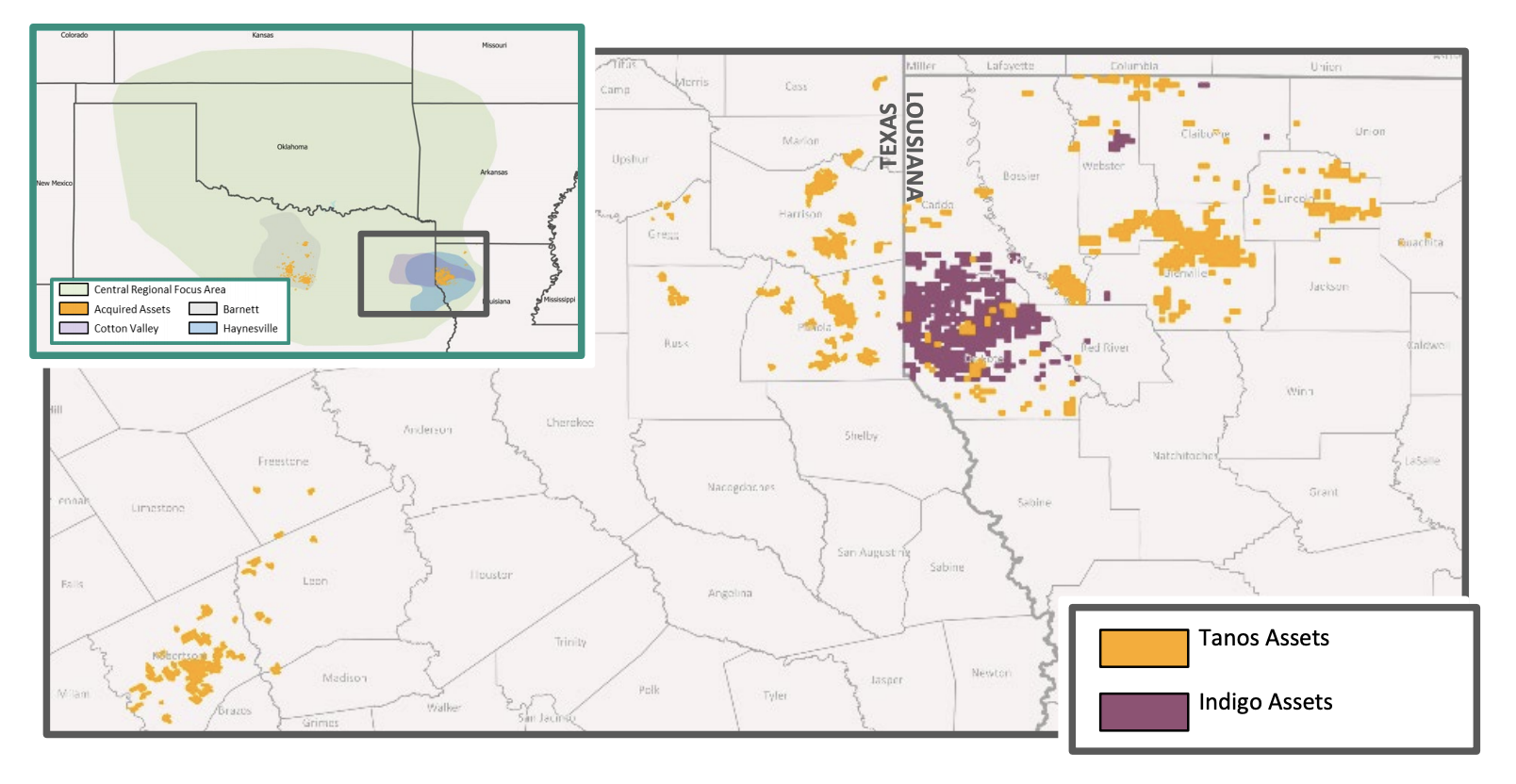

The acquisition of Tanos includes certain Cotton Valley and Haynesville assets in Louisiana and Texas that currently generate 14,000 boe/d—roughly 82 MMcfe/d. (Source: Shutterstock.com)

Diversified Energy Co. Plc completed its acquisition of Tanos Energy Holdings III LLC for $154 million in cash, continuing the company’s expansion in its newly established “central” regional focus area that includes producing areas within Louisiana, Texas, Oklahoma and Arkansas.

The acquisition of Tanos includes certain Cotton Valley and Haynesville assets in Louisiana and Texas that currently generate 14,000 boe/d—roughly 82 MMcfe/d—with 92% from 390 net operated wells. Diversified also added 40 MMboe (241 Bcfe) of PDP reserves.

“We are pleased to have closed our third acquisition within the central region,” commented Diversified CEO Rusty Hutson Jr. in a release by the company on Aug. 18.

Diversified completed its latest acquisition, previously announced in July, through a co-investment with funds managed by Oaktree Capital Management. The company had lined up a $1 billion acquisition partnership with the global investment firm in 2020 to pursue larger acquisition opportunities.

Headquartered in Birmingham, Ala., and listed on the London Stock Exchange, Diversified’s business model focuses exclusively on buying PDP natural gas assets, which, until its $135 million acquisition of certain Cotton Valley upstream assets from Indigo Minerals LLC in May, had all been located in the Appalachian Basin.

“We are also actively pursuing the operational and administrative synergies afforded by aggregating assets within a defined area much like we currently enjoy in Appalachia,” Hutson added in the release on Aug. 18. “Collectively, these efforts enhance the already significant free cash flow from the central region assets that complement our ESG, dividend distribution and debt reduction commitments to stakeholders.”

The Tanos acquisition also included the retention of about 55 Tanos field personnel and previous contractors expected to support efficient integration and incremental value creation, according to the Diversified release. Additionally, Diversified said it had identified roughly $51 million of estimated adjusted EBITDA before potential synergies it attributed to the “high price realizations from the favorable Gulf Coast natural gas market.”

Diversified funded the gross cash consideration of $154 million, or $117 million net at closing, of the Tanos acquisition with availability on the company’s revolving credit facility and cash on hand, plus the assumption of certain hedges through 2023.

Emily Patsy contributed to this article.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.