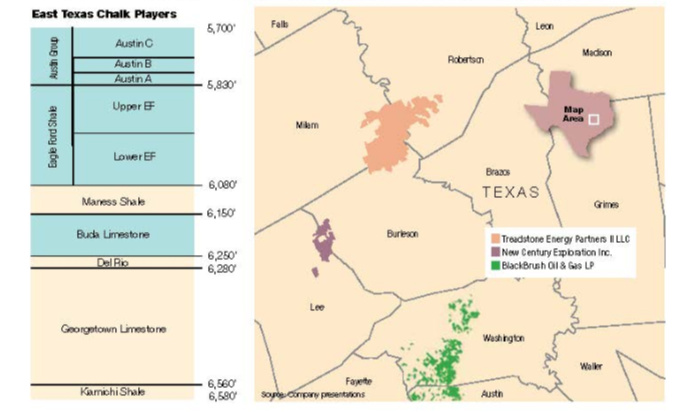

Treadstone is drilling and completing in the Chalk at the intersection of Burleson, Milam and Robertson counties, Texas, near the town of Hearne. (Source: Treadstone Energy Partners II LLC)

[Editor's note: A version of this story appears in the January 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The Austin Chalk is legend. Some operators it’s made; others, it’s broken. In some areas, it’s quiet, without many or any natural fractures; in others, it’s noisy.

& Gas LP’s new

Chalk prospect

in Washington

County, Texas,

sits in both the

quiet window and

in the fractured

window, said

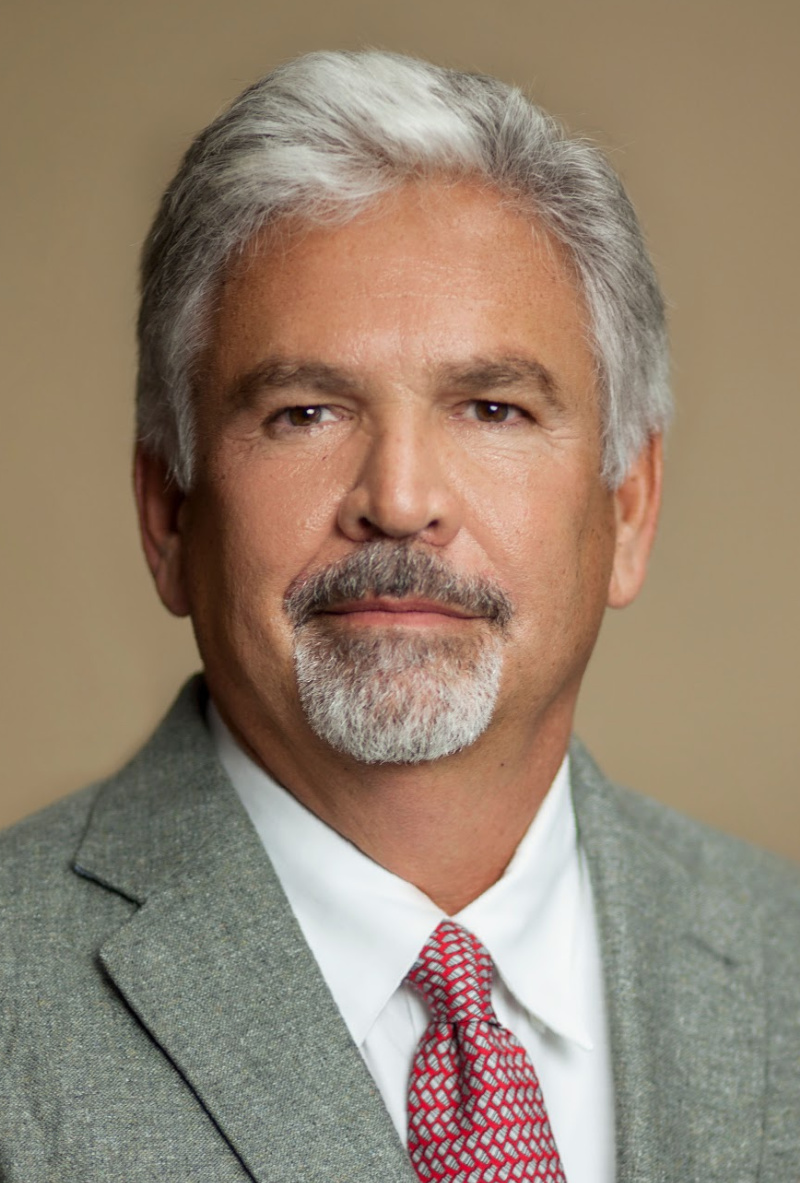

Mark Norville,

president.

