(Source: G.B. Hart/Shutterstock.com)

Coming off a rough third quarter that included frac hits, gassier wells, lower oil production attributed to its Central Basin Platform assets sale and depressed oil and gas prices, Permian Basin pure-play Diamondback Energy is looking ahead to 2020.

“Our goal in putting together our capital plan was to maximize oil-weighted production growth within a similar budget framework as 2019, getting more with less,” CEO Travis Stice told analysts Nov. 6. “As a result, we expect to grow our production 10% to 15% year over year and complete over 10% more net lateral footage than 2019.”

The company aims to produce between 310,000 and 325,000 barrels of oil equivalent per day (boe/d). This includes 205,000 to 215,000 barrels of oil per day (bbl/d) with capex between $2.8 billion and $3 billion as it works to co-develop zones in the Midland and Delaware sub-basins.

The 2020 plan also “assumes we cover our budget and base dividend above $45 oil and have over $675 million of pre-dividend free cash flow at $55 oil,” Stice said, adding the company’s commodity price assumptions for next year have weakened—$13 per barrel for NGL, down nearly 40% and $1.50 for realized gas.

The outlook was delivered as the company reported third-quarter 2019 net income of $368 million, up from $157 million a year earlier. Adjusted net income was $239 million, or $1.47 per diluted share, down 12%.

Production for the quarter averaged 287,100 boe/d, up 133% year over year. However, oil production for the quarter dropped to 185,500 bbl/d.

Several anomalies contributed to underperformance: the sale of its Central Basin Platform assets removed about 5,800 bbl/d of oil production and 18 wells in Reeves County’s Vermejo area and 14 wells in Glasscock County produced more gas.

Well Interference Woes

Plus, “the combination of Diamondback frac activity and offset operators both to the east and west of our leasehold cut production in half for over 20,000 gross barrels of oil per day during portions of the quarter,” Stice said.

While the company has dealt with frac hits in the past, this quarter was “extraordinarily difficult” in Howard County where another operator to the east had a 24-well pad with a frac spread on site for two and a half months, an executive said.

Well spacing has been an issue for some in the basin. Many shale players have targeted higher production by placing wells closer together. But that has resulted in less output, in some instances, leading to more conservative spacing—at least for those with available acreage.

Diamondback said it has “consistently maintained conservative spacing assumptions.”

Moving forward, the company is modeling production more conservatively, accounting for downtime with frac hits in mind given operators are in full-field multi-well pad development mode, Stice said.

He also assured analysts that wells that experienced frac hits recover to peak production.

“These are operational challenges, not reservoir problems,” he said.

Diamondback expects to grow oil production by more than 3% in the fourth quarter compared to the third quarter. However, frac hits are still expected, especially in Howard County where there is significant rig and completion activity.

‘Disappoints,’ ‘Negative’

Analysts responded in notes about the results, saying “disappoints as feared,” “negative 3Q actuals and 4Q guidance” and “negative on oil across Q3, implied Q4 and guided FY’20.”

Shares of the company’s stock fell about 14% to $77.21 by 1 p.m. CST Nov. 6.

“FANG reported disappointing results, including a miss on oil production, cash flow, and EBITDA on higher spending levels,” Gabriele Sorbara, principal and senior equity analyst for Siebert Williams Shank & Co., said in a note. “Further, FANG’s revised 2019 outlook was less favorable than anticipated and its initial 2020 outlook was light relative to expectations. As we feared heading into the print, FANG whiffed the quarter and downward revisions flowed through our production, cash flow and EBITDA estimates.”

It wasn’t all negative, though, as the analyst pointed out Diamondback is expected to generate peer-leading free cash flow “of more than $350.0 million at $45/bbl WTI all the way up to over $950.0 million at $60/bbl WTI.”

Average well costs were also reportedly more than 15% lower than Diamondback’s costs before its acquisition of Energen, synergies for which were also realized during the quarter, Stice said.

Analysts at Tudor, Pickering, Holt & Co. said that “35% of Q3 POPs being in areas with initial oil cuts of ~65% makes sense as a factor, and it’s good to get clarity on this mix going forward (15% in Q4 through 2020), but credibility on forecasting is likely brought into question and may take time to fully restore.”

