Mexican President Andrés Manuel López Obrador seeks to achieve “energy sovereignty” for his country. (Source: HartEnergy.com; Javier Garcia, Rainer Lesniewski/Shutterstock.com)

The equation seems simple enough: Mexico’s need for natural gas plus an abundance of cheap gas in Texas equals a boom of U.S. gas exports to Mexico.

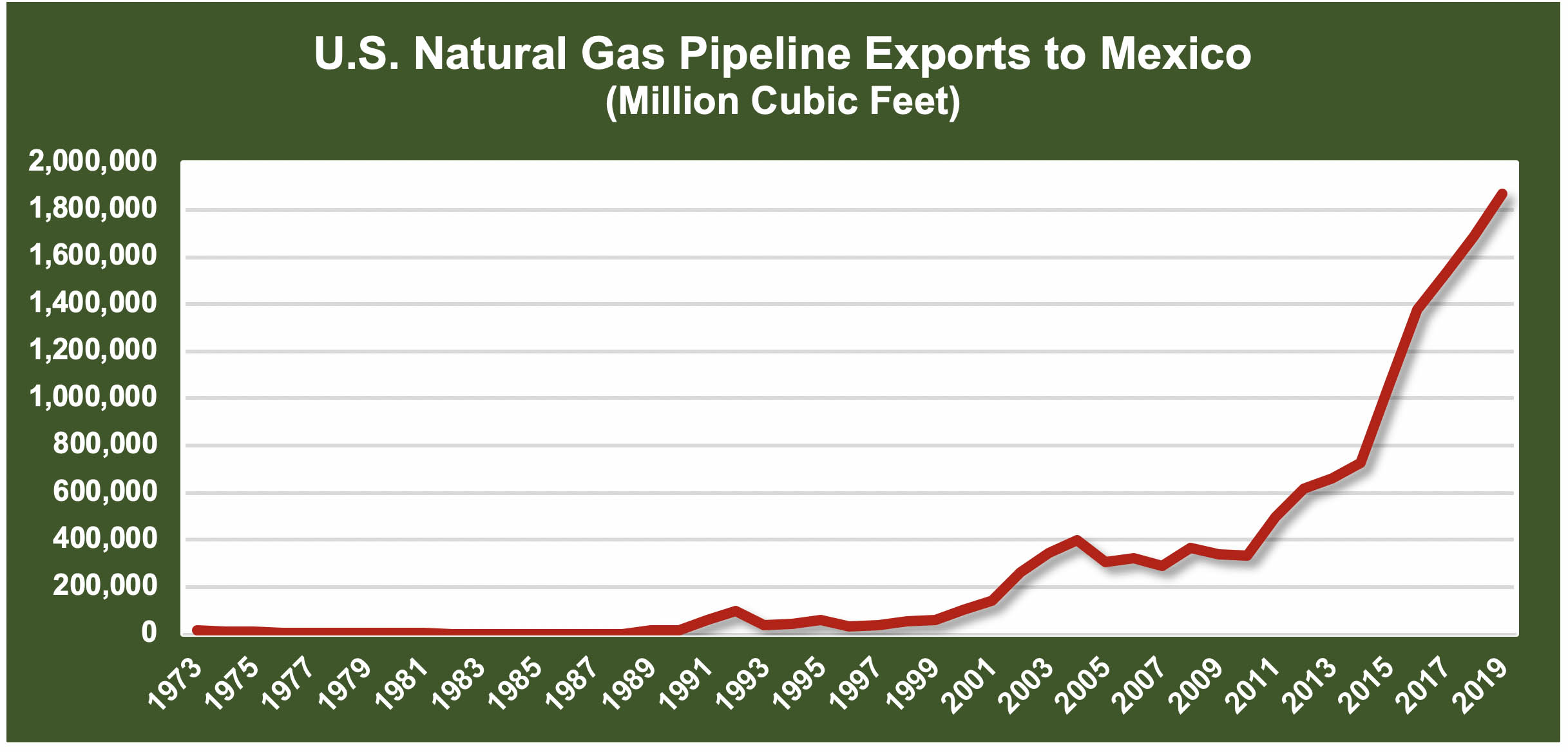

That is how it has added up, with pipelined U.S. exports to Mexico soaring 560% from 2011 through 2019. The equation is threatened, though, by a desire by the Mexican government to achieve “energy sovereignty,” a phrase akin to the Trump administration’s goal of U.S. “energy dominance.”

In other words, despite the upheaval put into effect by its energy reform, the country’s policy is drifting back toward a position in which hydrocarbons not “Made in Mexico,” like imported gas, will not be welcome. For that matter, exports of Mexican oil may not be terribly in favor, either, and the role of Petróleos Mexicanos (Pemex) is expanding.

