(Source: Hart Energy; Shutterstock.com)

[Editor's note: A version of this story appears in the May 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

A double black swan event, combining the coronavirus crisis and a crude oil price war between Saudi Arabia and Russia, has put heavy pressure on balance sheets of much of the energy industry. Capex budgets have been slashed as crude prices have collapsed. Debt levels are under heightened scrutiny. As several observers have commented, the name of the game is “survival.”

Few claim a real handle on the price of crude, but prices have trended lower, with an expected oversupply pushing WTI prices down as far as $20/bbl as of mid-March. Any success from a return to the bargaining table by Saudi Arabia and Russia might help slow the pace of inventory builds, but the bigger factor for crude prices is COVID-19-related demand destruction.

Some analysts predict a path for crude prices to the teens or single digits, as crude and product storage levels approach maximum capacity and unused space is quickly filled as the market demand for oil declines.

Obviously, in the current environment, revised budgets have been predominately designed to avoid any outspend and increase in debt. But resetting a budget hinges on key variables. With revised capex cuts set mainly on a $30 to $35/bbl WTI, budgets would still spend 120% of organic cash flow at strip, which has a $22 prompt month and nearly $25 for the balance of 2020, according to a March 19 Morgan Stanley report.

The above illustrates the urgency of scaling back capex to hold down debt. This trend has seen some producers retreat from a goal of modest growth to one of maintenance mode, or holding production flat, and then a move to survival mode allowing for declines in output by year-end. In a late March survey, Barclays estimated a 37% drop in capex by large and small and mid-cap producers in 2020 versus 2019.

Bifurcated debt markets

Capital markets can do little to shore up balance sheets. Equity markets have collapsed and, in any case, have been shut to upstream energy for months. Debt markets are bifurcated, with energy credits trading at deep discounts for all but the highest-quality issuers. For companies facing a need to refinance debt in the next few years, there is a “daunting debt wall” as maturities approach, according to an S&P Global report.

In addition, the outlook is for commercial banks to tighten significantly their reserve-based lending (RBL).

According to Tudor, Pickering, Holt & Co. (TPH), there could be a “brutal redetermination season” this spring, with the “best case scenario” being banks using oil and gas price decks based on the forward strip. Coupled with the high-yield debt market being closed, this means “many E&P names will trigger covenants on revolvers and will face high hurdles to tackle maturities as they come due.”

For those companies carrying relatively high leverage or facing near term maturities, the outlook is dim.

“The market is really punishing these companies, given the oil price outlook and the cost outlook of these levered companies.”

—Gary Stromberg, principal and head of high-yield energy research at PGIM Fixed Income.

Generally speaking, spreads in the high-yield energy sector have widened dramatically and now exceed by over 400 basis points the levels prevailing in February of 2016, when WTI fell to just over $26/bbl. In response to the widening of spreads in the corporate sector of the broader economy, Federal Reserve policy has been expanded so it can purchase corporate debt—but only if rated BBB- or higher, which excludes high-yield bonds.

Data from Bloomberg Barclays illustrate the sharp turn lower in the high-yield market. For example, Laredo Petroleum Inc. took advantage of a brief window in January to tap the high-yield market. It priced two bonds, with maturities in 2025 and 2028, at par to yield 9.5% and 10.125%, respectively. Prior to the OPEC meeting, the bond traded down markedly, to levels below 60, with yields well in excess of 20%.

In late March, in the wake of the OPEC meeting, the bonds were trading in the mid-30s to yield 35%.

“A name like Laredo could not come to market today, and that’s the case with a lot of E&Ps and drillers,” said one market observer.

Stronger names, such as Parsley Energy Inc., rated BB, and WPX Energy Inc., with a BB- rating, has not fared well but held up better. Parsley priced a senior note due in 2028 at par to yield 4.125%, while WPX priced a senior note due 2030 at par to yield 4.5%. Both bonds traded down to the low 90s prior to the OPEC meeting. After the meeting, the bonds traded at 57 to yield 13% and 51 to yield 13.75%, respectively.

The oilfield service sector has been hit even harder, where senior unsecured guaranteed notes had been issued by Nabors Industries Inc. and Transocean Ltd. These rank ahead of legacy unsecured notes without guarantees. Nabors’ two tranches, yielding 7.25% and 7.5% at par, traded down into the 80s pre-OPEC. The Transocean issue, priced to yield 8% at par, fared worse and slid into the 70s.

Post-OPEC, the discounts have deepened, with the bonds trading in the 30s and 40s, respectively.

Wave of bankruptcies

“I think it’s inevitable that we’re going to have another wave of bankruptcies,” observed Gary Stromberg, a principal and head of high-yield energy research at PGIM Fixed Income, an investment arm of Prudential Financial. New issuance has come to a halt, with the energy sector of the high-yield market “effectively closed,” and the market “really punishing” existing bonds in secondary trading.

Obviously, the breakup of the OPEC+ meeting without an agreement has only helped to hasten the slide in the energy high-yield market.

“I don’t want to say OPEC is unraveling,” said Stromberg. “But, clearly, not being able to continue the cuts they had in place is extremely bearish for the market.” And with Saudi Arabia putting over 2 million barrels per day (MM-bbl/d) on the market, coupled with demand destruction of 3 to 4 MMbbl/d due to the coronavirus, “if you start adding it all up, the world becomes awash in crude very quickly.”

Compared with the severe market conditions in 2015 to 2016, the high-yield credits today “are actually in better shape,” according to Stromberg. “We weeded out a lot of the really weak credits during the last mini cycle.” However, the fact that credits had improved—even as spreads in the sector had surpassed levels last seen in early 2016—“tells you how weak the high-yield energy market really is.”

The Barclays High-Yield Energy Index indicated a spread over U.S. Treasuries of about 700 basis points in early 2016. Recently, the spread widened still further to as much as 2,200 basis points. “The market is really punishing these companies, given the oil price outlook and the cost outlook of these levered companies,” said Stromberg.

In evaluating high-yield bonds, more stringent metrics are often being used, noted Stromberg. On proved developing producing properties, some investors are no longer using PV-10 metrics, but rather PV-12 or PV-15 valuation. No longer is any value accorded to proved undeveloped properties or to acreage in an assessment of collateral.

