Presented by:

At first blush, Diversified Energy Co. Plc’s foray into Oklahoma with its recent ConocoPhillips Co. bolt-on might have seemed counterintuitive that not so long ago the region was regarded as a shale pariah.

Even before a downturn, followed by the havoc of the pandemic, many operators viewed the Midcontinent’s hit-or-miss wells as a basin non-grata. Assorted bankruptcies didn’t help the Midcon’s rep as an underperforming play to be eschewed in favor of easier plunder elsewhere.

Diversified saw something else: steady production.

“The mom-and-pop era of oil and gas is pretty much over. You’re still going to have a little bit of it here and there, but … you have to have size, you have to have scale, you have to have efficiency.”—Rusty Hutson, Diversified Energy Co. Plc

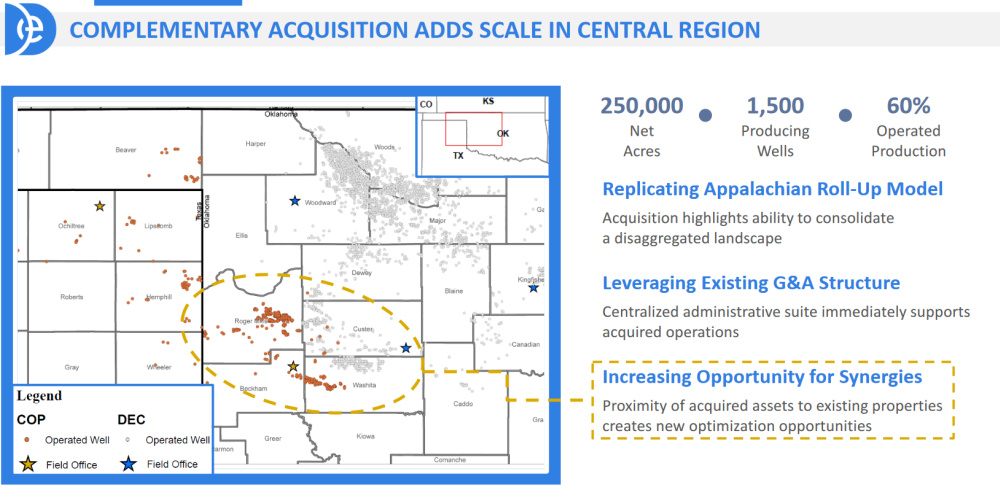

In late July, Diversified agreed to pay ConocoPhillips $240 million for 250,000 net Western Anadarko Basin acres at what Diversified priced at a PV-17 cost. The asset, Diversified CEO Rusty Hutson told Hart Energy in an interview, happened to fit glove-like with its 2021 purchase of Tapstone Energy’s Midcontinent assets for $419 million.

But there’s a familiar architecture to the deals Diversified has pursued in Oklahoma and other parts of what it calls its Central Region, which includes Texas and Louisiana. Strategically, the company sees that area as a major source of LNG shipments that, even if Diversified isn’t a direct supplier, will provide sustained, solid pricing for domestic energy needs.