It’s gassy here; it’s oily there. In a way, it’s ubiquitous. But, over the decades, it’s also been quixotic.

In Texas, the saying goes that everyone has a story about a pickup—as many as there are bluebonnets. In East Texas, most every operator has a story about the Chalk.

Every so often, a wildcatter comes up with a new idea, walks into a county courthouse and files new lease papers. Some of these ideas have worked out using the technology that was a la mode, thus the stuff of legend.

In this decade, the newest iteration of how to wrangle the Chalk—super-fracked, staged-interval laterals—is working where Chalk pay was left behind or hadn’t been attempted.

The traditional play in East Texas had been on the natural fractures. Operators today are tapping both the fractures as well as the matrix porosity. Increasingly, some are focusing on the quiet areas of the formation.

Chesapeake Energy Corp. bought East Texas-focused WildHorse Resource Development Corp. last year for $4 billion for its dual Eagle Ford and Chalk. Magnolia Oil & Gas Corp. bought EnerVest Ltd. property for its dual Eagle Ford and Chalk in both South and East Texas for $2.7 billion.

Smaller operators are working to prove their eastern Chalk as well. Here’s a look at what each has found and plans.

Quiet, not quiet

San Antonio-based BlackBrush Oil & Gas LP has plays in Washington County in both the fractured Chalk and the quiet Chalk. About half of its 24,600-net-acre block there is in one; the balance, in the other.

The privately held Ares Management Corp.-backed E&P made the first successful co-development of Chalk and the Eagle Ford in South Texas’ Karnes County in 2015, spawning a sub-play within the super-basin. Nearly all of this was sold to EnerVest in 2016.

With a Chalk map from the Rio Grande to central Louisiana, it headed east to Washington County for a new play. “Washington County is particularly intriguing,” said Mark Norville, BlackBrush president.

“We saw this quiet area that reminded us of what we saw in Karnes County where the production turned out to be so fantastic.”

After processing new 3-D data, however, the portion of the BlackBrush block in what’s known as Giddings East Field showed “tremendous fractured intervals still left to be drilled.”

