A wave of digital transformation has swept the oil and gas industry. Most oil majors have invested billions of dollars in data-driven digital technologies to unlock trapped treasures. According to Accenture’s Technology Vision 2019 survey, the energy industry is now moving toward a post-digital era, which means that digital transformation, which once gave companies a competitive edge, is now becoming a norm.

“Companies need to do much more than executing the commonplace digital capabilities in order to meet the ever-increasing expectations of the current and next generation of users,” said Rich Holsman, digital lead for Accenture’s Resources Operating Group.

Although the post-digital era will be challenging, it will provide tremendous opportunities to companies for maximizing digital technologies to enhance their operations. The Technology Vision survey has summarized five trends that will help companies succeed in the next phase of innovation.

The Power Of DARQ

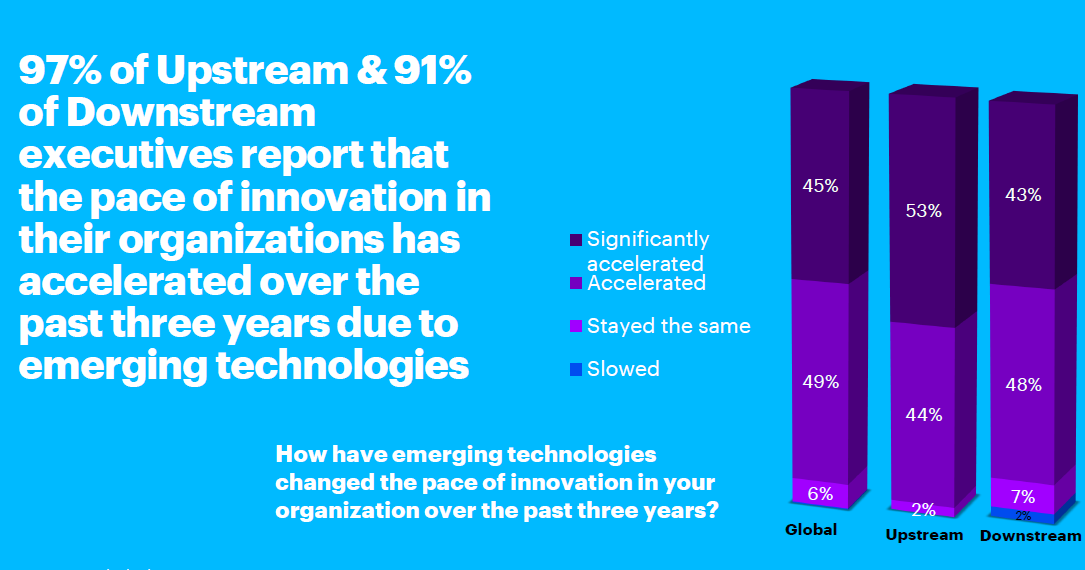

According to the study, 97% of upstream executives and 92% downstream executives report that the pace of innovation has accelerated over the past three years due to emerging technologies. The study further envisions that distributed ledger technology, artificial intelligence (AI), extended reality and quantum computing—which Accenture abbreviates as DARQ—will be the pillars of the next wave of innovation. This fact is supported by the finding that nearly 85% executives of the energy industry are currently experimenting with one or more of DARQ technologies. Also, majority of the industry players believe that these technologies will be “transformational” for their organizations over the next three years. Both upstream and downstream officials voted AI as the top DARQ technology to impact energy organizations.

Digital Demographics

According to the survey, technology-driven interactions are creating an expanding technology identity for every consumer. This knowledge will be key to not only understanding the next generation of consumers, but also to delivering rich, individualized, experience-based relationships in the post-digital age. The survey reveals that half of oil and gas industry executives believe that digital demographics give their organization a new way to identify market opportunities for unmet customer needs.

Tech-Driven Workforce

More than two-thirds of the respondents agreed that their employees are more “digitally mature” than their organization. Workers who are empowered by their skills and knowledge in addition to a new set of tech-driven capabilities, are “waiting” for companies to catchup.

“This doesn’t mean that [employees are] already capable, for instance, to interpret the analytics provided for preventive maintenance, or ready to work with digital twins. What it does mean is that employees are keen to see clear actions from the company to move forward with more up-to-date technologies and interfaces in their day-to-day work as employers often underestimate how digitally mature their employees are,” Holsman said.

In order to retain these tach-savvy workers or “human+” workforce as the study calls it, energy companies must adapt advanced strategies to support a new ways of working in the post-digital age.

Secure Ecosystem

Digitally-driven businesses that operate in an interconnected ecosystem increase exposure to risks not only to companies but to the entire ecosystem. The survey reports that 91% of upstream executives and 85% of downstream executives agree that to be truly resilient, organizations must rethink their approach to security in a way that defends not just themselves, but their ecosystems. “Oil and gas companies are experiencing cyber threats across an ecosystem as they work with a large variety of ecosystem providers such as their joint venture partners, specialty solution providers and software as-a-service solutions providers,” Holsman said. “In this new interconnected model, oil companies need to develop and manage security best practices across the entire oil and gas ecosystem.”

Lightning Speed Connections

As digitalization spreads and scales through the oil value chain, big tech firms and digital start-ups are targeting the oil and gas sector through automation, platforms, cloud applications and artificial intelligence.

In the post-digital era, every moment will be a market opportunity, the study claims. According to Holsman, downstream companies can utilize these opportunities to provide personalized services using data and artificial intelligence.

For instance, Shell offers customers the option to pay one cent extra per liter of fuel and invests that money in projects to reduce carbon emissions. Shell also revealed a new fuel delivery service, where customers can “order” fuel using mobile app and get the fuel delivered to them.

“Tomorrow’s energy industry leaders are already investing in the digital ecosystems of the future and the next wave of emerging technologies. This should give them a good start in the post-digital era—an age with massive customer, employee, and societal expectations,” according to the study.

Recommended Reading

Drilling Tech Rides a Wave

2024-01-30 - Can new designs, automation and aerospace inspiration boost drilling results?

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.