If there is a consolidation wave, Earthstone Energy wants to be one of the consolidators, CEO Frank Lodzinski says. (Source: Hart Energy/Shutterstock.com)

HOUSTON—A terminated merger in the Permian Basin late last year hasn’t deterred oil and gas industry veteran Frank A. Lodzinski from deal-making.

Far from it, actually. The CEO of Earthstone Energy Inc. was up-front about his intentions at the Leaders in Industry Luncheon held at the Petroleum Club of Houston on Aug. 14: Earthstone is actively looking for deals ranging from acquisitions and trades to business combinations.

“I’m going to blatantly conduct a commercial here and tell you all that we’re looking for deals and that we’re open for business,” Lodzinski told attendees of the luncheon hosted monthly by the Independent Petroleum Association of American and Texas Independent Producers & Royalty Owners Association.

Lodzinski has over 47 years of oil and gas industry experience including multiple ventures and business combinations. He joined Earthstone in 2014 following the company’s combination with Oak Valley Resources LLC—a private Eagle Ford-focused company Lodzinski had formed following the sale of GeoResources Inc. to Halcón Resources Corp. in 2012.

During his presentation, Lodzinski described Earthstone as a growth story and a leader among other Permian E&Ps within its peer group.

Growth Story

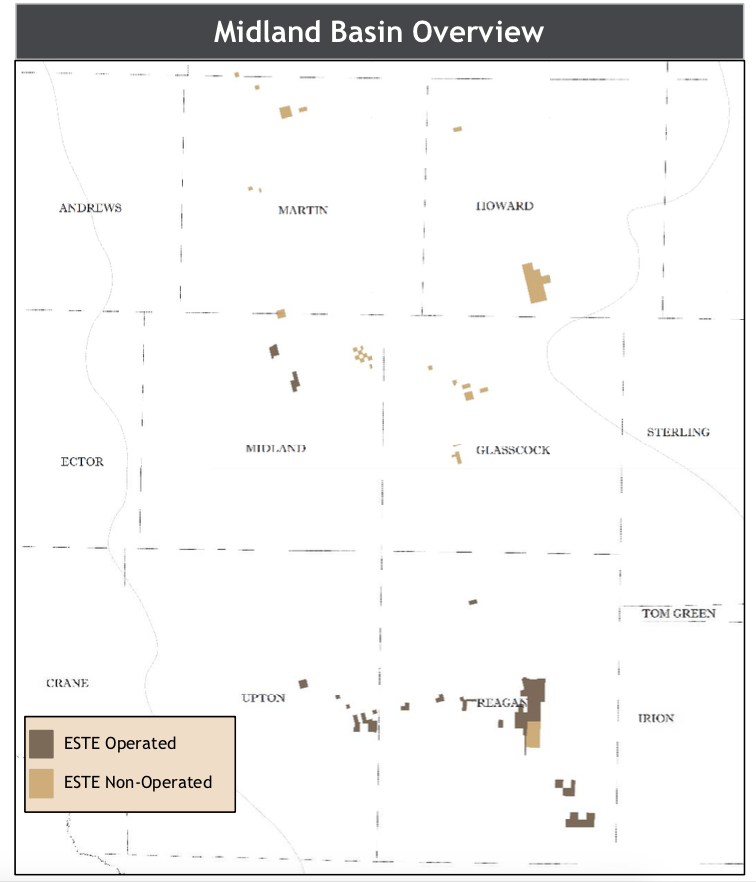

Based in The Woodlands, Texas, Earthstone has primary assets in the Midland Basin of West Texas, which the company has been “piecing together” since first entering the Permian in 2016, Lodzinski said.

Initially, Earthstone’s position in the Midland Basin was on a nonoperated basis through its acquisition of Lynden Energy Corp. Soon after the Lynden deal, the company added an operated position in the Midland Basin with its acquisition of Bold Energy III LLC. The all-stock acquisition of Bold, worth about $324 million, closed May 2017.

Backed by EnCap Investments LP, the acquisition of Bold included about 20,000 net acres in Reagan, Upton and Midland counties, Texas. According to a research note by Baird Equity Research from when the deal was announced in late 2016, Earthstone paid roughly $15,000 per acre for Bold—a surprisingly low price for Permian acreage at the time.

In October 2018, Earthstone was on the path to double its Midland Basin position through the acquisition of another EnCap-backed company, Sabalo Holdings LLC. The transaction was set to cost Earthstone roughly $950 million in cash and stock—marking the company’s largest acquisition to date.

However, a plunge in oil prices during fourth-quarter 2018 derailed the deal. By late December, both companies agreed to terminate the acquisition agreement citing “the recent significant decline in commodity prices and the related adverse effect on the debt and equity markets.”

‘Bring Us Deals’

Despite the stumble, Lodzinski said on Aug. 14 that Earthstone is actively looking for another business combination.

“If there is a consolidation wave that happens amongst the smaller guys, I want to be one of the consolidators and the attributes of how we run our company is the reasoning for why we think we can be successful,” he said.

