The U.S. Energy Information Administration’s outlook for crude prices sunk this month over mounting concerns about the banking sector and the broader economy. (Source: Shutterstock)

The U.S. Energy Information Administration (EIA) slashed its outlook for crude prices this year and in 2024, despite OPEC’s efforts to support prices through a cut in oil production in May.

OPEC and its allies surprised markets in April by announcing plans to cut oil production by 1.2 million barrels per day (MMbbl/d), pushing global crude prices higher.

After the production cuts were announced last month, the EIA forecast that Brent crude oil spot prices would average about $85/bbl in 2023, while WTI crude spot prices would average $79.24/bbl.

However, concerns about weakening global economic conditions, persistent inflation and perceived risks to the banking sector “outweighed the initial increase in oil prices and have led to lower prices,” the EIA reported in its latest Short-Term Energy Outlook published May 9.

The EIA now expects Brent crude spot prices to average $79/bbl in 2023, down about 7% from last month’s forecast.

WTI spot prices are expected to average approximately $73.62/bbl this year, also down about 7% from April’s outlook.

The EIA also lowered its outlook for crude prices in 2024 as storage inventories build and global production outpaces global demand in the second half of the year.

Brent crude prices are expected to average about $74/bbl in 2024, a decrease of $7/bbl from the EIA’s outlook last month. WTI prices are predicted to average around $69.50/bbl next year, down nearly $6/bbl from the last outlook.

Gas outlook dims

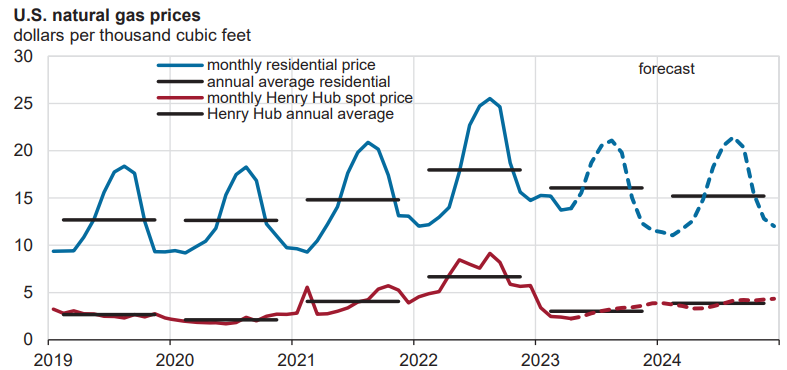

The EIA’s outlook for U.S. natural gas prices continues to weaken.

Producers saw natural gas prices rise about $9 per million Btu (MMBtu) last year but have since faced market oversupply, tepid demand and higher-than-average levels of storage inventories.

Henry Hub natural gas prices are expected to average $2.91/MMBtu in 2023, down slightly from last month’s forecast of $2.94/MMBtu for the year — and down more than 50% from 2022’s average of $6.42/MMBtu.

Gas prices should receive a lift back above $3 this summer as the demand for electric power generation surges.

Natural gas consumed to generate power in the U.S. from May through September will average 38 (Bcf/d). That’s the second-highest level on record, behind the 39 Bcf/d consumption seen in 2022, per EIA data.

“We expect the U.S. benchmark Henry Hub natural gas spot price to average $2.35/MMBtu in May and rise to around $3/MMBtu in July and August, when power demand peaks,” the EIA said.

The collapse in natural gas prices has caused some producers to reduce production guidance and slash drilling rig activity.

Price volatility has also affected the dealmaking market for gas-focused transactions. Speaking during first-quarter earnings on May 3, Chesapeake Energy Corp. President and CEO Nick Dell’Osso said gas-focused deals are especially difficult in a down-market.

RELATED

Chesapeake Would Buy Gas, But Who’d Sell at Sub-$3?

Recommended Reading

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.