missing about

the Austin Chalk

is that, yes,

it’s a naturally

fractured

reservoir, but it’s

also an 8% to

10%-plus porosity

reservoir. It

contains a lot of

oil that’s not just

in the natural

fractures”, said

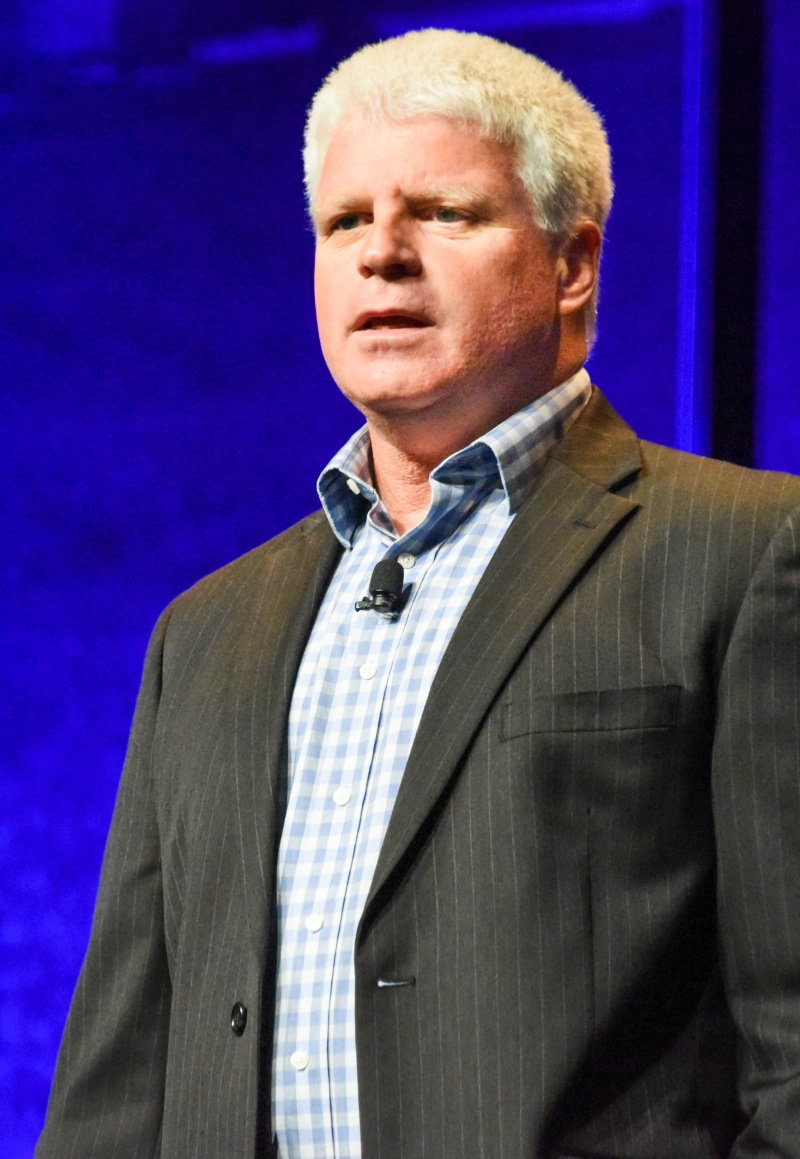

Frank McCorkle,

president,

Treadstone

Energy Partners

II LLC.

It was no surprise that the area is naturally fractured, he added; rather, the number of untapped fractures was surprising. Giddings East operators in the 1990s had made several 20- and 30 billion cubic feet (Bcf) wells.

In this new play, BlackBrush has tried one well. Cassidy 1 “crossed one of those fractures, and it had a tremendous kick. It’s the type of drilling I hadn’t seen since I started in this business in the 1980s when I worked for Clayton Williams [Energy Inc.],” Norville said.

It was a short lateral—about 2,500 feet—and had a first-30-day IP of 6.4 million cubic feet equivalent per day (MMcfe/d), peaking at 9 MMcfe/d. On a per-lateral-foot basis, it’s the second-best well in the field, Norville said.

BlackBrush is looking for a partner in that area. “If we can drill wells you don’t have to frack, that’s a $3.5- to almost $4 million savings on a per-well basis on a potential 10 to 20 Bcf well, which all of a sudden becomes very economic, even in the dry-gas environment,” he said.

The other half of the leasehold, “we’re going to have to frack,” he added. “But we’ve opened a door [in the overall block] where there could be some drilling for a nonstimulated, openhole completion play here as well.”

The company has about 49,000 net acres for Chalk in Texas. (It also has Chalk leasehold in Louisiana.) These are the 24,600 in Washington County; about 1,400 remaining in Karnes; and 23,350 in Frio County.

Of that, about half is HBP. Drilling continues in Karnes and Frio counties; it’s oily there— about 2,000:1 GOR. And wells are strong, IP-ing up to 1,500 barrels per day (bbl/d) from short laterals of 3,500 feet or less.

Washington is particular intriguing “when you look at the porosity—up to 8%. It’s a great position,” Norville said. BlackBrush’s pay-model cutoff is a minimum of 6% porosity. “It’s well up into that neighborhood.”

Business plan 3.0

Just one thing, though: It’s gas. How much gas? “One-hundred percent dry gas.”

In Washington County, the BlackBrush leasehold is along a slope margin. Early migration of hydrocarbons from Eagle Ford preserved porosity in the area at the time of Chalk deposition. It’s deep, overpressured and the temperature is high, thus it’s gas.

Up in Burleson and Lee counties, that’s the platform. It gets oily there.

In Norville’s Clayton Williams Energy days, wells tapped hydrocarbons that were in the natural fractures. Fracture stimulation would be needed to tap what’s embedded in the rock itself—the matrix porosity—and the economics for this also require horizontal wells.