“That’s a major change in the markets that’s happened over roughly the last year,” he said.

Hefty cuts to borrowing bases

For E&Ps facing near-dated maturities, the option of using a bank borrowing base to pay down senior notes or to provide liquidity has likely dimmed, according to Stromberg. “We understand the banks are using much lower prices in this spring redetermination season, and our expectation is that you’ll see pretty hefty cuts to those borrowing bases,” he said.

In addition, a number of E&Ps risk failing to meet the covenants of their bank facilities, said Stromberg. If in breach of a covenant, “the banks have in the past provided relief if they think it’s a short-term issue. But in this type of market and what we’re seeing with the commodity markets, the banks are going to be much less willing to give relief on covenants.”

What other options are available to producers—at a cost?

One possible avenue is a first lien term loan, “but it’s going to be expensive,” cautioned Stromberg.

“The problem is that, if you are at Libor plus 250 basis points on your borrowing base—which is where a lot of these E&Ps are—first lien energy bonds may have a 10% coupon,” he said. So you’re taking a company that already has trouble potentially serving interest payments at recent low oil prices, and now you’re adding a much bigger interest burden on it.”

One potential area for optimism, said Stromberg, was the likelihood of a rebound in natural gas prices.

“I have a more bullish, medium-term view of natural gas,” he said. “We’re going to see the rig count for oil come down. That does two things: It brings the oil supply down in the U.S., and a lot of the associated gas produced from Permian wells will also fall off. So, in a market where natural gas supply is declining in the U.S., and assuming a normal winter next year, you could see prices snap back a little quicker with gas.”

Over the longer term, however, market forces are “going to starve capital out of the system,” which will ultimately be good for the oil and gas sector, according to Stromberg. But in the meantime, “companies are going to struggle to find capital,” he warned.

“We’ve had a perfect storm of the coronavirus hitting the largest demand source for oil, transportation, at a time when OPEC has been holding 2 million barrels per day off the market and has effectively been losing market share to the U.S. And Saudi Arabia has made a very difficult decision to stop losing market share,” he said.

Coming surge of ‘fallen angels’

Rating agencies recently downgraded Occidental Petroleum Corp. to junk, burdened by $38 billion in debt following its acquisition of Anadarko Petroleum Corp. While defaults may shrink the high-yield market, “everyone is now focused on the coming surge of ‘fallen angels,’” which by Stromberg’s estimate could top $50 billion. “Investors have plenty to do,” but at oil prices below $30/bbl, “not many companies can break even.”

Funding issues for energy producers have reached a truly critical point—the point of survival—according to Matt Portillo, CFA, managing director of E&P research for TPH. “It’s all about survival,” he said. “The key is being able to survive and not destroy your balance sheet between now and the recovery. It’s really about who lives and who doesn’t in the current environment.”

A narrower filter of names able to access debt markets has been long in the making, according to Portillo.

The energy sector was “constructed around the view you’d always have access to a liquid capital market and you could constantly roll your debt forward,” he said. “But most upstream E&Ps were so focused on growth, coupled with assumed access to capital, that they never solved for trying to generate free cash flow. For years they didn’t generate enough free cash flow to pay back the principal they owed on their debt.”

As high-yield investors shifted their focus away from a net asset value model and toward a corporate free-cash-flow model, reticence grew in terms of continuing to fund some companies, especially among smaller cap names, according to Portillo. “That’s why I think you started to see the high-yield market bifurcate in a big way in 2019. And that’s caused a seizing up of access to capital last year,” he said.

From bad to worse

An already bad situation has gone “from bad to worse” with the twin shocks on demand and supply from the coronavirus pandemic and the market share war between Riyadh and Moscow, said Portillo. “A lot of the upstream sector will go into a bit of a death spiral if we stay at recent prices, because as they cut to cash neutrality, output starts to decline, EBITDA starts to decline and E&Ps are still not generating free cash flow.”

As capex is set closer to cash flow to avoid adding debt, TPH estimates U.S. oil production will decline by 10% to 11% from the fourth quarter of last year to the fourth quarter of 2020. This is based on an estimated 50% cut in capex for its coverage in 2020. For 2021, as industry hedges roll off for oil from 2020 levels, it expects a further 17% cut in capex, resulting in a 5% to 6% drop in year-over-year production.

As production slides, prospects for generating free cash flow frequently diminish, especially for smaller companies.

