Hart Energy:

Let’s start by talking about your decades of experience in the industry. We want to talk about that as well as how you have seen the dry gas window evolve.

Glenn Hart:

We accidentally ended up in the Eagle Ford Shale. My business partner, Jerry Holditch and I decided to make an unconventional play out of the Escondido formation and so we leased all of that acreage for the Escondido formation to drill it horizontally which it never had been done before. We were pleasantly surprised when we found out that there was Eagle Ford Shale underneath all of the acreage that we had just leased. So that is how we got there.

Hart Energy:

Moving to talk about Rio Grande E&P. Can you talk about the assets you currently have and where the company's focus is right now?

Glenn Hart:

I have done several startups in my career. Not just oil and gas, other types of startups. This was the hardest one ever. The capital is very difficult to come by. We started off with our first set of assets and it's kind of what private equity demands these days is that you must have a deal to get started. So we found a deal. It was the conventional assets, vertical wells that Amplify Energy and it was in a bid situation and we won the bid and that was our first assets. It's a pretty big bite for us. I think it was 367 producing wells and it was quite a chore to do all the onboarding of the well files, the lease records. We bought it right as they say and it's been really helpful to us building our staff quickly. One of our objectives from the beginning was to get back into the Eagle Ford territory. I had 10 years' worth of lessons learned over there and I didn't want to throw the learning curve away honestly.

Hart Energy:

It sounds like you were able to take those lessons learned and move forward. Can you talk a little bit about what those lessons have been for you?

Glenn Hart:

