(Source: Hart Energy)

Earthstone Energy Inc. agreed on Dec. 18 to a cash-and-stock transaction to acquire Independence Resources Management LLC (IRM), a privately held independent E&P company backed by Warburg Pincus LLC and operating in the Midland Basin.

The transaction, valued at about $185.9 million, is expected to roughly double both Earthstone’s production and adjusted EBITDAX with minimal impact to leverage, according to Robert J. Anderson, the company’s president and CEO.

“This transaction is another important step in the execution of our growth strategy to further increase our scale with high-quality accretive acquisitions,” Anderson said in a statement. “This is consistent with our stated strategy to be a consolidator in the Permian Basin and positions us well for additional value-enhancing transactions.”

“We will maintain strict financial discipline as we consider future transactions, both as it relates to valuation and to maintaining our balance sheet strength,” he added.

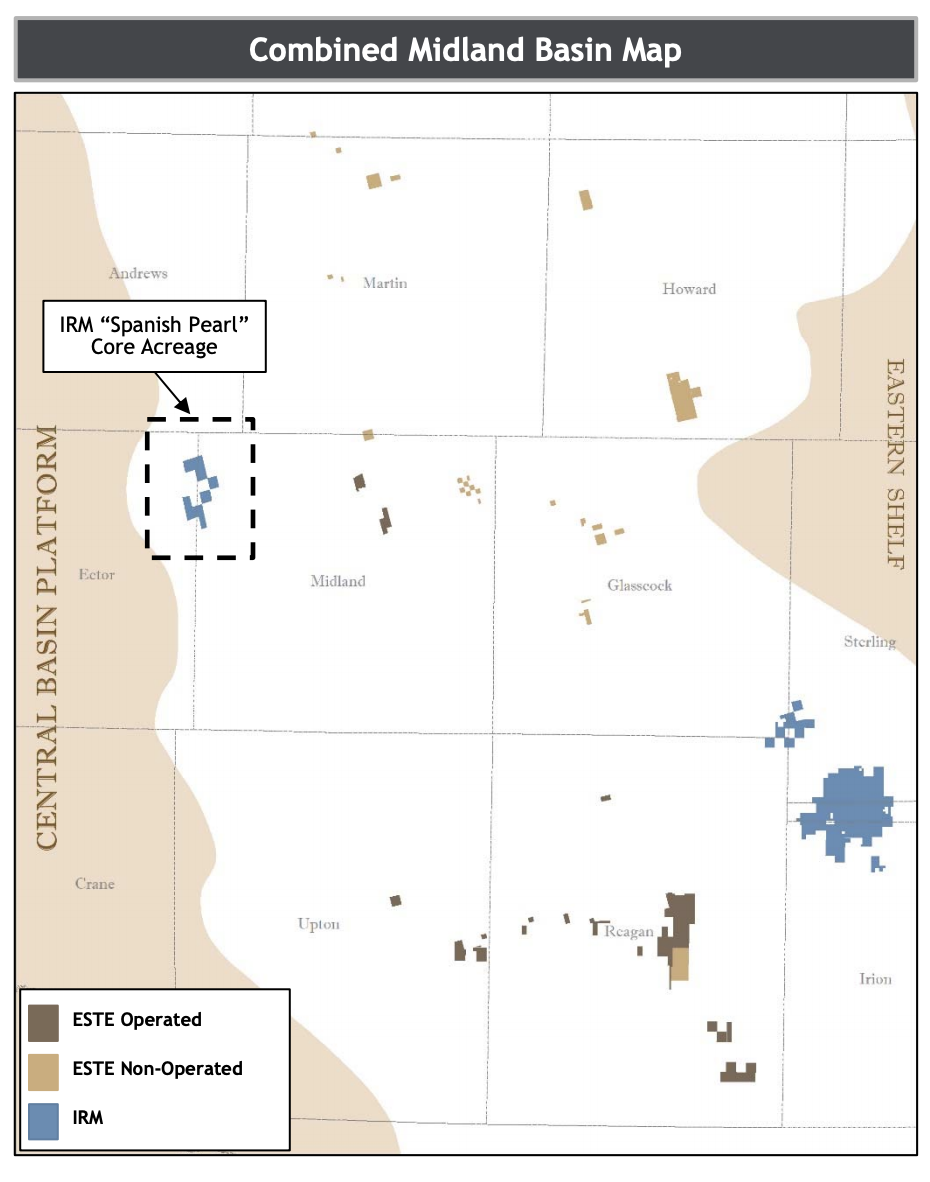

Formed in December 2014 with a $500 million line-of-equity investment from Warburg Pincus, IRM holds about 43,400 net acres in two contiguous blocks in the Midland Basin of West Texas. The company’s production averaged 8,780 boe/d (66% oil) during the third quarter.

About 4,900 net acres of IRM’s Midland Basin position are located in Texas’ Midland and Ector counties and includes an inventory of 70 undeveloped horizontal locations targeting the Middle Spraberry, Lower Spraberry and Wolfcamp A zones with an average IRR of 45% at strip pricing.

The Midland and Ector county acreage is 100% HBP and 93% operated. The company also holds an additional 38,500 net acres in the eastern Midland Basin that is 100% HBP and 100% operated.

Anderson said the 70 gross drilling locations from IRM’s core acreage carry a similar return profile to Earthstone’s highly economic Midland Basin wells and will compete with the company’s existing inventory for future development capital.

“With the large majority of IRM’s production coming from its core acreage in Midland and Ector counties, the acquired assets have a very similar and complementary low operating cost, high margin profile as our existing assets, allowing us to maintain our peer-leading cash margin operating profile,” he said. “With a minimal need for incremental general and administrative costs, we expect to improve cash margins further by targeting an approximately 25% decrease in our go forward cash G&A per unit costs.”

Earthstone will target resuming drilling activity in the first half of 2021 through a one-rig program Anderson said he expects to be fully funded well within the company’s operating cash flows.

“This added scale and quality inventory enhances our development options and free cash flow generating capacity,” he added.

IRM Key Asset Statistics |

|

| Daily Production for 3Q 2020 (boe/d) | 8,780 |

| PDP reserves (MMboe) | 16.3 |

| PDP PV-10 ($MM) | $173 |

| Core net acres | ~4,900 |

| Total net acres | ~43,400 |

| % HBP / % Operated | 100% / 99% |

| Gross locations | 70 |

Earthstone expects to close the transaction in first-quarter 2021.

The purchase price of the transaction consists of an estimated amount of $135.2 million in cash as of Nov. 30 but expected to be lower on the closing date based on current forecasts and approximately 12.7 million shares of Earthstone’s Class A common stock valued at $50.8 million based on a closing share price of $3.99 on Dec. 16.

In conjunction with the transaction, Warburg will have the right to appoint one director to Earthstone’s board. EnCap Investments LP will maintain the three existing EnCap-affiliated directors, resulting in a board of directors consisting of nine members.

No changes to Earthstone management will occur in connection with the transaction.

RBC Capital Markets LLC and Wells Fargo Securities, LLC acted as financial advisers to Earthstone for the transaction. Jefferies LLC was financial advisor to IRM. Legal advisers included Jones & Keller PC for Earthstone, and Latham & Watkins LLP for IRM.

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Aker BP’s Hanz Subsea Tieback Goes Onstream

2024-04-22 - AKER BP’s project marks the first time subsea production systems have been reused on the Norwegian Continental Shelf.