The South Texas Eagle Ford Shale’s emergence as an M&A hot spot in late 2022 highlights the play’s market potential this year. (Source: Shutterstock.com)

EOG Resources. Devon Energy. Marathon Oil.

Some of the largest U.S. independent E&Ps are thriving in the South Texas Eagle Ford Shale, adding acreage and assets and counting on the play—long in the shadows of the neighboring Permian Basin—to be a highlight of their portfolios.

The Eagle Ford is producing more than 1.2 MMbbl/d; that’s up slightly from this time last year, when production was close to its pre-pandemic level of 1.1 MMbbl/d, according to U.S. Energy Information Administration (EIA) data.

While the basin’s per-barrel tally remains a stretch away from its 2015 peak of almost 1.8 MMbbl/d, business is keeping the play in a tight race with the Bakken in North Dakota as both basins compete for second place to the mighty Permian Basin, where producers in West Texas and New Mexico coaxed more than 5.6 MMbbl from the earth each day in January.

Natural gas production in the Eagle Ford Shale has been a far steadier story, with EIA drilling productivity data showing routine production near 7 Bcf/d range since 2015, after a climb from around 5 Bcf/d that began in 2013.

The basin’s rig count this year is solid, holding in the 70’s since July and up 44% year-over-year from 50 rigs, according to Baker Hughes data.

Location, location, location

By proximity alone, the Eagle Ford offers several advantages, analysts at East Daley Analytics said.

“Producers in South Texas are closer to Gulf Coast industrial demand centers and export terminals, resulting in higher realized prices for crude oil, natural gas and NGL. And unlike the Permian, producers in the Eagle Ford aren’t plagued by significant takeaway constraints for natural gas,” the analysts said in late November.

Indeed, the Eagle Ford was adding rigs in November, peaking at 97 by Dec. 1, with a gain of five rigs added across four weeks. That figure represents the highest count since March 2019.

By contrast, the Permian in West Texas and eastern New Mexico shed 23 rigs during the same period.

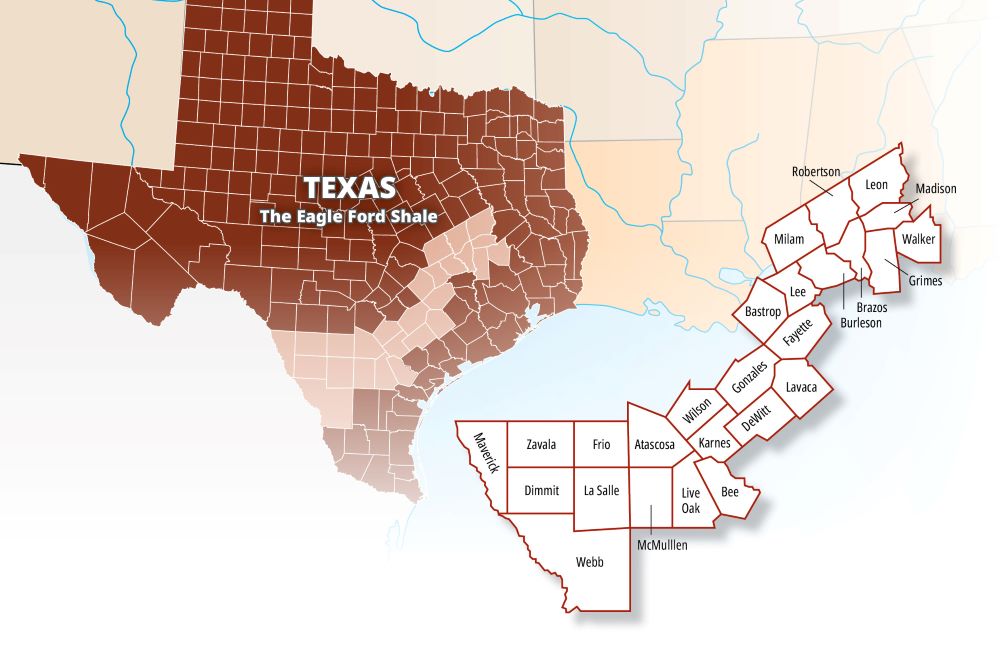

One of the reasons the Eagle Ford Shale is a popular place for oil and gas resource development is that it encompasses a more rural area than other shale plays. Across the Eagle Ford Shale, which covers 20,000 square miles and lies east of the cities of San Antonio and Austin but includes smaller towns like College Station, almost all oil and gas leases are held on large ranches.

