DT Midstream’s investment thesis is to own pure-play natural gas assets connecting premier supply basins with key demand centers and market regions, and with revenues supported by long-term take-or-pay contracts with creditworthy and diverse customers, according to a release by the Detroit-based company. (Source: Shutterstock.com)

DT Midstream Inc. agreed on Sept. 29 to acquire National Grid Plc’s full ownership interests in the Millennium Pipeline as part of the company’s strategy of owning pure-play natural gas assets.

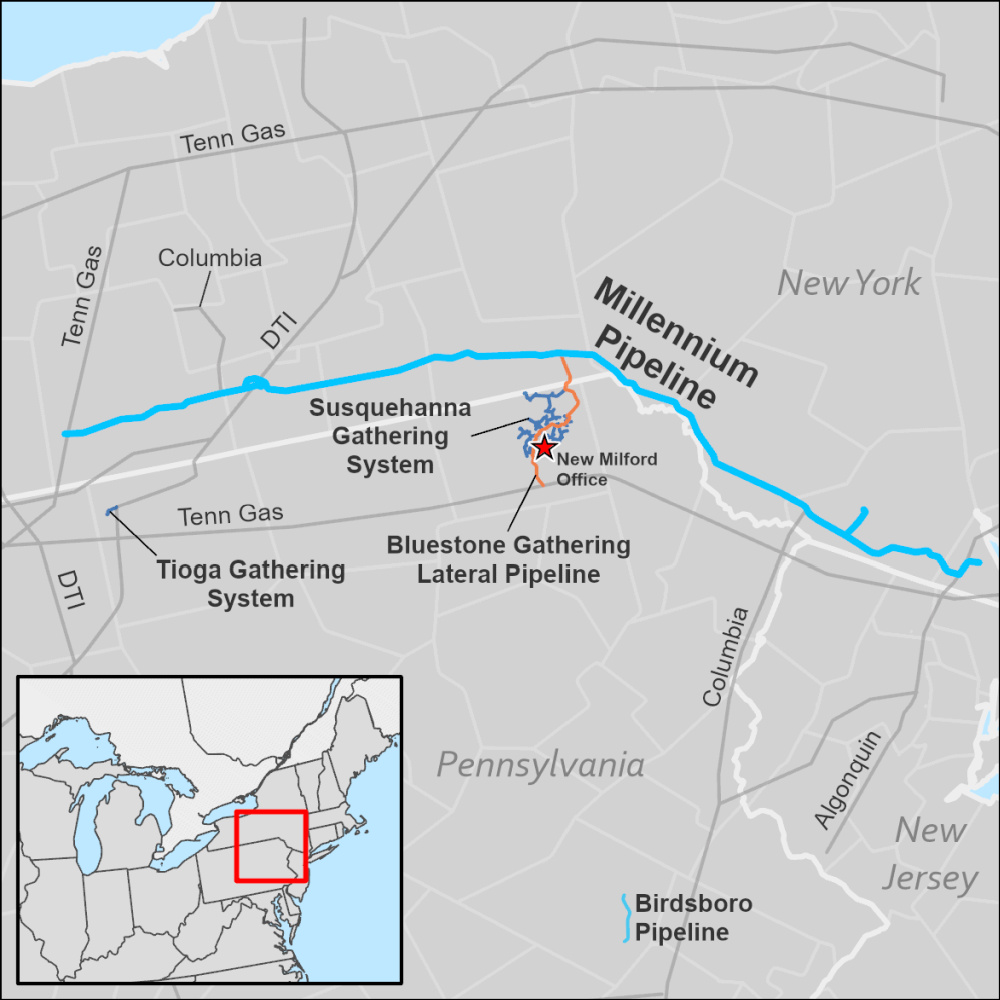

In service since 2008, the Millennium Pipeline is a 263-mile interstate pipeline strategically positioned to deliver Marcellus and Utica gas to utility and power plant markets across New York State and New England.

Headquartered in Detroit, DT Midstream is a founding developer and existing owner of Millennium Pipeline, which is also interconnected with the company’s wholly-owned Bluestone Gathering Lateral Pipeline that has upstream connections to its Susquehanna Gathering System.

“Increasing our ownership in a premium integrated asset like Millennium Pipeline directly aligns with our strategic investment thesis and accelerates our growth plan,” DT Midstream President and CEO David Slater commented in a company release.

Under the terms of the agreement, DT Midstream will pay National Grid about $552 million in cash to acquire its 26.25% ownership interest in the Millennium Pipeline. Upon closing, DT Midstream’s total ownership in Millennium Pipeline will increase to 52.5%.

“This transaction also increases the revenue contribution from our pipeline segment, underpinned by take-or-pay contracts with high credit quality customers,” Slater added.

DT Midstream expects an incremental adjusted EBITDA contribution of $12 million to $14 million in 2022 from the transaction, subject to close timing and other customary adjustments.

“This transaction will be immediately value accretive and, given the strength of our balance sheet, will be fully funded with cash on hand and available credit capacity,” noted Jeff Jewell, executive vice president and CFO of DT Midstream, in the company release.

The transaction has been approved by DT Midstream’s board of directors and is expected to close in the fourth quarter, subject to regulatory approvals. DT Midstream put the transaction multiple at 10x 2023 adjusted EBITDA.

Lazard is financial adviser and Shearman & Sterling LLP is providing legal counsel to DT Midstream for the transaction.

Recommended Reading

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.