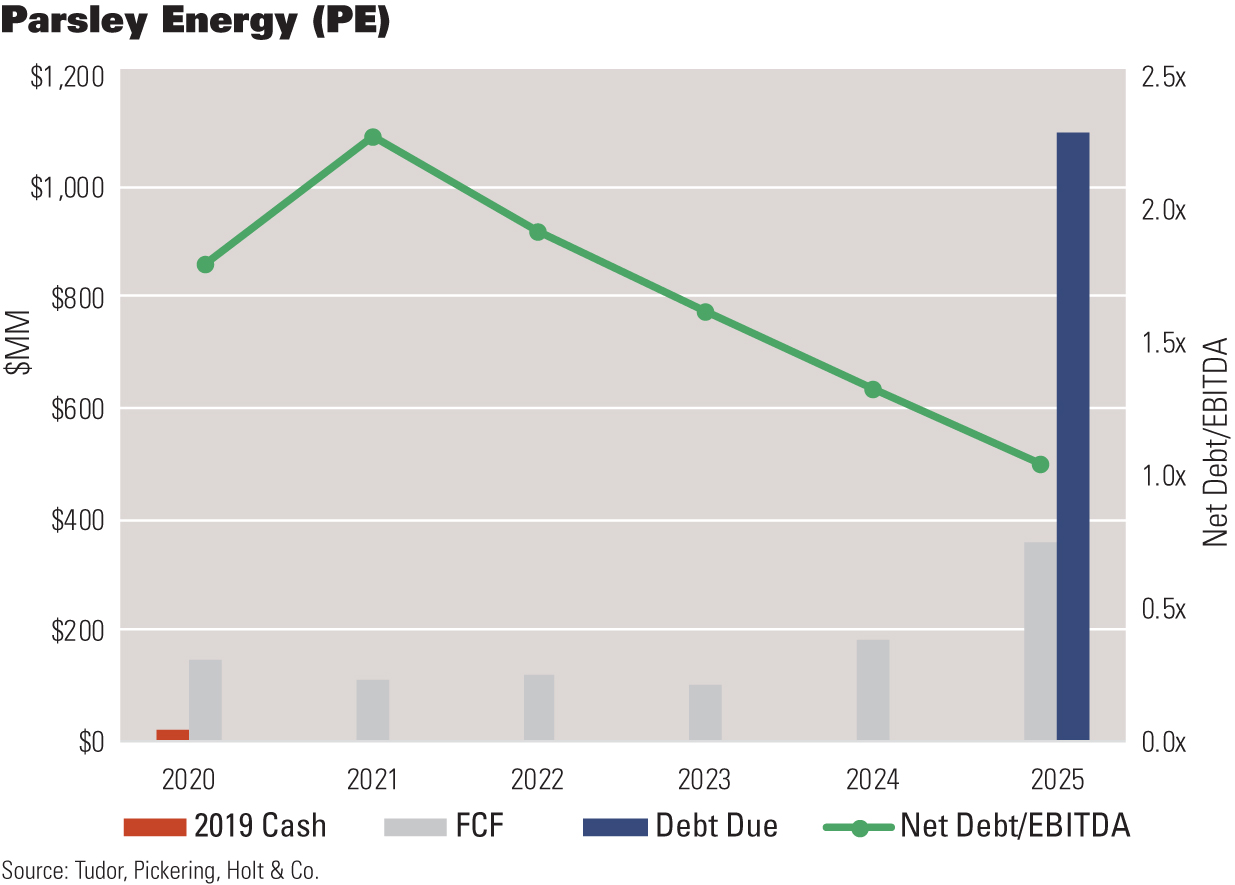

“The punchline from investors is that real distress is likely to hit E&Ps that don’t organically generate free cash flow to pay back their debt over the next three or four years,” said Portillo, citing feedback from institutional investors. As a result, “anyone with a debt maturity wall coming due before 2024 is likely to find itself in real distress as it relates to both equity and debt investors.”

