 - The U.S. Department of Energy’s Office of Environmental Management awarded nuclear technologies company BWX Technologies Inc. a contract worth up to $45 billion for environmental management at the Hanford Site.

Laredo Oil Settles Lawsuit with A&S Minerals, Erehwon

2024-03-12 - Laredo Oil said a confidential settlement agreement resolves a title dispute with Erehwon Oil & Gas LLC and A&S Minerals Development Co. LLC regarding mineral rights in Valley County, Montana.

DOE Considers Technip, LanzaTech For $200MM ‘Breakthrough’ Technology Award

2024-03-25 - The U.S. Department of Energy funding will be used to develop technology that turns CO2 into sustainable ethylene.

US Decision on Venezuelan License to Dictate Production Flow

2024-04-05 - The outlook for Venezuela’s oil industry appears uncertain, Rystad Energy said April 4 in a research report, as a license issued by the U.S. Office of Assets Control (OFAC) is set to expire on April 18.

New BOEM Regulations Raise Industry Decommissioning Obligations by $6.9B

2024-04-15 - Under new regulations, the Bureau of Ocean Energy Management estimates the oil and gas industry will be required to provide an additional $6.9 billion in new financial assurances to cover industry decommissioning costs.