Co-developed Zones

On the call, Stice said Diamondback has reexamined assumptions that led to the performance.

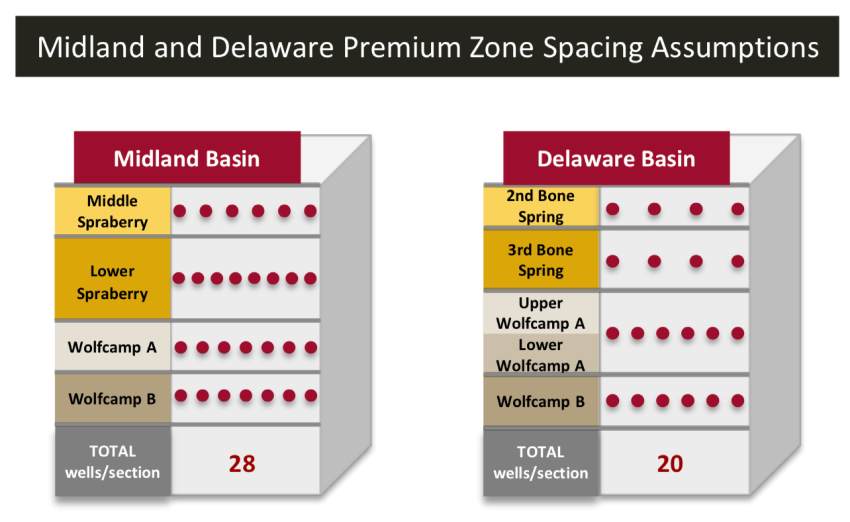

In addition, “We’ve increased the amount of co-development zones across more productive zones, which will begin in 2019,” Stice said. “We expect to increase that in 2020, particularly in the Midland Basin. While this strategy is expected to maximize net present value and expand inventory life, in some areas this capital allocation decision generates lower first year oil production per developed pad.”

Co-development is part of Diamondback’s strategy for the next several years, he said.

But the company said it has not changed inter-lateral spacing assumptions within each zone.

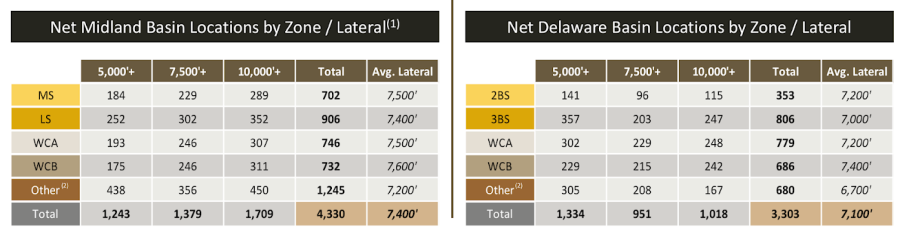

Prior to 2019, the company focused on the Wolfcamp A and Lower Spraberry. This year and 2020, Stice said it will increase exposure to the Joe Mill, Middle Spraberry and Wolfcamp B zones, given improved well performance and NPV benefits of co-development between zones.

“This holds true to a lesser extent for the Delaware Basin as well where we have more 2nd and 3rd Bone Spring development plans along with our primary development in the Wolfcamp A,” Stice said.

Diamondback also plans to add fewer new high oil cut wells to the 2020 production unit compared to previous years, lowering its oil mix, and improve capital efficiency.

“Investor sentiment toward energy remains decidedly negative, even in the face of commodity prices performing fairly well this year. The U.S. rig count is now down over 25% year over year, and we expect that downward trajectory to continue with opposing capital markets, tighter lending conditions and the search for free cash flow sector wide,” Stice said. “As a result of these conditions, we expect continued pressure on U.S. production growth numbers, and expectations for 2020 U.S. production growth needs to recalibrate lower, all of which may potentially support oil prices pending demand growth.”

Recommended Reading

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Defeating the ‘Four Horseman’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production — and keep the cash flowing.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.