Earthstone Energy agreed to acquire the New Mexico assets of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies in the Permian Basin backed by NGP Energy Capital Management LLC. (Source: Titus Oil & Gas)

Roughly four weeks after proclaiming itself the “new” Earthstone Energy Inc., The Woodlands, Texas-based company announced yet another transaction June 28: the acquisition of Titus Oil & Gas and a 26% increase in production in the Delaware Basin.

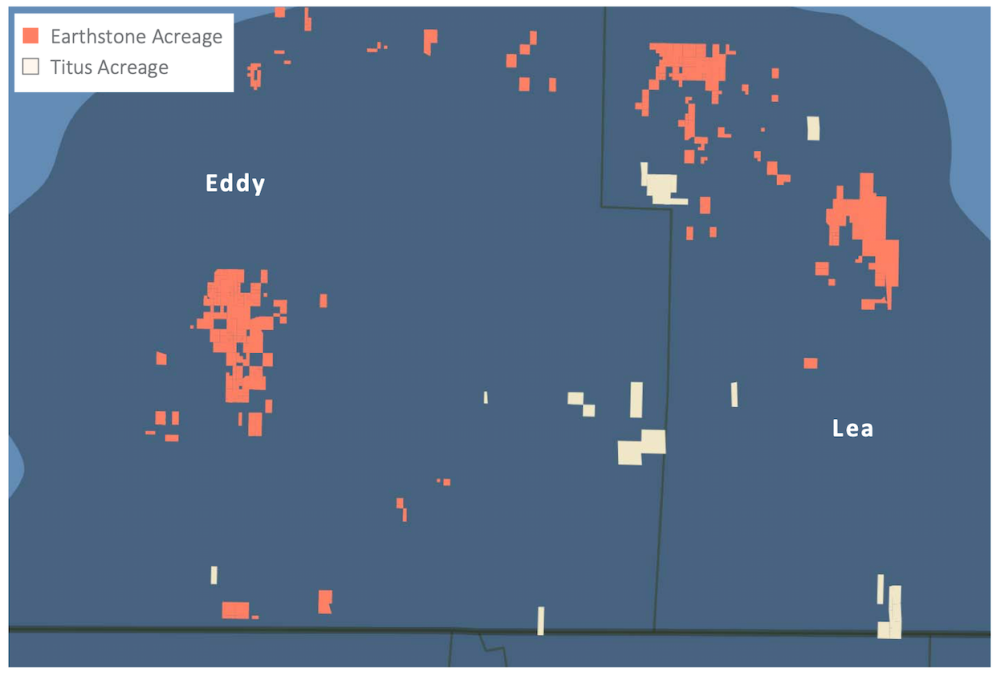

The $627 million acquisition adds 86 net locations in the Permian Basin in Eddy and Lea counties, N.M., on 7,900 net acres of leasehold. It isn’t clear how much of the leasehold might be on federal acreage.

The deal also marks Earthstone’s seventh acquisition since 2021, a span that includes the closing of roughly $1.89 billion in acquisitions in the Permian Basin.

“

The Titus acquisition continues our path of building scale in the Permian Basin, increasing our daily production to around 100,000 boe/d upon closing. We had a goal of adding to our recently established northern Delaware Basin position and are excited about this transaction and the drilling inventory we are acquiring as it is among the highest economic locations in the Permian Basin.”—Robert J. Anderson, president and CEO, Earthstone Energy Inc.

Earthstone agreed to pay Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, $575 million in cash and the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price).

Based on June 17 strip prices, Earthstone said it valued Titus’ proved developed PV-10 at $857 million as of Aug. 1. It estimates the next 12 months of adjusted EBITDAX at $320 million to $340 million. In June, Titus’ net production was 31,800 boe/d. The company had reserves of about 28.9 MMboe.

Earthstone said its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

Titus is currently running a three-rig drilling program on six wells with a 93% working interest in Lea County. Earthstone said it would maintain two rigs in the Delaware Basin, two rigs in its Midland Basin position and consider an additional rig in the Delaware upon closing the deal. The company also said it would increase its capex by as much as $50 million.

The impact of the acquisition on Earthstone’s guidance for the remainder of the year will be dependent on when the deal closes. Following its $860 million acquisition on June 2, Earthstone had said its second half production would be about 78,000 boe/d.

Earthstone President and CEO Robert J. Anderson said the Titus acquisition continues the company’s path toward building scale in the Permian Basin and increasing daily production to about 100,000 boe/d upon closing.

“We had a goal of adding to our recently established northern Delaware Basin position and are excited about this transaction and the drilling inventory we are acquiring as it is among the highest economic locations in the Permian Basin,” Anderson said in a news release. “We continue to pursue synergies from the two acquisitions completed since the beginning of 2022.”

Earthstone Energy after Titus |

|||

| Earthstone | Pro forma Titus | % Change | |

| 4Q 2022 Production (Mboe/d) | 76-80 | 94-103 | ~26% |

| 4Q 2022 % Oil | ~41% | ~46% | ~9% |

| FY 2022 Capex ($MM) | $410-$440 | $435-$490 | ~9% |

| Shares Outstanding (MM) | ~139 | ~142 | ~3% |

Anderson said the company is pleased with execution on its northern Delaware Basin assets, which were acquired earlier this year, and expected to apply that knowledge to the Titus acquisition.

“We have continued to build out our high margin asset base, which is generating significant free cash flow to which this acquisition will contribute in a meaningful way,” Anderson said.

Anderson also said he believed that the price of the acquisition was attractive, “with our ability to buy the assets at less than 2x PDP cash flows using current Nymex strip prices.”

“The combination of the attractive price being paid, the current high level of commodity prices and production of the acquired assets will allow us to acquire the assets utilizing primarily debt funding while having only a minimal impact on leverage,” he said.

Earthstone expects to increase fourth-quarter debt / last quarter annualized adjusted EBITDAX by only 0.1x while remaining below its targeted 1.0x leverage ratio at year-end 2022.

Earthstone intends to fund the cash portion of the consideration and fees and expenses with cash on hand and incremental bank borrowings. The company has received $400 million in increased commitments from existing lenders.

“The moderate levels of expected leverage and significant incremental free cash flow further strengthens our outlook in 2023, while positioning us to consider implementing a shareholder return plan as we look into 2023,” Anderson said.

Earthstone’s board and the boards of the Titus entities all approved the deal unanimously.

Earthstone’s legal advisers included Haynes and Boone LLP and Jones & Keller P.C. for Earthstone. Titus was represented by Bracewell LLP and Jefferies LLC acted as its exclusive financial adviser.

Recommended Reading

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.