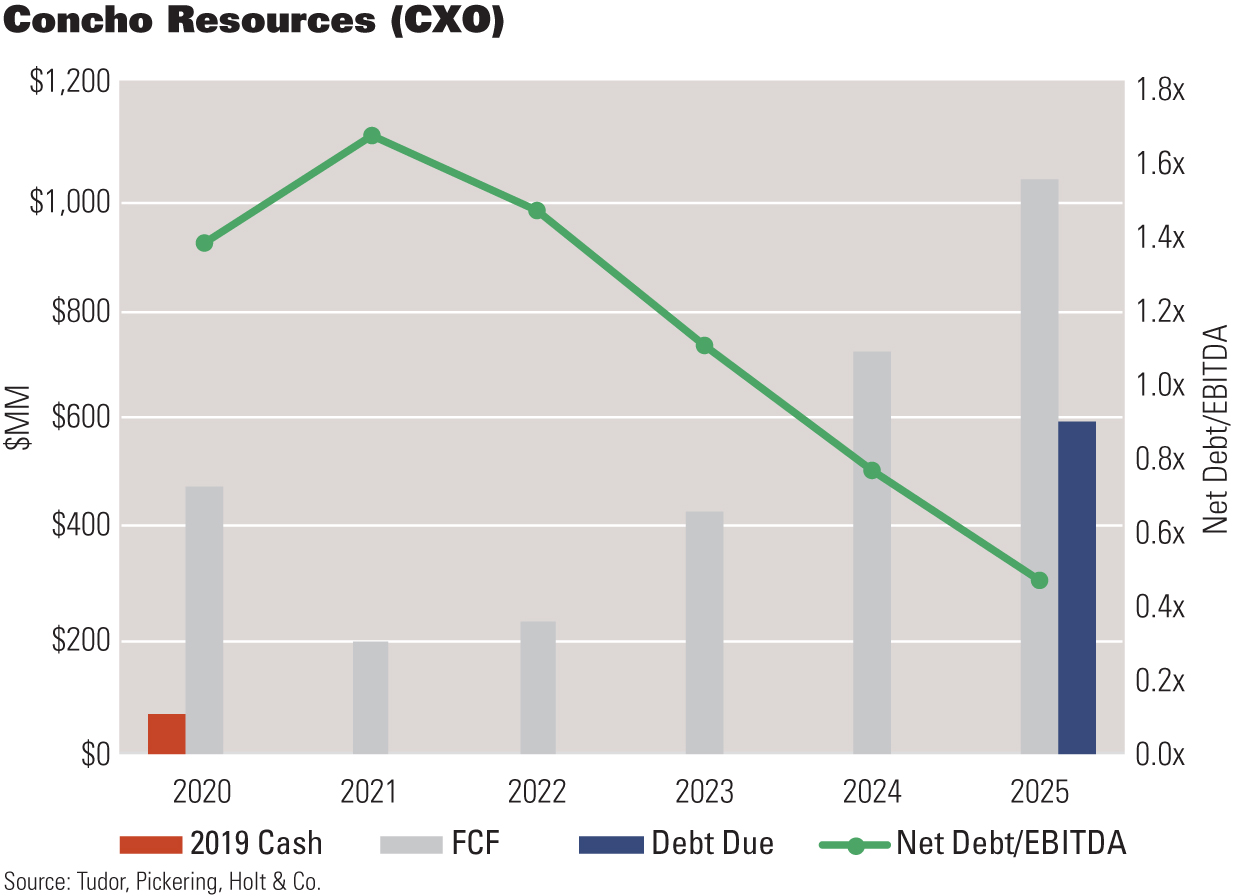

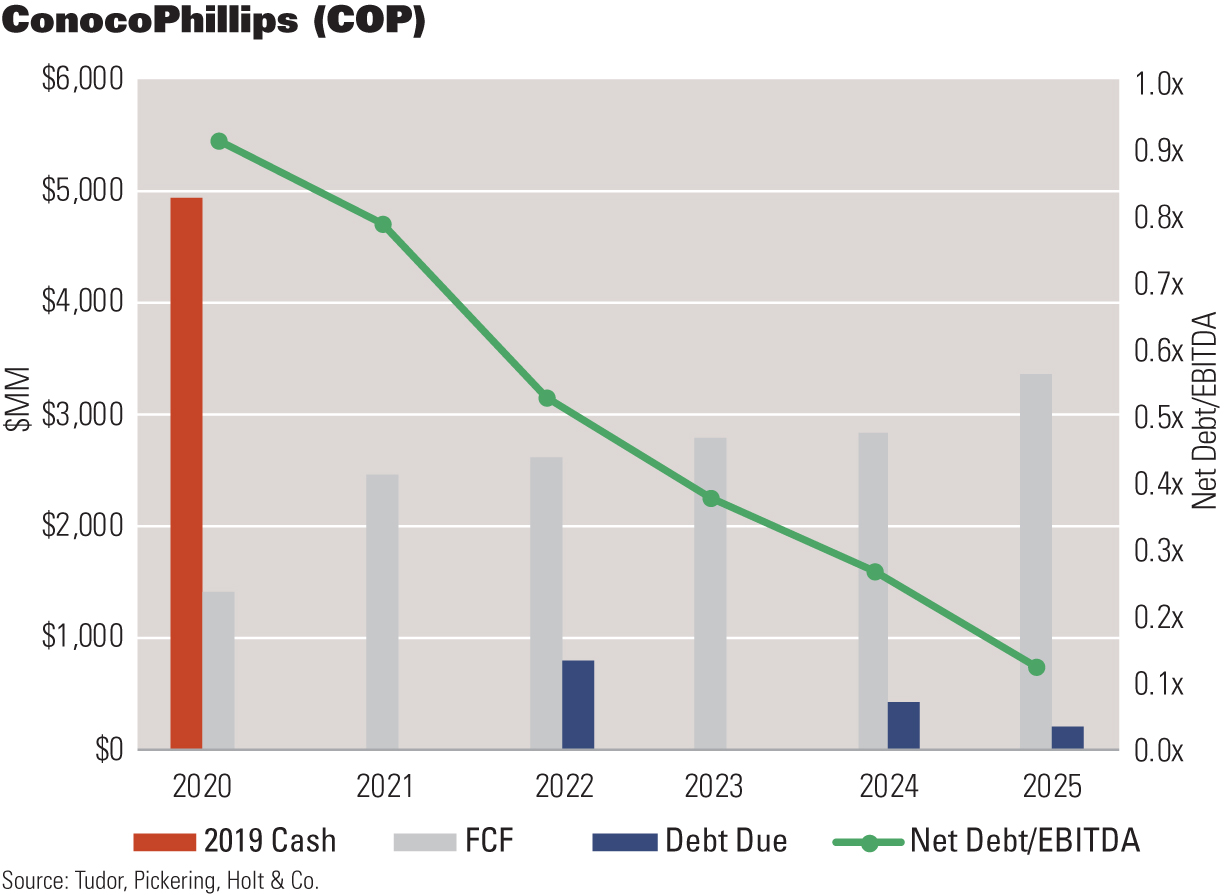

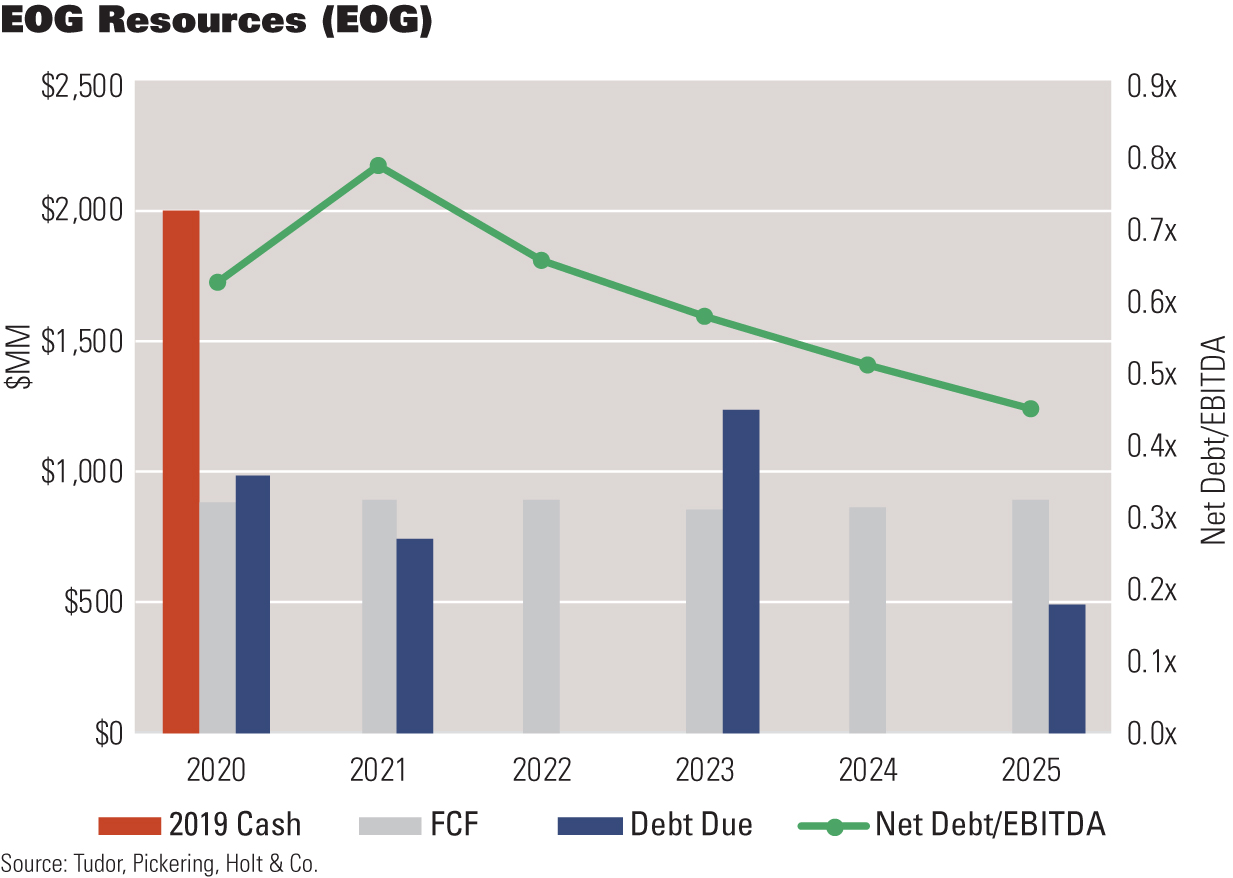

Before the collapse in crude prices, a rule of thumb was that “the market really didn’t have much appetite to finance extensions of debt maturities if leverage was over 1x to 1.5x net debt-to-EBITDA at $50/bbl WTI,” said Portillo. Some greater latitude may be afforded to larger, financially stronger producers, but interest in rolling over debt would not extend beyond 2x by EBITDA Concho Resources Inc. for even core names, he added.