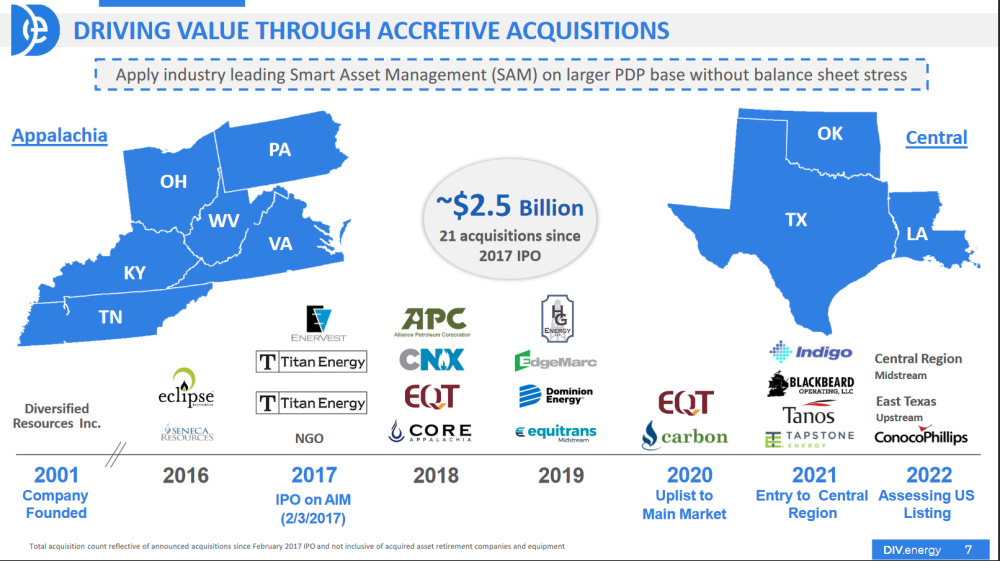

But Diversified’s adventures in the Central Region are, in effect, an attempt to repeat what it successfully created in the Appalachian Basin: a PDP machine.

Diversified’s strategy

Diversified, which trades on the London Stock Exchange, continues to pursue the strategy that made it successful as it began accumulating low-decline assets, in earnest, since 2016. In the ensuing years, the company has knocked back 21 total transactions valued at about $2.5 billion.

The similarities Diversified saw in between the Midcontinent and the Appalachian Basin were simply too good to pass up.

When Diversified “dipped our toes into Oklahoma, specifically into that western area of Oklahoma, the Western Anadarko, we loved that area,” Hutson said. Specifically, the basin’s production profile looks a lot like its eastern holdings, with typically mature wells that need little maintenance capex.

“There’s not a lot of brand-new wells with high declines,” he said. “They’re more mature producing assets.”

Diversified ran up transaction after transaction in the Appalachian Basin before now moving to build a similar business of size and scale in the west. The ConocoPhillips bolt-on expands on the theme. It offers low, first-year declines of 8% and a gas-weighted production mix and the assets are contagious with Tapstone’s.

ConocoPhillips Midcontinent Acquisition Highlights |

|

| Gross Purchase Price ($MM): | $240 |

| Net Purchase Price ($MM): | $210 |

| Effective Date: | June 1 |

| Expected Closing: | September |

| Source of Funding: | Cash and debt financing |

| Post-acquisition Leverage: | 2.2x |

“The mom-and-pop era of oil and gas is pretty much over,” he said. “You’re still going to have a little bit of it here and there, but … you have to have size, you have to have scale, you have to have efficiency, you know. You have to be able to drive synergies and efficiencies in your operations, keep your costs down, especially in inflationary aspects is what we’re seeing today.”

Oklahoma’s bad rap, according to Hutson, comes from the haphazard quality of wells, which doesn’t affect how Diversified approaches its deals.

“That’s one thing that we’ve kind of played off of, is we can go in behind some of these areas where there’s been some negative connotations around the drilling and completing,” he said.

Diversified, by contrast, concentrates on already producing assets that slowly bleed off production and can be optimized to run more efficiently.

“We buy PDP,” he said. “The beauty of our model is that we have low capex, because we’re not drilling a bunch of wells annually.”

ConocoPhillips quietly shopped its Midcontinent assets because they clearly weren’t part of the company’s larger plans, Hutson said. He isn’t sure how many people were involved in the sales process, though in his experience any large company, whether ConocoPhillips, Exxon Mobil Corp. or BP Plc, tends to attract interest.

“I don’t know if we were the highest bidder, but I can tell you that we were the only one they really worked with shortly after the bids were taken,” he said.

ConocoPhillips’ Midcontinent assets consisted of 1,500 producing wells, including 60% operated production. The wells are, on average, about 16 years old and have an estimated remaining life of 26 years, according to Diversified.