Those holdings mean that there are fewer landowners with which to deal, making leasing arrangements far simpler than in other shale plays. The Barnett Shale, for example, includes urban areas in and around Fort Worth and Arlington, on the western edge of Dallas.

“It certainly helps that, at least in large parts of the Eagle Ford, you’re dealing with large landowners,” said Andrew Dittmar, director at Enverus Intelligence Research. “It definitely makes [oil and gas development] much easier.”

The ownership landscape makes for a sparsely populated region to develop. As such, across much of the Eagle Ford Shale there are fewer people to raise concerns about oil and gas development.

Well-defined and deeply understood

A mature play, the Eagle Ford’s oil and gas reserves are well-defined, Dittmar said. Oil production is centered on the upper end of the basin, and natural gas is produced in the south.

It makes for an attractive area to drill because its rock becomes shallower and denser as it extends to the northwest. In fact, the Eagle Ford Shale can be seen on the surface of the ground in its namesake town, where it appears as clay soil. Elsewhere, an outcrop of the Eagle Ford Shale is visible in part of the Dallas-Fort Worth metropolitan area.

Additionally, the Eagle Ford’s deposits of oil and natural gas, which were formed about 80 million years ago, lie within rock that is more brittle, and thus, more permeable than the rock in other basins, meaning that the deposits within it are far easier to extract by fracking.

It is “one of the best understood shale plays” in terms of exploration and extraction, Dittmar said. “There’s not a lot of surprises anymore.”

Indeed, EOG Resources has operated in the Eagle Ford for more than 10 years. It’s a mature relationship that works in the firm’s favor.

EOG’s early wells in the basin were 8,500-ft laterals drilled at a cost of $12 million. The price is now down by more than half, between $4 million to $5 million each, said Ken Boedeker, EOG’s executive vice president for exploration and production, in November.

“That’s that continual improvement,” he said during the 2022 BofA Securities Global Energy Conference webcast.

Boedeker also said the location of EOG’s assets in the Eagle Ford presents new opportunities in the wake of global desire for LNG.

“We have a significant amount of flexibility on what we can take with LNG,” he said. “The majority of our gas out of the Eagle Ford … obviously goes into [Corpus Christi]. We do have an increased exposure to LNG. We have 140 million a day now exposed to international pricing with LNG. And that goes up to 420 million a day in 2025 with Cheniere Stage 3 coming on. There’s an additional 300 that’s linked to Houston Ship Channel, just to make sure there aren’t any differentials at that point in time.”

In short, producers see abundant opportunities in the Eagle Ford. And many want to get in on it. RBN Energy analyst Housley Carr said recently that heightened M&A activity in the area may represent at least the beginnings of a return to the mid-2010s in the Eagle Ford Shale.

Consolidation may be key. Acreage ownership is fragmented in the Eagle Ford, largely among dozens of private companies running one or two rigs that would be prime targets for acquisition by larger companies.

At present, the Eagle Ford Shale is “more a buyer’s market than a seller’s market,” although acquisitions will come at a premium for buyers, Dittmar said.

The future of the Eagle Ford Shale

Looking forward five to 10 years, Dittmar said, the Eagle Ford Shale will still be an active and important play, with small private companies still playing a role in developing its resources as larger companies look to acquire those smaller interests as consolidation of the Eagle Ford Shale’s resources continues.

Companies such as EOG continue to test new ideas in the Eagle Ford, such as its EOR program, which has boosted its drilling results exponentially in recent years.

Today in the Eagle Ford Shale, oil and gas exploration companies are revisiting old well sites and trying out new extraction techniques. Thus far, he said, results of that approach have been mixed. But that innovation will be “one of the interesting go-forward stories” in the Eagle Ford Shale, he said.

“[It is] one of the best understood shale plays [in terms of exploration and extraction]. There’s not a lot of surprises anymore.” —Andrew Dittmar, Enverus Intelligence Research

Dealmaking in the Eagle Ford Shale during the second half of 2022 was a rare bright spot in an otherwise dark year for upstream A&D in the U.S. Large-cap public companies like Devon Energy Corp. and Marathon Oil Corp. dominated deal activity with balance sheet strength and steady stock performance that gave them the ability to capitalize on their positions and take on the large, high-quality offerings of private sellers.