“The key is being able to survive and not destroy your balance sheet between now and the recovery. It’s really about who lives and who doesn’t.”

—Matt Portillo, CFA, managing director, E&P research, TPH.

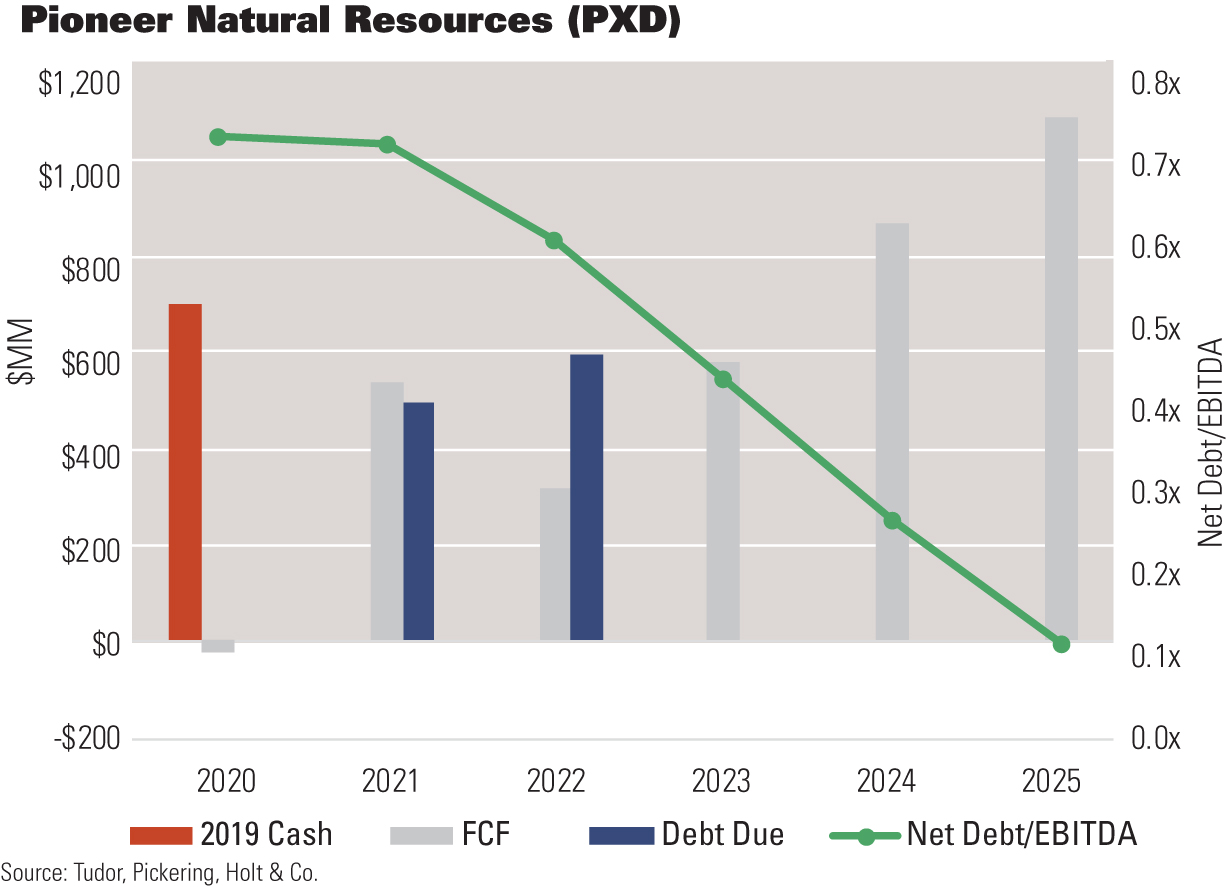

Names that are viewed by TPH as core holdings make up a relative small group: ConocoPhillips Co., Concho Resources, EOG Resources Inc. and Pioneer Natural Resources Co.