If the deal closes in September, as expected, Diversified will implement its “smart asset management” program, which includes tidying up wells, performing maintenance and adjusting compression as needed. The concept, to borrow a baseball analogy, is to “hit a lot of singles and end up with a lot runs. That’s what we’re trying to accomplish,” Hutson said.

ConocoPhillips Midcontinent Asset Highlights |

|

| Acquired PDP Reserves (MMboe): | ~31 |

| PDP PV-10 of Acquired Reserves ($MM): | $297 |

| Current Production (Mboe/d): | ~9 |

| Total Cash Costs ($/boe): | $11.40-$12 |

| Estimated Adj. EBITDA Margin: | ~70% |

Shareholder returns

Diversified’s strategy has essentially remained unchanged since its inception as a vertically integrated business model. It’s focused on building size and scale by adding assets that increase its production base. From there it focuses on synergies and lowering expenses.

The company “continues to get better in driving higher margins, which then drives higher cash flows,” he said. “And that’s where we want to be.

“When I say we can replicate Appalachia, that’s what it’s all about. It’s really size and scale driving those operational efficiencies that we were able to accomplish in Appalachia.”

That model paid off for investors, Hutson said. Since its IPO in 2017, the company boasts a 250% shareholder return with $492 million in dividends paid. Its reported first-half 2022 free cash flow yield of 22%.

And the company will continue to grow.

“Worst-case scenario, all we need to do really is cover our decline rates year-over-year,” he said.

Hutson entered the year telling his team he wanted $750 million in liquidity, which the company was able to generate. Diversified retains about $450 million-$500 million in liquidity, “knowing that we can do additional transactions and, I would anticipate, hopefully doing something else before the end of the year of potentially some size,” he said.

The opportunities are clearly not in short supply.

“We’re looking at every deal,” he said.

But the company has no set amount of deals it plans on annually.

“We’re going to prepped and ready to do them if they make themselves available,” he said. “But we want to make sure we’re doing the right deal because it doesn’t do any good to do 10 of them if they’re all wrong.”

Closure for orphans

Diversified has also embarked on improving its vertical integration this year by purchasing a number of service companies as it virtually corners the market on plugging and abandonment (P&A) providers.

Hutson estimated the company’s three acquisitions, along with its own internal P&A teams, now account for nearly 40% of all plugging capacity in Appalachia.

“We started with one plugging crew. We were still using outside firms,” he said. “What [the acquisitions] do is it gives us the ability to, number one, control the cost.”

While other E&Ps are being whipsawed by inflation, Diversified’s been able to withstand the worst of it, largely because it doesn’t drill, buy frack sand or compete for labor.

The larger strategy is two-fold. First, the company will address its own plugging needs—doubling to 200 wells a year its pace of sealing its own orphan wells. Secondly, it will be providing services to third parties, primarily states that have federal money to plug and abandon wells.

“The states have put bidding out … to plug orphan wells in their portfolio,” Hutson said. “We’ve been bidding and winning those.”

Hutson said the company estimates it can plug 600 wells annually, including 400 for external parties and 200 of its own.

“The 400 [wells] that we’re plugging for external parties will cover the cost of our 200” wells, he said, bringing its internal plugging costs to zero.

“It has a significant impact on our overall liability and our overall net asset value,” he said.

Diversified will also have plenty of work to do, potentially, for decades. The company has 15 plugging crews on the ground and they will remain profitable because they’re seldom without work.

“The state of West Virginia probably has 6,500 orphan wells,” he said. “That’s going to take multiple years to take care of. The same for Pennsylvania and Ohio and Kentucky.

“So, we believe that business will continue to drive substantial revenues,” he said. “The key to that business, any service business, is keeping your equipment busy. And so that won’t be a problem there.”

Diversified likely won’t look for similar additions in its Central Region, Hutson said, because it owns fewer wellbores and the area is populated by higher-producing, newer-producing wells.

“That liability is longer term and there’s just lots of sevice companies in Texas and Louisiana,” he said.

Recommended Reading

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.