Eclipse’s acquisition of EnCap-backed Travis Peak will boost the company’s Utica dry gas acreage by about 85% for less than $2,000 per acre. (Source: Hart Energy)

[Editor's note: This story was updated at 2:45 p.m. CST Dec. 11.]

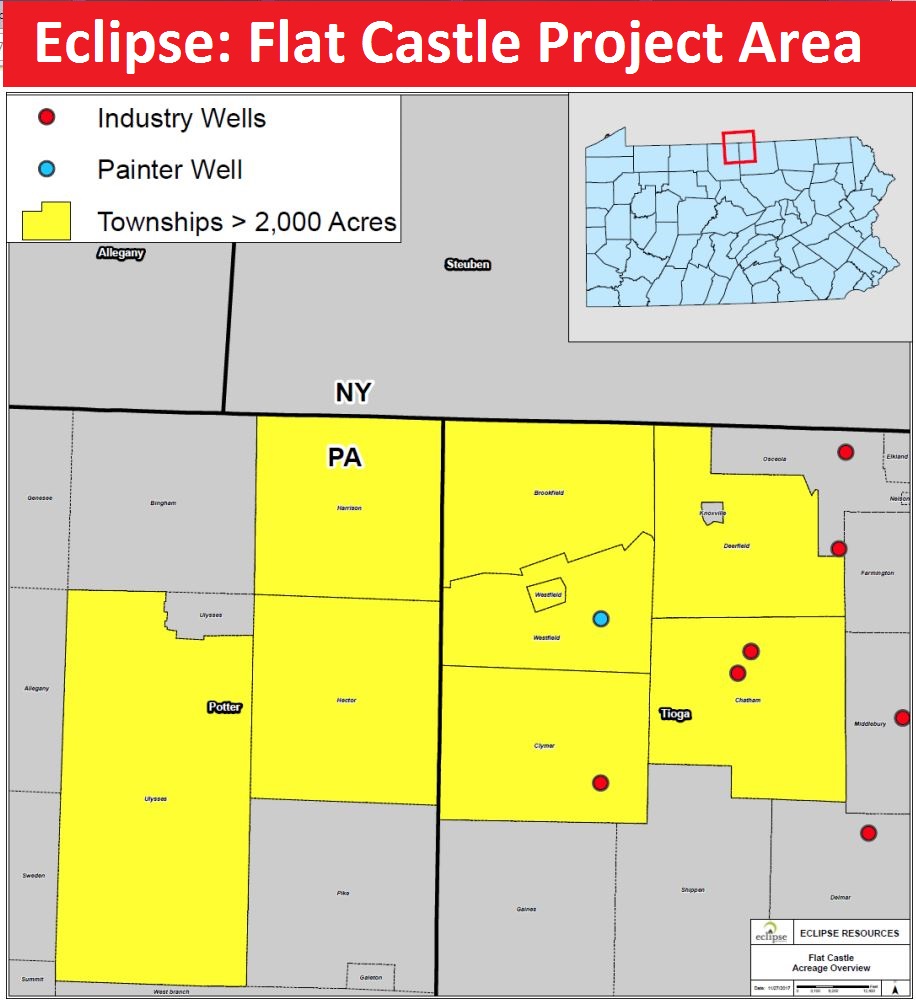

Eclipse Resources Corp. (NYSE: ECR) entered an agreement on Dec. 11 to acquire about 44,500 highly contiguous net acres in north-central Pennsylvania, which analysts said will add another core area to the company's Utica Shale portfolio for “cheap.”

The State College, Pa.-based company and its subsidiary, Eclipse Resources-PA LP, agreed to acquire the Utica assets from EnCap-backed Travis Peak Resources LLC in an all-stock transaction valued at $93.7 million.

Eclipse stands to gain oil and gas leases, wells and other oil and gas rights and interests in Tioga and Potter counties, Pa., plus a single, proved developed producing well with average production of 6.5 net million cubic feet per day (MMcf/d).

Eclipse is pegging the deal cost at $1,900 per acre. At that price, the company’s implied value for Travis Peak’s single producing well is $9.15 million, estimated Mike Kelly, senior analyst with Seaport Global Securities LLC.

At less than $2,000 per acre, Kelly said the Eclipse deal is “cheap.” Still, the position offers 52% to 77% internal rates of return and boosts the company’s surface acreage by a “substantial” 45% or more.

Eclipse will call its newly-acquired position the Flat Castle project area, which will add about 87 net drilling locations (based on a 16,000 ft lateral length).The deal boosts its identified dry-gas acreage in the play by about 85%, according to a company release.

“We like the transaction as it adds more acreage and inventory than incremental shares and doesn’t stress the balance sheet,” Kelly said in a Dec. 11 report.

Eclipse said it expects the area will support extensive development of its “super-lateral” drilling and completion technique.

Benjamin W. Hulburt, chairman, president and CEO of Eclipse, said the acquisition not only increases its inventory of drilling locations but allows the company to continue leveraging “innovative drilling and completions techniques while remaining Appalachian Basin focused.”

“We believe the Flat Castle project area is located in one of the best underdeveloped areas of the Appalachian Basin and will nicely complement our existing asset base, with the potential returns on these wells competing with those in our core Utica dry gas acreage,” Hulburt said in a statement.

Eclipse said the acreage is delineated by 22 industry wells, including Travis Peak’s well. Initial “type well” estimates of the acreage indicate EUR’s of between 2 and 2.3 Bcf per 1,000 ft of lateral at a cost of about $1,025 per lateral foot, which are consistent with or better than the company’s current southeast Ohio’s Utica dry gas core, according to the company release.

The company plans to spud its first well in the Flat Castle position in first-quarter 2018 with full-scale development planned for the fourth quarter, Hulburt said.

Hulburt added that the location of the Flat Castle project area is significantly west of Eclipse’s “more currently [pipeline] constrained Northeastern Pennsylvania peers” and will support the company’s ability to reliably move gas out of the area for the foreseeable future.

“The company anticipates that the gas it produces in the Flat Castle project area will be transported through the Dominion and Tennessee gathering systems, which are exposed to improving Appalachian price differentials,” he said

In addition, Eclipse said Dec. 11 its midstream subsidiary, Eclipse Resources Midstream LP, agreed to purchase all of the outstanding equity interests of Cardinal NE Holdings LLC for $18.3 million cash from Cardinal Midstream II LLC. Cardinal NE Holdings owns midstream infrastructure with associated gathering rights on the Flat Castle acreage.

Eclipse expects that the proximity of the Cardinal infrastructure to Dominion’s gathering system will allow the company to build, own and operate the gathering system as wells are drilled, according to the release.

The transactions were approved by a special committee of Eclipse’s board of directors composed entirely of independent directors. The $93.7 million in Eclipse's common stock to be issued to Travis Peak will be based on the weighted average share price before the deal closes.

Eclipse said it expects the Travis Peak acquisition to close in January, subject to the satisfaction of customary closing conditions. The company also anticipates a second closing for purposes of curing any title or environmental defects with respect to the properties being acquired. The transaction will have an effective date of Sept. 1.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.