Marathon Oil

Marathon Oil closed its acquisition of Ensign Natural Resources’ Eagle Ford assets for $3 billion cash in December.

“This acquisition satisfies every element of our disciplined acquisition criteria,” said chairman, president and CEO Lee Tillman. “It’s immediately accretive to our key financial metrics, it will drive higher shareholder distributions consistent with our operating cash flow driven return of capital framework, it’s accretive to our inventory life with attractive locations that immediately compete for capital and it offers truly compelling industrial logic given our existing Eagle Ford footprint and our track record of execution excellence in the play.”

The acquisition adds 130,000 net acres (99% operated, 97% working interest) in acreage adjacent to Marathon Oil’s existing Eagle Ford position. Ensign’s estimated fourth-quarter production will average 67,000 net boe/d, including 22,000 net bbl/d of oil, Marathon said.

Along with that acreage, the acquisition included 700 existing wells across Live Oak, Bee, Karnes and DeWitt counties in Eagle Ford as part of what is now Marathon Oil’s presence in Eagle Ford of 290,000 net acres.

According to Marathon Oil, the existing wells “offer upside redevelopment potential.” In a November news release, Marathon estimated the deal would bring them “more than 600 undrilled locations, representing an inventory life greater than 15 years.”

At the time of the acquisition, Marathon Oil was anticipating fourth-quarter 2022 production at 67,000 net boe/d, nearly double what the company’s presence had been in the Eagle Ford Shale.

Tillman said the acquisition would boost the company’s inventory life with high rate-of-return locations, driving a 17% increase to 2023 operating cash flow and a 15% increase to free cash flow.

Devon Energy

In August, would-be Eagle Ford consolidator Validus Energy accepted a $1.8 billion cash consideration to sell to Devon Energy.

Just two months before, the company’s CFO Cameron Brown said the Denver-based firm only had $1 billion of capital commitments available for deals with which the firm “would love to continue to consolidate the basin.”

Fast-forward to the fall, and instead, Devon president and CEO Rick Muncrief was touting the benefit of adding Validus’ assets to his company’s portfolio: 42,000 net acres with production of about 35,000 boe/d.

“This acquisition satisfies every element of our disciplined acquisition criteria.” —Lee Tillman, Marathon Oil Corp.

The buy “captures a top-tier oil resource with a meaningful runway of highly economic inventory that is complementary to our existing footprint in the Eagle Ford,” Muncrief said.

The addition of Validus almost doubled Devon’s current Eagle Ford footprint. The company’s pro forma position of 82,000 net acres was expected to produce an estimated 73,000 boe/d in 2022—well above the 38,000 boe/d that Devon reported for the basin during the second quarter.

“Color us a bit surprised,” said Tudor Pickering Holt & Co. analyst Matt Portillo in a note to investors.

The added scale poised Devon to realize $50 million in average annual cash flow savings from capital efficiencies, operating improvements and marketing synergies, while keeping leverage relatively unchanged at current strip prices, management said.

WildFire Energy LLC

WildFire Energy has gobbled up billions of dollars’ worth of acreage in the Eagle Ford since making its entrance there in 2021, when it acquired rival E&P Hawkwood Energy in a $650 million deal.

The firm emerged in January as the buyer of Chesapeake Energy’s 377,000 acres in the Brazos Valley region of the Eagle Ford Shale in a $1.4 billion deal.

The terms included more than 1,300 wells and will boost WildFire’s presence in the eastern Eagle Ford to nearly 2,000 wells on 600,000 contiguous acres across Burleson, Brazos, Robertson, Madison, Lee, Washington and Grimes counties.

President and COO Steve Habachy said the deal was designed to be “transformative to the business” by providing WildFire with an economy of scale for getting barrels into the Gulf Coast market.

Recommended Reading

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

ARM Energy Sells Minority Stake in Natgas Marketer to Tokyo Gas

2024-02-06 - Tokyo Gas America Ltd. purchased a stake in the new firm, ARM Energy Trading LLC, one of the largest private physical gas marketers in North America.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.