Dominican Republic’s Minister of Energy and Mines, Antonio Isa Conde, spoke at the event which launched the country’s first ever licensing round offering 14 offshore and onshore blocks for bidding. (Source: Wood Mackenzie)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

HOUSTON—It was a historic moment for the Caribbean island nation as it officially launched its first ever licensing round for bidding in cooperation with Wood Mackenzie, in a roadshow held on July 10. The country is offering investors and stockholders a mix of onshore and offshore blocks with a simple fiscal regime and a flexible low-risk contract.

“A new chapter is beginning in the history of our nation,” said Antonio Isa Conde, minister of Energy and Mines. “We are stepping forward into virgin territory, but are optimistic about the level of interest already shown by the international companies and investors.”

The energy officials said that technical data is freely available, which includes 21,500 km of 2-D seismic. Areas offered for bidding include six blocks in the Cibao Basin, one block in the Enriquillo Basin, three blocks in Azua Basin and four offshore blocks in the San Pedro de Macoris Basin, all of which have at least three plays in addition to geophysical and geographical data to begin the exploration process. About 86 wells have been drilled in the basins, out of which roughly 22 wells have had oil and gas shows. However, there has been no commercial production so far.

The acreage is approximately 500 sq km for onshore blocks and 2,500 sq km for offshore blocks.

The country is also open for bidding to the industry stakeholders beyond the current round. Besides the 14 blocks offered, operators have the option to propose other blocks for the bidding process until mid-September. First contract awards are expected to be announced by the end of the year.

Energy officials called the awarding criteria “simple and transparent” with a low cost of entry proposition and no signing bonus required. Licensing terms include a minimum investment of $2 million for onshore blocks and $4 million for offshore blocks.

“With an awarding process based on a clear and transparent process, now is the time to invest,” said Alberto Reyes, vice minister of hydrocarbons during his presentation at the event. “This is an opportunity to explore our frontier basins and create value for investors.”

The awarding criteria is focused on incentivizing exploration and blocks will be assigned solely on additional work commitments in the first exploration phase.

Reyes pinned hopes on the positive and sustained macroeconomic indicators in the country to attract both domestic and foreign investors.

“Over the past few decades, Dominican Republic has continued to reform its economy and public image by developing key industry sectors,” he said. He added that investors will have access to preferential markets through free trade agreements with U.S., Central America and Europe.

Juan Agudelo, director of upstream consulting at Wood Mackenzie, said that the Dominican Republic has recently designed its fiscal policy per production sharing contract terms weighing the objectives of both the state and the operator.

“The fiscal regime is designed to be simple, flexible and equitable while allowing the production of projects of all sizes,” he said.

Faiza Rizvi can be reached at frizvi@hartenergy.com.

Recommended Reading

US Eases Tailpipe Rules, Slows EV Transition Through 2030

2024-03-20 - The Biden administration is unveiling final rules on March 20 that make it easier for automakers to continue selling gas-powered models and slows the projected transition to electric vehicles through 2030.

DOE Considers Technip, LanzaTech For $200MM ‘Breakthrough’ Technology Award

2024-03-25 - The U.S. Department of Energy funding will be used to develop technology that turns CO2 into sustainable ethylene.

US EPA Removes Existing Gas Plants From Proposed Carbon Rule

2024-02-29 - The U.S. Environmental Protection Agency will exclude existing natural gas power plants from its proposed carbon regulations that it plans to finalize in April.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

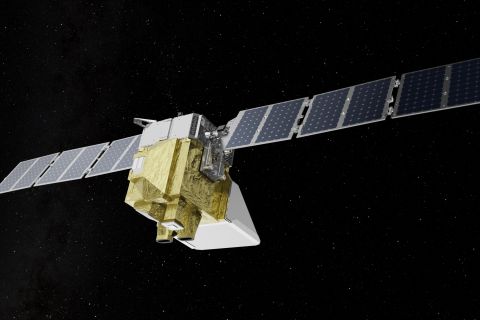

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.