During a mid-May earning call, Diamondback Energy CEO Travis Stice repeated twice that “large-scale M&A is off the table” for the Permian operator. (Source: Hart Energy, Diamondback Energy logo by Pavel Kapysh / Shutterstock.com)

The strange case of Diamondback Energy Inc.’s trailing stock performance among its peers, a point of fixation among analysts, appears to have its roots in the Permian Basin operator’s slightly less aggressive framework for rewarding shareholders and its reputation as a “serial acquirer.”

It’s not a reputation without merit. Over the years, even a cursory glance at Diamondback’s acquisitions lends some credence to that view. Since 2017, the company has closed four deals valued at $1 billion or more. That includes its 2021 acquisition of QEP Resources for $2.2 billion. Its largest deal during that span was its 2018 acquisition of Energen Corp. for $9.2 billion worth of stock.

But the company is now publicly holding firm to a lower-key acquisition strategy that won’t include the massive deals that have built it into one of the largest operators in the Permian Basin.

And the company’s deal activity has been muted so far this year.

In early May, Diamondback announced that it had acquired 6,200 net acres in the Delaware Basin for $230 million using cash on hand. The Ward County, Texas, acreage gives the company an additional 58 gross long-lateral locations with an 85% net revenue interest in what Stice called a “high rate of return area.” The seller was not disclosed. Kirkland & Ellis served as Diamondback’s legal adviser.

“In fact, we’ve already begun drilling the position, but do not expect to have production until late this year,” Stice said.

Diamondback Delaware Basin Acquisition

|

|

| Average daily oil production (bbl/d) | 1,300 |

| Net locations | 43 |

| Average lateral length (ft) | 10,300 |

| Average working interest | 74% |

| Net revenue interest (NRI) | 66% |

| Effective NRI | 85% |

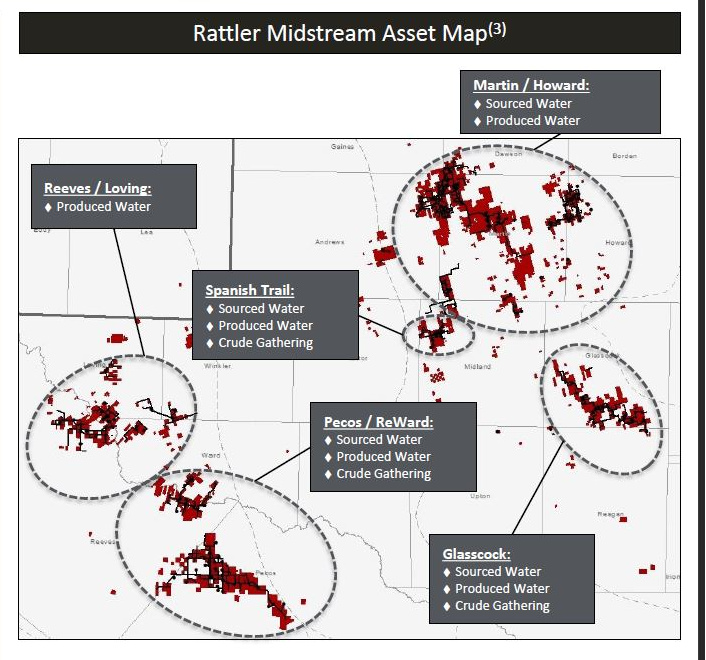

More recently, the company said on May 16 it would acquire all publicly held common units it didn’t already own in its midstream MLP—Rattler Midstream LP—in a stock-for-unit deal valued at $575.2 million. The deal gave Rattler unit holders roughly a 17% premium.

But during a mid-May earning call, Stice repeated twice that “large-scale M&A is off the table” for the company.

“We do hear a lot about this narrative that Diamondback is a serial acquirer and let me just put it simply: large-scale M&A today is quite frankly, off the table,” he said. “We’ve got nothing on our deal sheet that's considered more than a tuck-in like the [Ward County bolt-on].”

Stice also addressed the company’s planned $2 billion share buybacks, which he said are evaluated along the same vein as leasehold acquisitions.

Nitin Kumar, senior equity analyst at Wells Fargo, said management has also “espoused a counter-cyclical view of cash returns, focusing on buybacks and base dividend growth rather than variable dividends.”

Kumar added that “we believe the longer-term investment case for the company that is anchored in its counter-cyclical and differentiated cash return strategy remains strong.”

Stice said Diamondback has taken its foot off the buyback pedal because of rising share prices. A buyback must generate a return well in excess of the company’s weighted average cost of capital, assuming a reasonable mid-cycle oil price, he said.

“In the first quarter, our price debt was approximately $60 a barrel, and as such, we were able to take advantage of some of the volatility in the new market and repurchased 57,000 shares at an average price of $117 a share,” he said. “Through the end of the first quarter, we've spent about $440 million or 22% of the $2 billion program our board authorized last September.”

Still, JP Morgan, Goldman Sachs and Wells Fargo analysts have all expressed some degree of concern, either their own or of the market’s that amid a large number of assets being marketed in the Permian Basin, Diamondback may be tempted.

As JP Morgan analyst Arun Jayarm noted during the company’s earnings call, the “market appears to be concerned about Diamondback executing perhaps a procyclical type of M&A deal.” Wells Fargo similarly shared “concerns that FANG may be an acquirer of assets in 2H22, although management has downplayed the role of M&A in its strategic plans.”

And Goldman Sachs analysts wrote on May 26 that the company’s stock performance has lagged its large-cap peers, including EOG Resources Inc., Continental Resources Inc., Devon Energy Corp. and Pioneer Natural Resources Co. Diamondback’s value has grown by about 35% amid the commodity price bonanza compared to its cousins, which have seen a 54% increase in valuation.

“There are concerns that the company has slowed down its share repurchase program due to its intent to pursue large-scale M&A. However, the company has indicated that any M&A would be more bolt-on in nature, and has reiterated its commitment to returning 50%+ of its FCF (free cash flow) to shareholders,” the Goldman Sachs report said.

On the call, Stice said Diamondback said the M&A environment “remains a seller’s market, and we’re not going to underwrite M&A at today’s oil prices, just like we’re not going to underwrite repurchasing stocks at today’s oil prices.”

As for it’s Rattler Midstream roll-up, David Deckelbaum, an analyst at Cowen, said the transaction won’t “move the needle much” for Diamondback but makes sense from a couple of different perspectives.

Rattler’s unit holder received an 8% dividend compared to the 2% fixed dividend for Diamondback, giving the deal “an inherent arbitrage in cost of capital.”

Consolidating the midstream assets, which Diamondback went public with in 2019, is about 2% dilutive of the company’s stock. But it will allow for greater simplicity and more direct reporting of the midstream company’s $340 million EBITDA for 2022.

Rattler Midstream’s debt and credit facility, about $730 million total, is already reported on Diamondback’s balance sheet.

“Considering that the midstream business is effectively fully built out and FANG does not intend on growing, consolidating as much of the business as possible follows sound logic of simplifying reporting and maximizing FCF to FANG holders that trades at a current discount. Further, FANG certainly does not need to rely on RTLR as a financing vehicle and the move should be well received as an inevitable evolution of the business model,” Deckelbaum wrote.

Diamondback did not immediately respond to a request for comment.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.