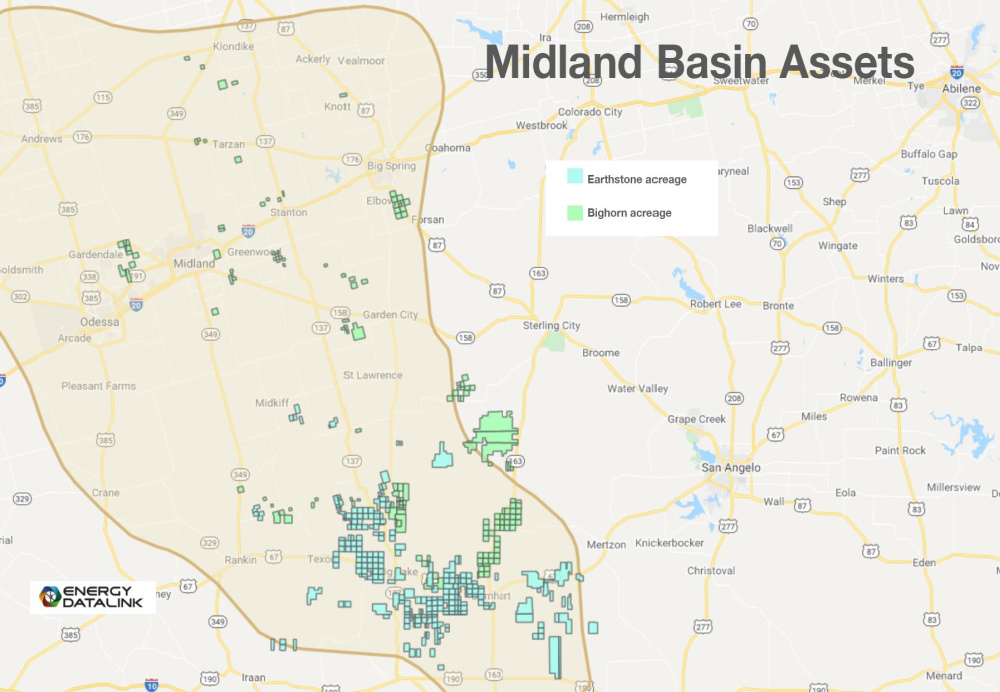

Earthstone Energy Inc. recently completed its acquisition of Bighorn Permian Resources LLC, a privately held operator in the Midland Basin, concurrently multiple significant financings.

“We are pleased to have taken multiple significant steps in the ongoing transformation of Earthstone as we have closed on the Bighorn Acquisition and on significant debt and equity financings this week,” Robert J. Anderson, president and CEO of Earthstone, commented in a company release on April 14.

According to the release, Earthstone closed a $550 million private offering of senior unsecured notes, a $280 million private placement of equity (PIPE) and an amendment to the company’s revolving credit facility, which, among other things, increased the borrowing base to $1.325 billion.

In his statement, Anderson said Earthstone funded the Bighorn acquisition with well over 50% equity in the form of direct consideration to the seller and the new equity investment from the PIPE, “maintaining our conservative capital structure,” he added.

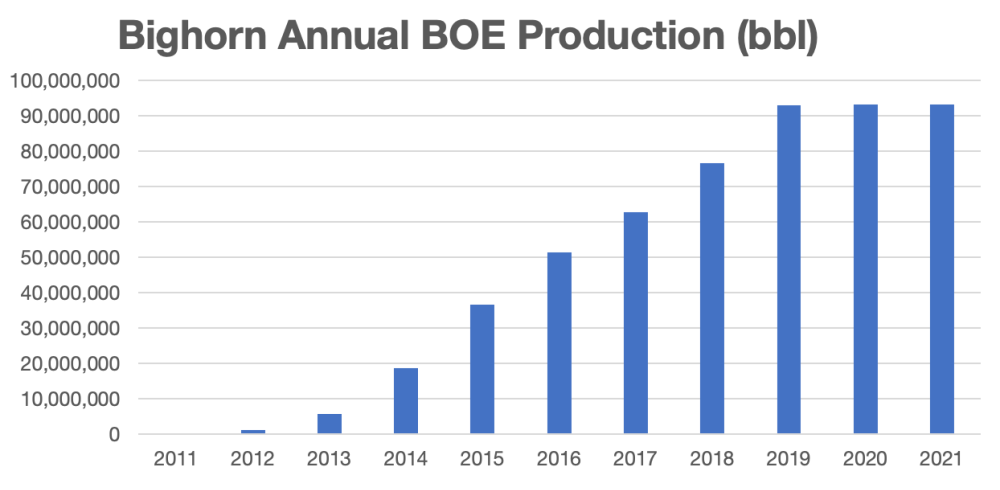

Earthstone announced in late January its agreement to acquire the assets of privately held Bighorn Permian Resources in the Midland Basin for roughly $860 million in cash and stock.

At closing, however, the cash consideration for the Bighorn acquisition was reduced from the announced $770 million by approximately $131 million to $639 million. Further, the equity consideration was reduced from the announced approximately 6.8 million shares of Class A common stock by approximately 1.2 million shares to 5.7 million shares, both based on preliminary purchase price adjustments.

Earthstone on April 14 said it continues to operate two drilling rigs in the Midland Basin and two drilling rigs in the northern Delaware Basin. The company estimates its average daily production for the first quarter to be approximately 35,500 boe/d (44% oil, 26% NGL, 30% natural gas), which the company said only includes 45 days of production from the assets it acquired in the northern Delaware Basin from Chisholm Energy in February.

“Combining the recently closed Chisholm Acquisition and its high-quality inventory in the northern Delaware Basin with the Bighorn Acquisition and its low-decline, high free cash flow production base in the Midland Basin has created significant incremental scale for Earthstone. ... Our near-term focus will be to continue integration efforts on both the northern Delaware Basin assets and the newly acquired Midland Basin assets,” Anderson said.

“We expect to continue our pursuit of additional scale through accretive acquisitions that we believe will result in continued improved cost structure and creation of shareholder value, while always keeping our balance sheet strength as the top priority,” he added.

As of April 14, Earthstone estimates it had total debt outstanding of $1,013 million, comprised of $550 million of senior unsecured notes and $463 million of debt outstanding under our credit facility, leaving $337 million of undrawn availability on the $800 million of total commitments under our credit facility.

The PIPE was included with EnCap Investments LP, a current beneficial owner of approximately 47% of Earthstone’s total Class A and Class B common stock, and Post Oak Energy Capital LP, an unaffiliated party. In conjunction with the closing of the PIPE, the Earthstone board of directors has expanded to 11 members with the appointment of Frost Cochran, who is a managing director and a founding partner of Post Oak Energy Capital LP.

Johnson Rice & Co. LLC served as financial adviser to the audit committee of Earthstone with respect to the PIPE. RBC Capital Markets was exclusive financial adviser to Bighorn. Legal advisers included Haynes and Boone LLP and Jones & Keller, P.C. for Earthstone, and Simpson Thacher & Bartlett LLP for Bighorn.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.