Earthstone Energy Inc. said Jan. 7 it had completed the acquisition of Independence Resources Management LLC (IRM), a Midland Basin operator backed by Warburg Pincus LLC.

The cash-and-stock transaction, valued at about $185.9 million, is expected to roughly double both Earthstone’s production and adjusted EBITDAX with minimal impact to leverage, said President and CEO Robert J. Anderson in a Dec. 18 release by The Woodlands, Texas-based company announcing the acquisition.

“We are pleased to be able to begin 2021 with the completion of this significant acquisition and would like to thank the team at IRM for working with us to close this transaction just three weeks after announcement,” Anderson said in a statement on Jan. 7.

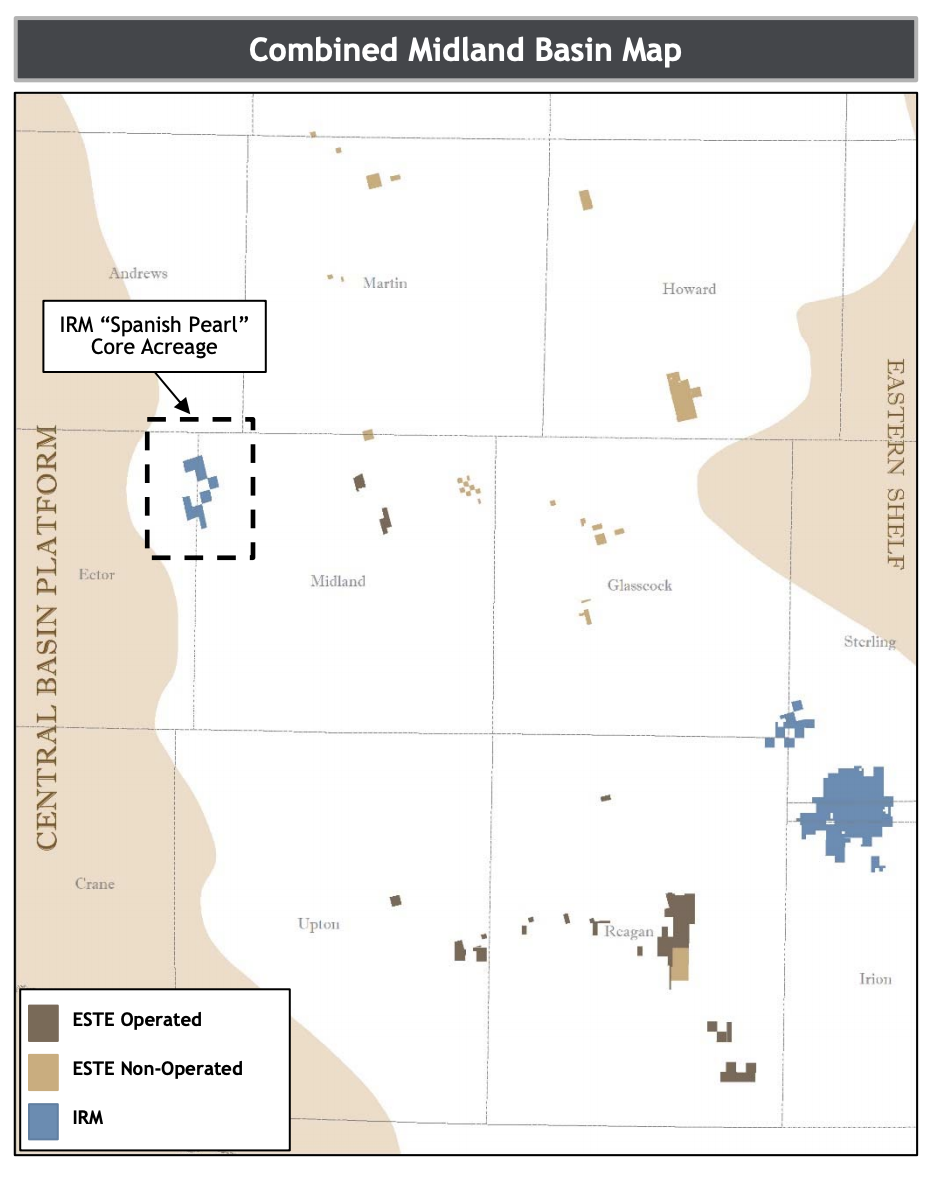

Formed in December 2014 with a $500 million line-of-equity investment from Warburg Pincus, IRM holds about 43,400 net acres in two contiguous blocks in the Midland Basin of West Texas. The company’s production averaged 8,780 boe/d (66% oil) during the third quarter.

About 4,900 net acres of IRM’s Midland Basin position are located in Texas’ Midland and Ector counties and includes an inventory of 70 undeveloped horizontal locations targeting the Middle Spraberry, Lower Spraberry and Wolfcamp A zones with an average IRR of 45% at strip pricing. The company also holds an additional 38,500 net acres in the eastern Midland Basin.

“The added scale of this acquisition enhances our ability to deliver top tier operational and financial results with a heavy focus on generating low-cost, high margin production,” Anderson continued in his Jan. 7 statement. “We remain committed to financial discipline while continuing to seek further increases to our scale with high-quality accretive acquisitions.”

In December, Earthstone projected it would resume drilling activity in the first half of 2021 through a one-rig program that Anderson said he expects will be fully funded well within the company’s operating cash flows.

The aggregate purchase price for the IRM acquisition consisted of $131.2 million in cash consideration and approximately 12.7 million shares of Earthstone’s Class A common stock valued at $50.8 million based on a closing share price of $3.99 on Dec. 16.

In connection with the closing, the Earthstone board of directors expanded to nine members with the appointment of David S. Habachy, who has been a managing director on the energy team of Warburg Pincus since 2017.

No changes to Earthstone management were expected to occur in connection with the transaction.

RBC Capital Markets LLC and Wells Fargo Securities, LLC acted as financial advisers to Earthstone for the transaction. Jefferies LLC was financial advisor to IRM. Legal advisers included Jones & Keller PC for Earthstone, and Latham & Watkins LLP for IRM.

Recommended Reading

US Geothermal Sector Gears Up for Commercial Liftoff

2024-04-17 - Experts from the U.S. Department of Energy discuss geothermal energy’s potential following the release of the liftoff report.

Oil, Gas Drilling Tech Transfer Boosts Fervo’s Geothermal Prowess

2024-02-14 - Geothermal company Fervo Energy is learning from oil and gas drilling and completion techniques to improve geothermal well costs and drill times.

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

Amid ‘Battery Arms Race,’ Xerion CEO Talks Tech, Maturing Market, China

2024-04-10 - The late-stage battery startup is active in the military and electronics space, but is gaining attention for technology that extracts lithium from geothermal brine.

Google Exec: More Collaboration Needed for Clean Power

2024-04-17 - Tech giant Google has partnered with its peers and several renewable energy companies, including startups, to ramp up the presence of renewables on the grid.