That’s similar to what BlackBrush did in creating a new Chalk play in Karnes, where the Chalk is quiet. “In Karnes, we weren’t the first to try Austin Chalk over there, but we were the first to frack it with an Eagle Ford-style frack.”

The E&P began as a conventional-rock shop in 2005. While it was focused on South Texas for Olmos, San Miguel and Edwards, the Eagle Ford play developed around it, “so we morphed into an unconventional shop,” Norville said.

For that, it had to get private-equity (PE) financing; super-fracked, long laterals are much more expensive than verticals. As the PE “market’s dried up for now,” Norville said, it’s looking at drilling “completely through the PDP process.”

So, again, “we’re morphing into something new. We’re not going to be the type of company just flipping things—a transactional company. We’re going to be a company that’s going to be a long-time player.”

It expects to exit 2019 with 11,600 barrels of oil equivalent per day (boe/d) net. In November, it was completing an eight-well pad—landed in the Chalk, lower Eagle Ford and upper Eagle Ford—with Inpex Eagle Ford LLC.

Plans for 2020 are to continue drilling for Chalk and Eagle Ford in Karnes and Frio counties and for Eagle Ford in McMullen County. If costs decline, Norville expects BlackBrush could drill for Chalk in Washington County and for Eagle Ford in Maverick County.

Hearne-area oil

Houston-based Treadstone Energy Partners II LLC is on the northern end of the East Texas Chalk, up on that platform, in the oil window. It has two rigs drilling and plans to average between 1.5 and two rigs at work this year.

It’s drilled 20 Chalk wells and five Eagle Ford wells in the area to date. “Our Eagle Ford is very economic,” said Frank McCorkle, president. “It’s just not as economic as our Austin Chalk.”

Operating most of the other rigs in its neighborhood are Chesapeake and privately held Hawkwood Energy LLC.

Treadstone I sold its Buda-producing Fort Trinidad Field in Houston and Madison counties in 2014 for $715 million. It had grown production there from about 20 bbl/d in 2011 to more than 10,000 bbl/d.

In 2016, it picked up 42,000 net acres from Anadarko Petroleum Corp. for Chalk, Eagle Ford and Buda in northern Burleson, southern Milam and western Robertson in an area known as Hearne. That came with 650 bbl/d.

It’s bolted on about 4,000 net more since then. Kayne Anderson Energy Fund VI LP is backing Treadstone II; it backed the first Treadstone, too.

It’s all contiguous, except for a few spots, McCorkle said. The Chalk is fractured where Treadstone is.

The acreage also contains about 43,000 net for underlying Eagle Ford. And deeper Buda’s prospective on all of it as well. The Anadarko acreage was all HBP; what’s been added since isn’t.

“We will start drilling into it,” McCorkle said. “But it’s very recent leasing, so we have three to five years on most of that.”

Unlike the rest of Giddings Field, the Hearne area wasn’t drilled heavily. He suspects it’s still relatively pristine because of “what we’re taught about fractured carbonates when we’re in school and throughout our early careers: You drill them, you produce out the natural fractures, you don’t produce anything from the matrix, it goes to water and it’s done.”

It gets dismissed. But “what people are missing about the Austin Chalk is that, yes, it’s a naturally fractured reservoir, but it’s also an 8% to 10%-plus-porosity reservoir. It contains a lot of oil that’s not just in the natural fractures,” McCorkle said.

Without fracking the formation to tap the matrix porosity in the past century, “the wells behaved exactly as people expected them to. We came back in and did a fracture-stimulation design—accessing the matrix oil and not the natural fractures—and that’s where our oil is coming from.

“It’s coming from the matrix of the reservoir.” That’s in addition to the oil from the natural fractures.

‘Oil, not boe’

Treadstone’s Chalk laterals are primarily 6,000 feet. It’s using between 60 and 70 bbl of water and about 2,000 pounds of sand per lateral foot. Wells are cased and cemented and have ESP lift. Stage spacing is between 100 and 150 feet.