In addition to business combinations, Earthstone is looking in the Midland Basin “extensively for additional things to do through acquisitions, through trades [and] through drillbit organic growth,” he said.

Most recently, Earthstone closed a wellbore development agreement in July set to accelerate development in its Midland Basin position. The company revealed the agreement with “an unaffiliated industry partner” during its second-quarter earnings earlier this month.

Structured as wellbore-only, the agreement covers the development of an eight-well program during 2019 in central Reagan County, Texas, with an option for up to 11 additional wells next year. In return for paying a higher portion of the capital cost, Earthstone’s Drillco partner will earn 35% of the working interest in the wells.

Lodzinski voiced his eagerness for Earthstone’s next deal, urging the luncheon attendees multiple times to “bring us deals.” He also told the crowd that he wasn’t afraid to venture outside Earthstone’s core basin to grow.

“I hope I don’t startle some of our investors by saying what I’m going to say next,” he said. “While we have been focused clearly on the Midland Basin, the market doesn’t seem to care anymore about single basin.”

Instead, he said investors are pushing for scale and efficiency. As a result, Earthstone would not rule out an acquisition in the Eagle Ford where the company also has a position of 14,300 net acres in the core of the South Texas shale play, according to Lodzinski.

Earthstone’s Strength

Regardless of the company’s growth story and its drive for more deals, Lodzinski said an important strength to note about Earthstone is its leverage.

“We have never been overleveraged [and] I will never be overleveraged,” he said adding that Earthstone still doesn’t “borrow money for acreage and we still do not borrow money for G&A and never will.”

As of June 30, Earthstone had $5.8 million in cash and $110 million of long-term debt outstanding under the company’s credit facility with a borrowing base of $325 million. In total, the company’s liquidity was roughly $220.8 million.

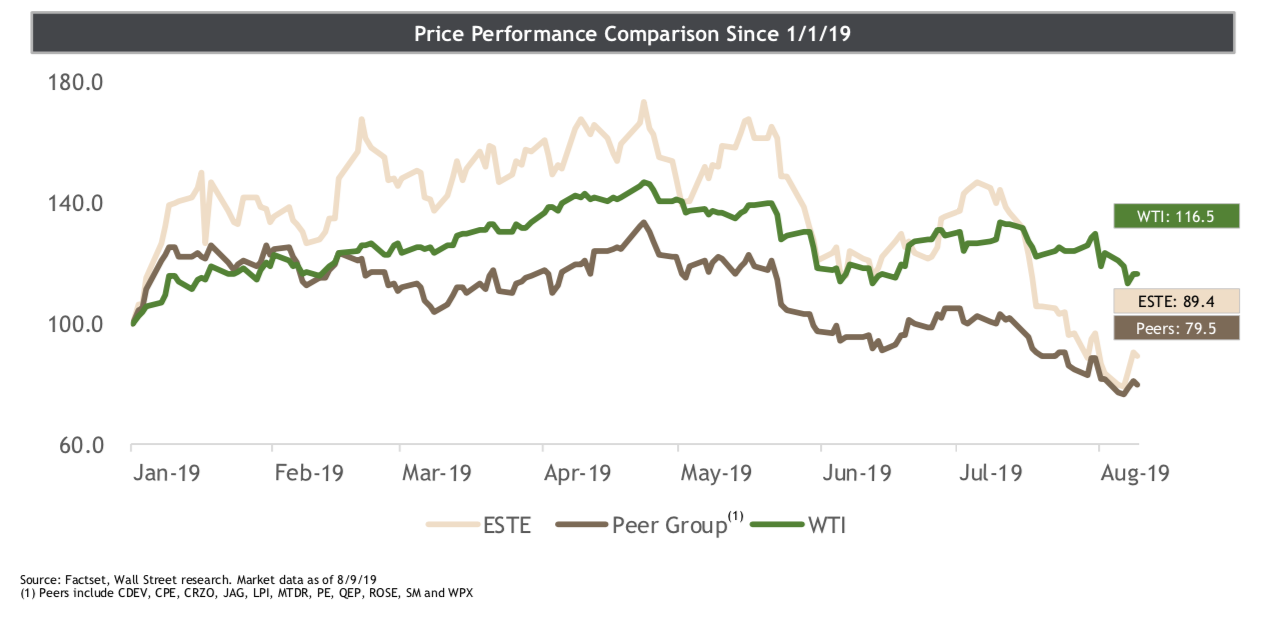

Lodzinski noted that due to the company’s financial prudence and cost control, Earthstone has traded above its broader and higher-graded peer group despite overall market price declines—something that he said he’s “pretty proud of.”

“All we do is control what we can,” he said. “And that’s our balance sheet, our operations and our cost. What else can you control, right? If you control your costs and you operate efficiently and you don’t get overlevered, you should be able to survive these downturns that we’ve been in for an extended period of time.”

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.