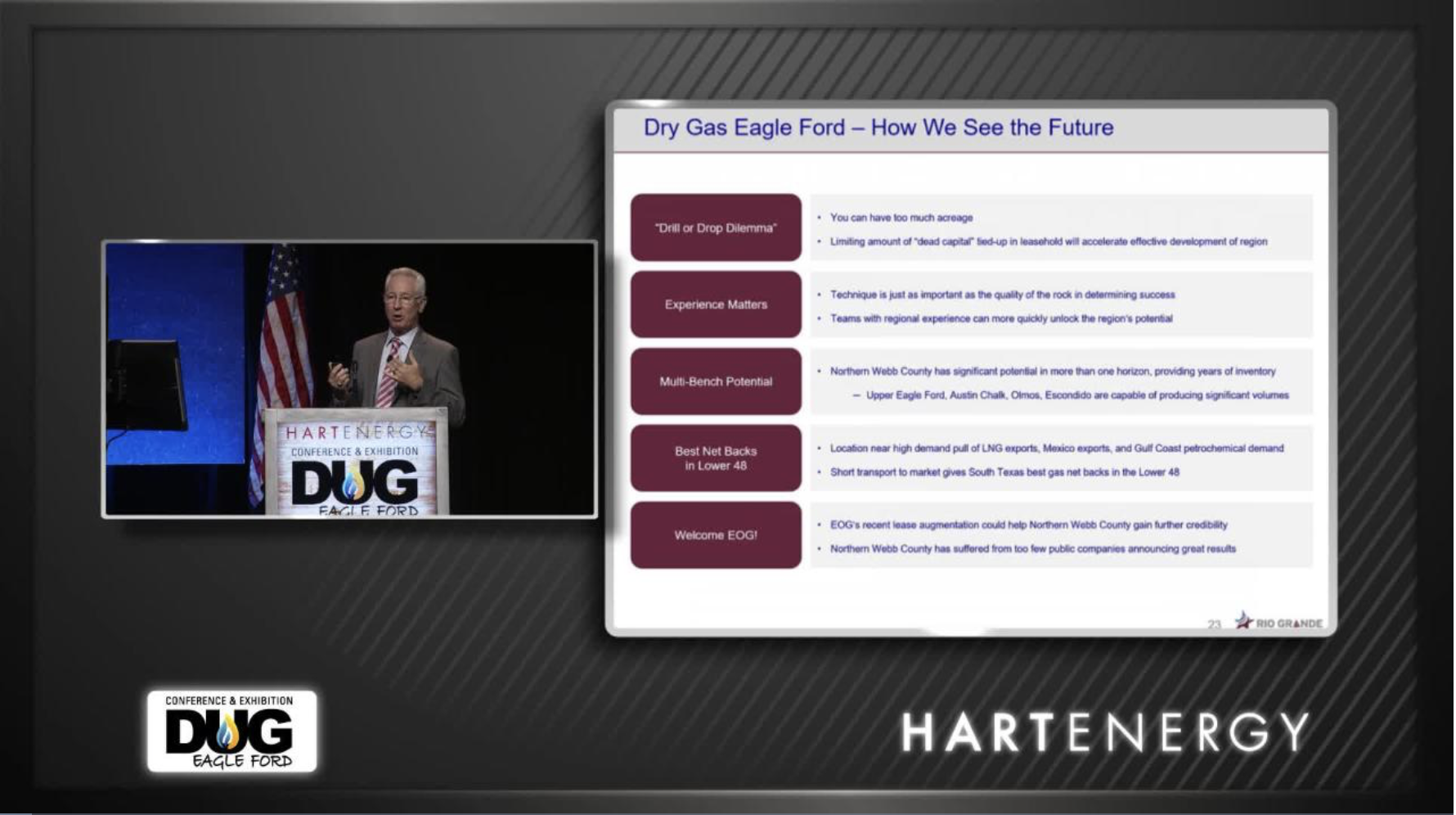

You can have too much acreage and it's a chore to get around to it and it cost a lot of money to test all the different areas when you have a big position. On top of that, we had very little infrastructure this had been like a geologic graveyard. Some of this acreage hadn't been leased in 20 years. There was really no wells. People take for granted, especially in South Texas ranches. It's typical the geologist picks the location that's 10 miles inside the ranch and you have to build 10 miles of road to get to his location, but that cost a lot of money. So coming back this time, the infrastructure is more mature. There are roads in place. There are pipelines close by. It changes the ball game economically, completely.

Hart Energy:

The company has spud its first well recently. Can you touch on that?

Glenn Hart:

The plan was for us to get back to the Eagle Ford and we have owned the Amplify assets, which operate under the name of Columbus Energy. So the Columbus Energy assets have been great but the biggest growth is going to come from the Eagle Ford. Believe it or not, I had a connection on getting the acreage in a bar in Laredo, Texas. That's the main reason we all like to spend a lot of time there. Our relationships are probably our number one asset. If you walk into Laredo, Texas as an outsider you're going to have a hard time maneuvering. It’s somewhat like South Louisiana that if you are an outsider you are not going to be able to get much done. Our relationships are probably our biggest asset. So, sure enough, funny story is that we had just closed the Columbus Energy assets, literally taking over operations the next day. So about eight people from our company we're headed for Laredo for different reasons. Landmen, geologists you name it. I was introducing my new VP of land to all the people that I felt like he should know. We decided to meet at our favorite restaurant The Border Foundry. And in the bar celebrating was the Benavidez family who had won a lawsuit that had something to do with their father. They said, “hey we haven't seen you in a while we're glad you're back.” After the conversations evolved they said, “We just got some acreage back in a lawsuit settlement.” I knew exactly what they were talking about and I said yes. So we spoke for it that very first day that I was back. So, that's the lesson of the relationships. At one point on their ranch, we had leased 23,000 acres and I bet we drilled 50 wells. Maybe even more than that. Our reputation is everything down there.

Hart Energy:

Are there any industry trends that you're seeing right now or anything that Rio Grande is focusing on?

Glenn Hart:

We believe in the mantra that people have been talking about in this conference, about free cash flow. That's my roots in the business. I worked for Tenneco Oil Co. as a production engineer. That was my first job out of school. They gave you a territory and said these wells are yours and you are to budget for your expenses. You are projecting your production. We will tell you what price to use. From the get-go, Tenneco called it “N.L.O.I, Net Lease Operating Income.” That's my roots in the business and Tenneco was built by what they used to call acquire and exploit. Now everybody tells us that is a bad word to say exploit so we better not do that. But, essentially what you do is, you buy properties that have drilling upside and you drill further wells and that's exactly what our specialty became in my career as I went on my own.

Related videos:

DUG Eagle Ford: Well Interference, Focus On Drilling Inventories

DUG Eagle Ford: SilverBow Rebranded, Diversifying

DUG Eagle Ford: Venado Oil & Gas On Fast Cycle Times

Recommended Reading

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.

Canada’s First FLNG Project Gets Underway

2024-04-12 - Black & Veatch and Samsung Heavy Industries have been given notice to proceed with a floating LNG facility near Kitimat, British Columbia, Canada.

Apollo Buys Out New Fortress Energy’s 20% Stake in LNG Firm Energos

2024-02-15 - New Fortress Energy will sell its 20% stake in Energos Infrastructure, created by the company and Apollo, but maintain charters with LNG vessels.

FERC Approves ONEOK Pipeline Segment Connecting Permian to Mexico

2024-02-16 - ONEOK’s Saguaro Connector Pipeline will transport U.S. gas to Mexico Pacific’s Saguaro LNG project.