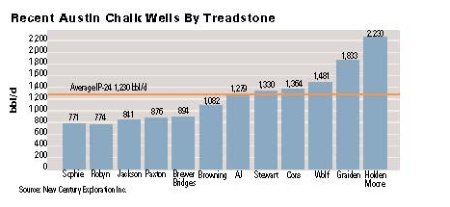

“It’s worked better than we had anticipated,” McCorkle said. Treadstone’s Chalk wells to date average 945 bbl/d in 30-day IPs—vs. 300 bbl/d from old-model wells—and cumulative production of 160,000 bbl in their first 10 months vs. 53,000.

“This is oil, not boe,” he added. “I don’t report boe; we’re not in the natural gas business.” Its Holden-Moore 3HA had a 24-hour IP of 2,230 bbl/d and made 438,000 bbl in its first 11 months. Its smallest IP-24 well was Sophie 1HA with 771 bbl/d.

Overall from its leasehold, including Eagle Ford wells, Treadstone’s current production is now more than 10,000 bbl/d.

And some of the additional production is actually coming from the old wells, which are experiencing incidental stimulation from completions in new wells. “Base production has increased about 40% since acquisition,” McCorkle said.

Operators—and investors—have been concerned about repeatability of performance from the Chalk, but that’s a vestige of when Chalk wells were openhole, tapping natural fractures. Instead, in Treadstone’s modern Chalk play, “there is not as wide a range in the performance in our wells as there are in most of the resource plays.”

The initial rate is strong, “but it also has exceptional long-term performance,” he said.

was believed to

be depleted, “but

it’s not depleted

at all. You’d just

taken out what

could be obtained

from natural

fractures; now

you can go back

in and get the

rest of it”, said

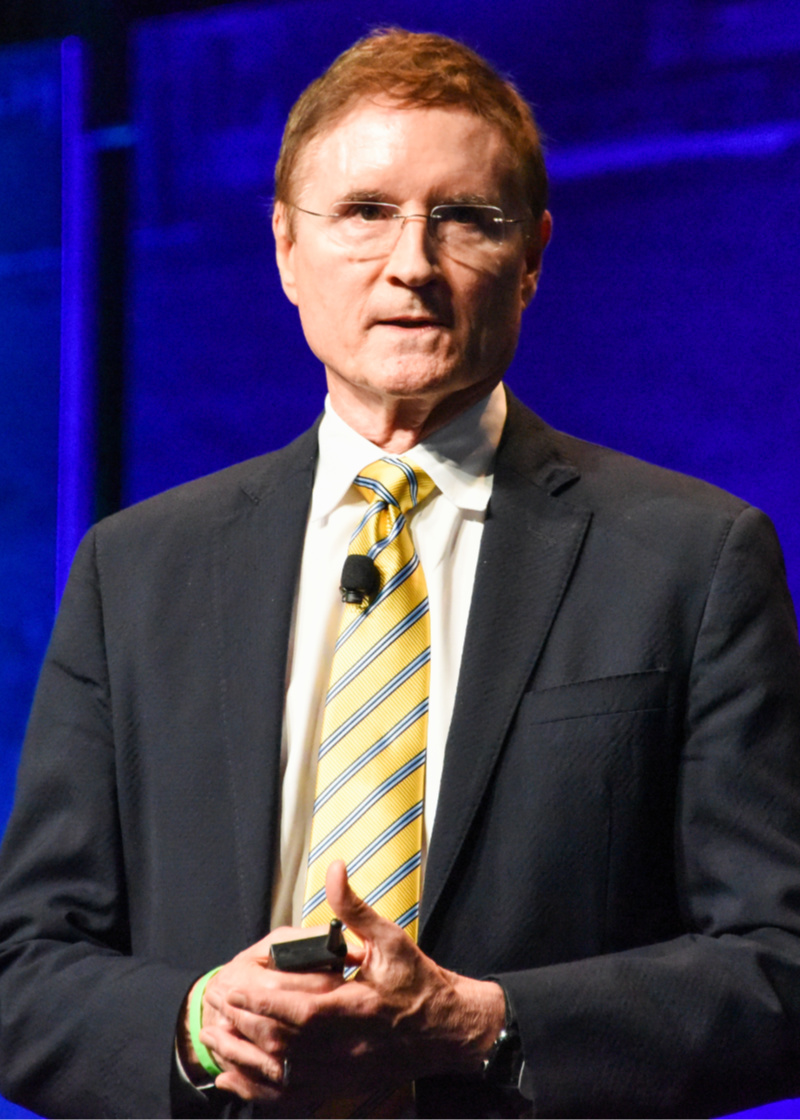

Phil Martin, CEO,

New Century

Exploration Inc.