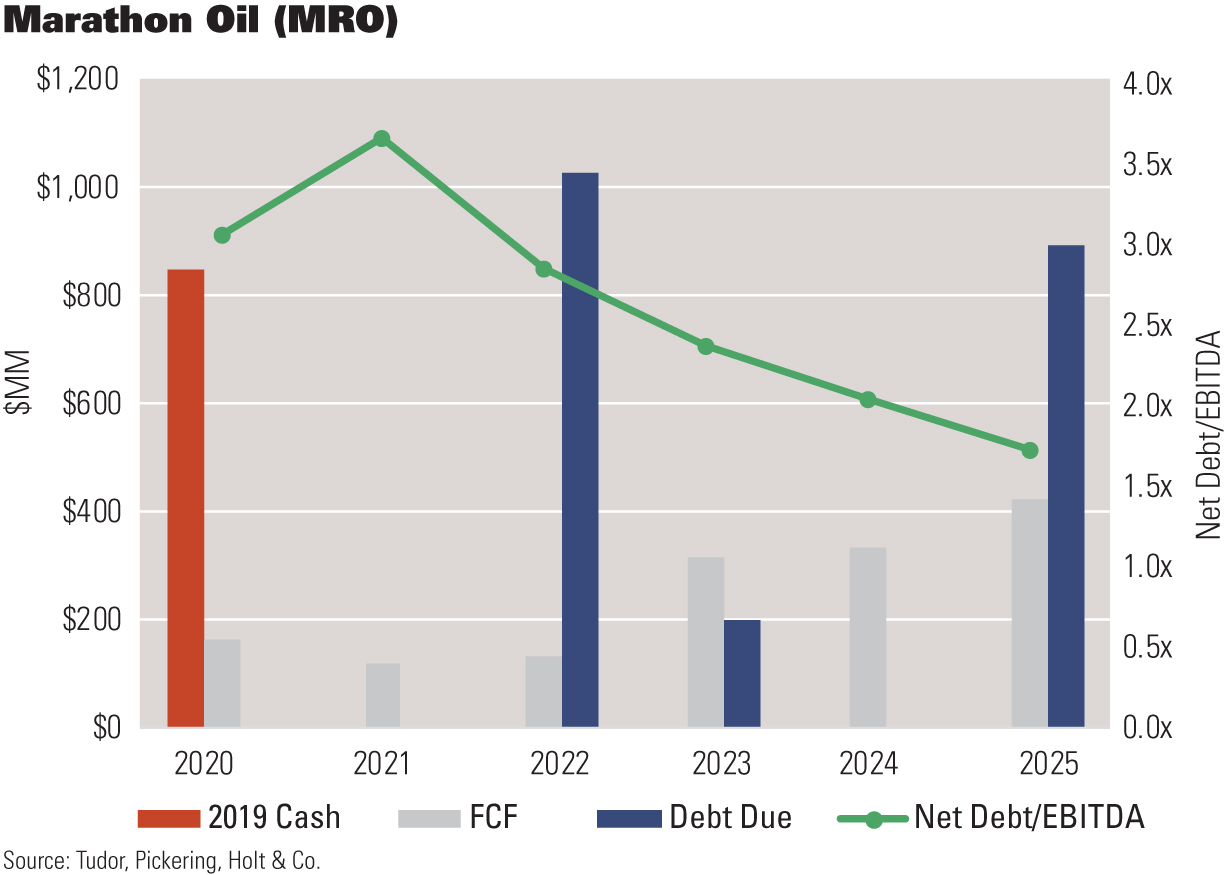

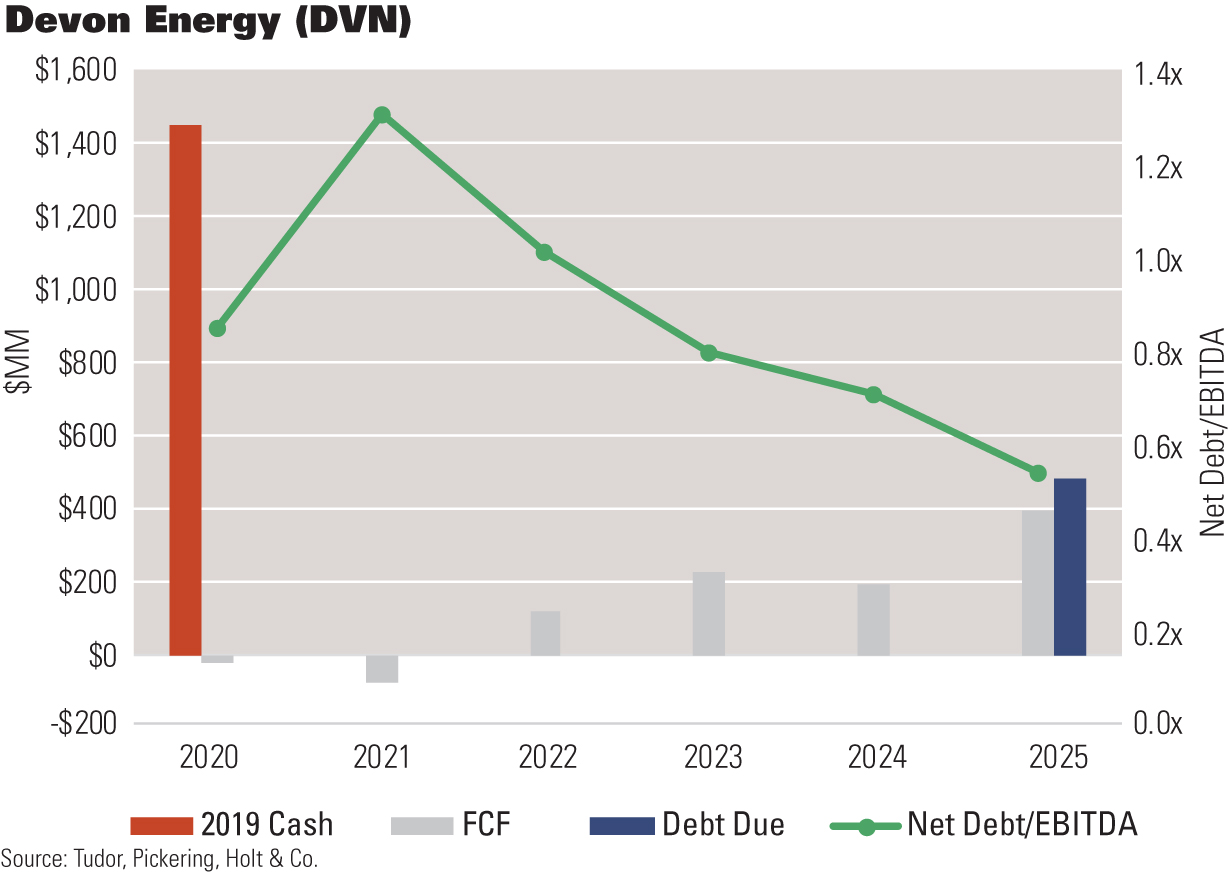

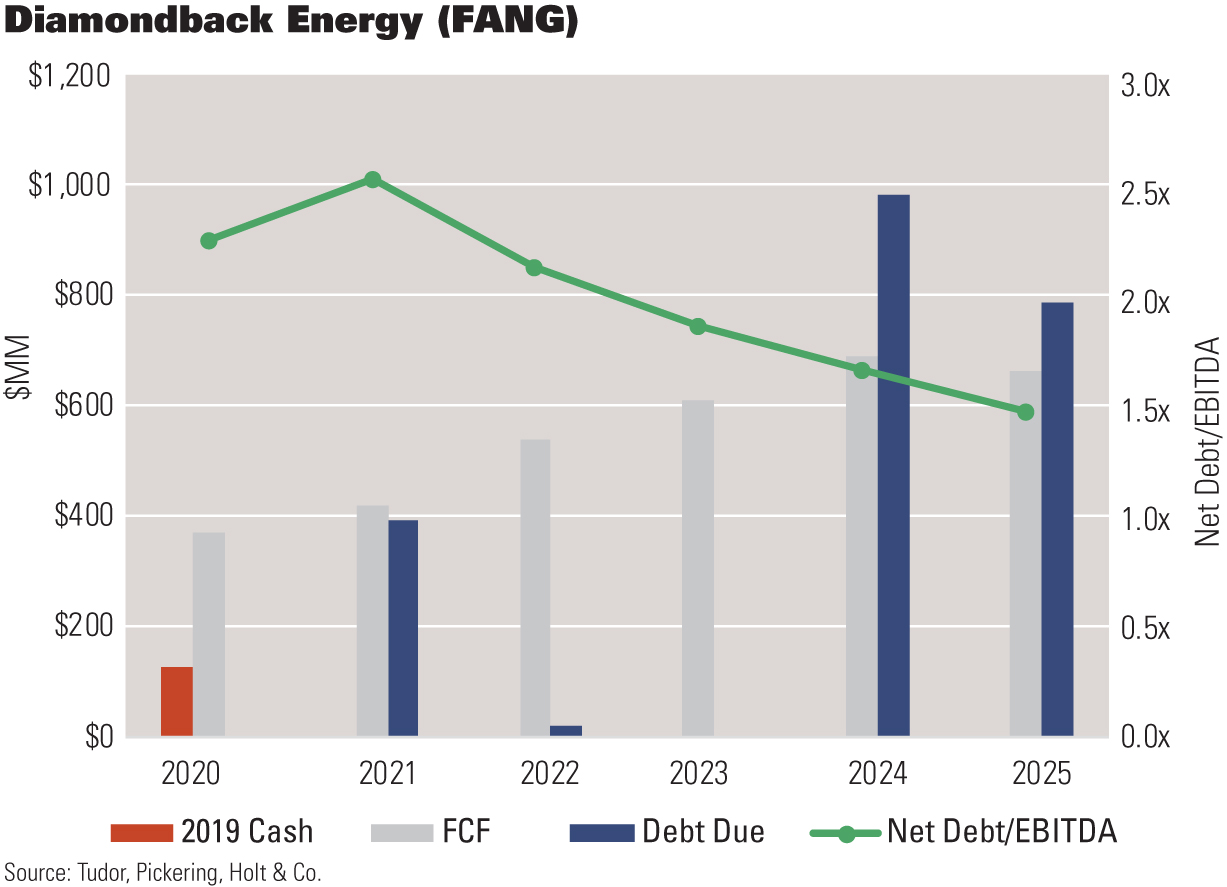

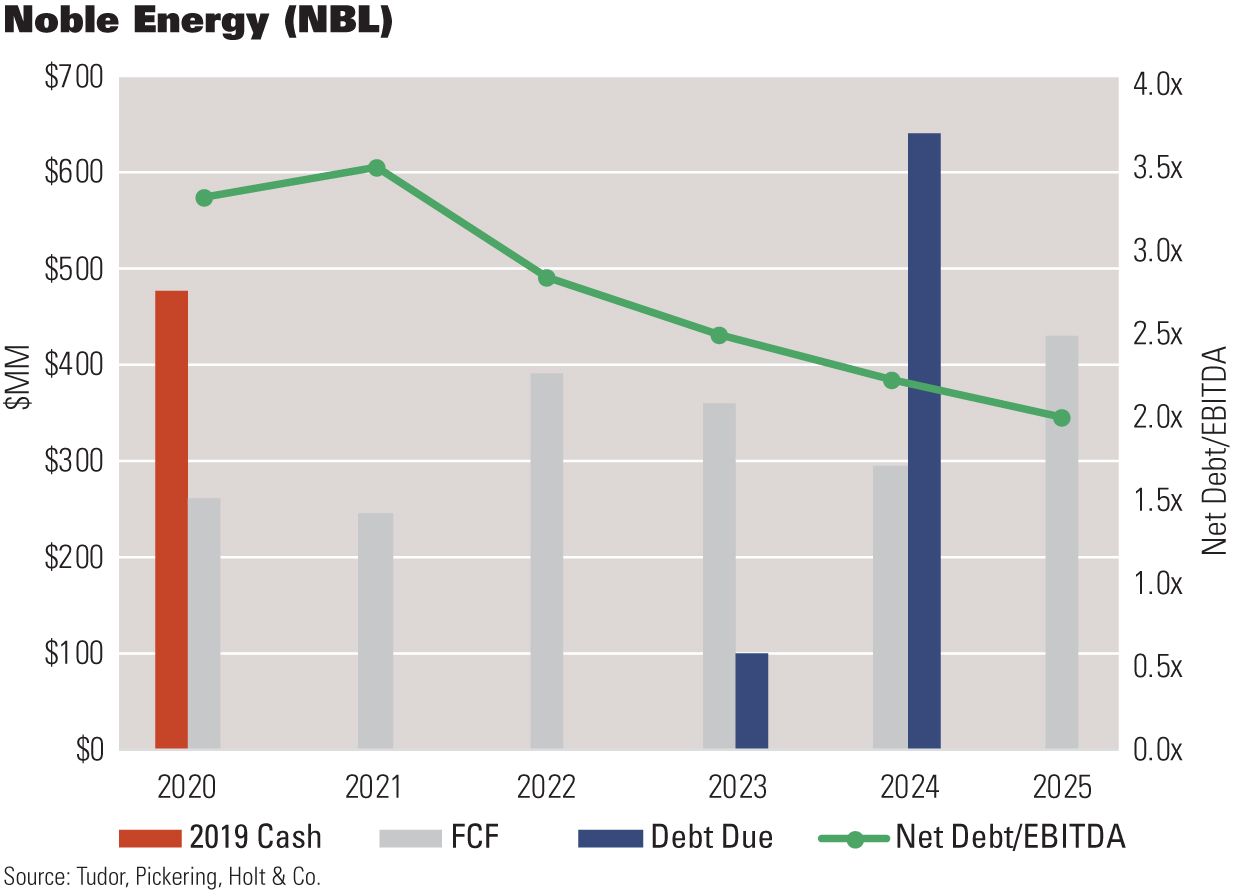

A second group of more “risk-on” producers—names to visit as the market looks close to bottoming—is made up of two parts: large-cap value stocks and well-positioned Permian mid-cap names. The former is comprised of Devon Energy Corp., Marathon Oil Corp. and Noble Energy Inc., and the latter of Diamondback Energy Inc., Parsley Energy Inc. and WPX Energy Inc.