The early stages of a global oil collapse with the world tumbling into recession is hardly the best time for U.S. gas exporters to have to contemplate the potential loss of a huge and growing market. The American approach—both in industry and government—has been that, no matter the political leanings of Mexican leadership, it would make no economic sense to abandon cheap gas imports from its northern neighbor and ally just to develop expensive domestic production.

That is what the highly touted Mexican energy reform was all about: encouraging foreign investment and moving away from the Pemex monopoly over oil and gas. Conventional wisdom asserts it would be illogical to divert from that course. In the case of Mexican President Andrés Manuel López Obrador, however, illogical may be trumped by ideological.

“In Mexico, even though the president has maintained the reform legally and he has committed not to change any laws prior to 2021, the reality of things is that the oil bids have been canceled, electricity options also have been canceled, the regulatory bodies have been undermined,” Lourdes Melgar, a nonresident fellow in the Center for Energy Studies at Rice University’s Baker Institute for Public Policy, said during a recent webinar.

“Pemex is working very hard at becoming a monopoly again, blocking all competitors, using old tactics and new tactics,” said Melgar, who lives in Mexico City. She also expressed concern that the country is pivoting away from natural gas and toward the use of oil in electrical generation.

“This is actually, from my point of view, a tragedy because Mexico developed a broad network of pipelines under the past administration to be able to import natural gas from Texas,” she said. “We have the pipelines but we’re basically not using them as we should.”

Troubled Pemex

Despite the commitment to Pemex from the López Obrador administration, the company is in trouble. Ratings companies, including Moody’s, have downgraded its credit rating to junk-bond status. The president pledged to increase Pemex’s production to 2.7 MMbbl/d by 2024, but 17 months after taking office, output is down 15% to 1.72 MMbbl/d.

And while the government believes Pemex can ride out the current crisis by producing more gasoline in domestic refineries, the global demand reduction induced by the COVID-19 pandemic and the subsequent plunge in prices may overwhelm the company.

Read: Mexico's Pemex Posts $23.6B 1Q Loss

Melgar doubts that the refining solution is viable.

“We have a huge problem with logistics because we don’t have [storage facilities] to put all this fuel oil which is, of course, very low quality,” she said, explaining that the high-sulfur content of Mexico’s heavy crude limits its potential markets.

“So, a big issue there is an attitude that Pemex does not have to revise its budget, which is really baffling analysts because we know that at the current price, many of the projects that Pemex has are basically non-competitive,” Melgar said, adding that despite this, López Obrador refuses to budge in pursuit of his plans.

“At some point there comes a reckoning, and I think it comes this year,” David Shields, an oil consultant in Mexico City, told the Washington Post.

In a video of the April 9 meeting of OPEC and other producers, Mexican Energy Secretary Rocio Nahle can be seen in the bottom row in the middle. (Source: OPEC.org)

The OPEC Telenovela

The Mexican people, who took scant notice of global oil maneuvers in the past, were suddenly glued to their screens when news coverage of the market share war between Saudi Arabia and Russia evolved into a gripping telenovela. Then, Mexico itself was drawn into the plot.

At the April 9 meeting of OPEC and other producers, the Saudis and Russians agreed to reduce production, but only if other producers would cut their output by 23% of average production in October 2019. That meant a decrease of 400,000 bbl/d for Mexico. López Obrador balked, angering the Saudis and Russians and placing Secretary of Energy Rocio Nahle in a bind.

The president’s priority, Melgar said, “is that, no matter what, Mexico should keep its target of producing 2 million barrels a day by the end of the year, and this is why Secretary Nahle had such a hard time at that meeting. She would not agree to a cut. It’s very interesting because in the past Mexico never has agreed to cut production.”

Under pressure, López Obrador eventually proposed to cut 100,000 bbl/d. President Donald Trump intervened on Mexico’s behalf, offering to cover the rest of OPEC+’s demand with a decrease in U.S. production.

Melgar, former deputy secretary of energy for hydrocarbons for Mexico, has plenty of experience dealing with OPEC and other international players. This time, however, she was not in the room. Still, she was able to perceive a significant geopolitical shift.

That Trump would intervene in a dispute to support the initiative of a cartel was a departure from the previous official U.S. position. What the deal means for Mexico remains unclear. What will Mexico owe the U.S. in exchange? Melgar isn’t sure.

“Something happened in there,” she said, “but basically the key point is, our president thinks that Mexico can continue to go on with business as usual even under this current scenario. It’s really surprising.”

Recommended Reading

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.