Operators do have to prepare for the water cut, though. In Treadstone’s area, it ranges from 30% to 80%, averaging about 70%.

It expects to be free-cash-flow positive this year, McCorkle said. Plans are to continue drilling until the opportunity to sell the asset arises. “This asset was truly a diamond in the rough for Treadstone.”

More proppant

New Century Exploration Inc. has about 10,000 net acres—more than 50% HBP—in Burleson County on trend with Treadstone and a little bit updip of it. In addition, New Century is in the oil window; GOR is about 400:1. It’s on the northern edge of Chesapeake’s leasehold.

The position is contiguous except for about 700 acres, said Phil Martin, New Century CEO, “and it is also extremely well configured for development.” The northwesterly/southeasterly orientation is perpendicular to the planes of maximum stress.

“The chalk is high-porosity, but it’s a low-permeability rock. What the industry is doing now is going into areas where you don’t have as many natural fractures and, then, making your own fractures,” Martin said.

Studying the Treadstone wells, he has found that the more proppant it uses in a well, “the better they do—almost without exception.” Also, Martin said, “as they get farther and farther away from the natural-fracture field, the better they do.”

The EUR on Treadstone’s Holden Moore 3HA “projects out over 1 MMbbl.” Martin estimates a well cost of $4.5 million, IRR of 120% at $55 oil, an ROI of 3.3 and payout in less than a year.

He has also found that—in the matrix-porosity play versus the fracture-porosity play—chemicals, particularly clay-control, have been helpful in increasing connectivity.

“The Chalk has very widespread layers of volcanic ash intermittently spaced through the formation and they can seal the fractures kind of like putty.”

Chemicals that move through these ash seals extend the induced fractures, allowing them to reach more of the formation in Austin A, B and C. “That’s another technology that I think has been very helpful,” Martin said.

Past disrespect of the Chalk was “really just a lack of understanding.” Rather, most of the Chalk’s potential is held within the matrix porosity, rather than within the natural fractures. “It’s very oil-saturated,” he said.

Giddings Field was believed to be depleted, “but it’s not depleted at all. You’d just taken out what could be obtained from natural fractures; now you can go back in and get the rest of it.”

A time to buy

A limestone, the Chalk was deposited during the Cretaceous in a shallow marine environment over the Eagle Ford, which is where most of the Chalk oil comes from. Later, the Taylor Group—another shale—was laid over it.

“So you have your top seal, you’ve got your source and you’ve got a high-porosity formation to produce from if you can figure out how to get it out,” Martin said.

The Chalk has produced some 600 MMbbl to date at Giddings Field. Calculating its oil in place is tricky, though, Martin said. There’s the oil in the fracture porosity, and there’s the oil in the matrix porosity.

“Also, permeability is very low, and that’s not something easily measured by logs,” he said. “You can get some of that from cores, but, again, the difference in matrix and fractures complicates things.”

Water-saturation calculation is also tricky and, in general, storage capacity in a mixed-lithology, fractured limestone is difficult too.

Martin has observed, though, that every EUR calculation continues to be exceeded in time, “fortunately. Whatever we calculate EUR to be, [the actual recovery] ends up higher than we thought.”

The Talara Capital Management-backed E&P is “kind of hunkering down right now,” meanwhile; it isn’t drilling. Rather, it’s watching operators develop all around it, further de-risking its leasehold that way.

“This play is just like the Eagle Ford,” Martin said. “The technology is moving very rapidly, and we’re learning from others. Technology keeps getting better; it never moves backwards.”

In addition to drilling, “there are areas I’d like to be acquiring right now to expand our block.” New Century has up to $100 million for the right deal.

In the current capital-constrained era of oil and gas E&P, the PE-backed, build-and-flip model is stalled. “I really think that’s a boneyard now,” Martin said. “Investment capital is a lot more focused on a model that delivers dependable returns than just on growing acreage and PUDs.

“To realize returns from asset sales is just kind of a pipe dream right now.”

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.