“All those names have plenty of liquidity and will be able to make it through the cycle,” said Portillo. As noted earlier, Parsley and WPX took advantage of a debt window being open earlier in the year. “Although they were at the upper bounds of the leverage metric, there was a clear line-of-sight to compression of that EBITDA multiple. And they got fantastic rates on the debt they issued.”

For the large-cap value names, Devon and Marathon, Portillo pointed to both producers having substantial cash positions and, as a result, no real liquidity or maturity issues of concern. In Noble Energy’s case, he pointed to the significant free cash flow under long-term contract from its Leviathan project in the Mediterranean Sea as one of several factors allowing the company to “navigate through the cycle.”

On the other side of the coin are the many companies that face “major concerns in the near term on liquidity and leverage,” according to TPH. The reality is that “the industry, for the most part, doesn’t work below $50/bbl,” observed Portillo.

“The distress is going to accelerate,” he commented. “The banks have tried to be as lenient as they possibly can over the last few years in order to work with the industry. Unfortunately, the collapse in the asset market is starting to cause losses to accelerate on a number of the credit facilities and the high-yield and unsecured bonds in the market. And we don’t see the asset market improving any time soon.”

Are there any rays of light if you look out far enough beyond the clouds?

Assuming U.S. oil production declines during the next two years and demand reverts to a normalized level in 2021, “a lot of the spare capacity in the OPEC+ countries basically gets eaten up,” said Portillo. “And we’re starting to see major project deferrals in areas like the Gulf of Mexico and internationally. For 2022 and beyond, the market is facing a very tight amount of spare capacity globally.”

One-directional trade

In a debt market characterized by steep selloffs and heightened volatility, relative value is lost amid an almost one-way wave of selling, according to Ray Lemanski, managing director and head of credit strategy at KeyBanc Capital Markets Inc.

“Nobody is looking for relative value right now among the oil and gas names, whether it’s the debt or the equity names,” said Lemanski. “There isn’t a lot of differentiation. Investors aren’t saying, ‘I like this over that.’ People are selling what they can. And, right now, everything is pretty much one-directional.”

Lemanski recently conducted a study in which he assigned high-yield E&P bonds to one of three categories. The largest category by far was one titled “stressed/distressed,” which made up over 75% of the total and comprised issuers trading on a yield-to-worst of 13% or more. These are ones where the issuers face “much more significant credits issues and the market is losing confidence in them.”

The first of the two other categories is termed “market rate” and comprises issuers that should be able to refinance in a more normalized type of market, typically on a yield-to-worst of around 8% or lower. The second was those whose refinancing depended on some improvement in the credit or commodity environment, typically associated with an upturn in oil and gas prices.

To see some stability in bonds issued by the E&P sector, “the first thing that has to happen is the bond prices in the secondary market need to bottom out—and that’s not happening,” he said. “Everybody’s been hit, including the midstream and, to a lesser extent, the pipeline companies. And it’s another tremendous body blow to the folks in the oilfield service sector,” he added.

“The best indicator of market trends for E&P issuers is to look at the price of the bonds and the yields as we go forward,” said Lemanski. “Look at them across the board, look at them by basin, look at them by rating category, and see if there are trends that you can discern, and then you can make a bit of a broader call. Looking at each individual name right now isn’t really telling you very much.”

For example, looking at a universe of over 15 names in the Permian Basin, only three were trading at stressed/distressed levels, according to Lemanski. By contrast, in Appalachia, bonds were trading at yields ranging from 15% up to over 20%. And in the Bakken, a number of E&Ps, both public and private, were trading at yields that were north of 30%, he said.

Basins that ‘lead you out’

In terms of trends, “the basins or sectors that were more favored before this happened will be the ones that will lead you out. And the ones that were less favored will remain so and will recover less quickly,” he advised. “You’ll see buyside analysts start to come out from under their desks and point to relative value between one name and another. That’s not taking place right now.”

In the interim, the issues that are “front and center from a credit standpoint” for E&Ps are the outcome of redeterminations of RBL facilities from banks and the steepness of the underlying price decks, according to Lemanski. The near-term price assumption will be sub-$30/bbl, and the question then relates to how steeply the commodity curve is assumed to move up in the out years, he said.

“The best indicator of market trends for E&P issuers is to look at the price of the bonds and the yields as we go forward.”

—Robert Lemanski, managing director, KeyBanc Capital Markets Inc.

Compared to 2014 to 2016, when WTI finally hit a low of $26/bbl, are funding sources more or less resilient?

“In general, the banking system is a lot better capitalized than at that time. And the banks have become somewhat more conservative in their RBL exposures than when they were caught in 2014 to 2016,” said Lemanski. However, when the Saudis moved in late 2014, we weren’t facing an external shock affecting the demand for oil as we are experiencing today. So I think it’s potentially worse.”

The problem is that “so much of the recovery in capital spending in the U.S. has come from the oil and gas industry,” he observed. “And that is going to grind to a halt for a while. I’m not sure we’ll see much more issuance for quite some time in 2020,” said Lemanski

What would be the leading indicators of a functioning high-yield energy market?

“First, we need to get some general market stability, apart from oil and gas,” said Lemanski. “In addition, there is an awful lot of oil that we need to work off. Even our lower-cost producers are struggling at current levels to survive and make money. You have to have some sort of resolution of the problem so you don’t have this enormous amount of oil overhanging the system.”

And at some point “you’ll see the stronger or the more liquid credits, usually in the top tier, test the market successfully. Then others will follow on, perhaps from not as high a tier as the first to test the market. And full recovery of the sector is when first-time issuers are able to successfully tap the market at not an enormous spread to existing names trading in the market.”

Recommended Reading

Exclusive: Calling on Automation to Help with Handling Produced Water

2024-03-10 - Water testing and real-time data can help automate decisions to handle produced water.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.