Viper Energy Partners LP completed its previously announced acquisition of Swallowtail Royalties on Oct. 1 in a cash-and-stock transaction estimated to be worth nearly $500 million.

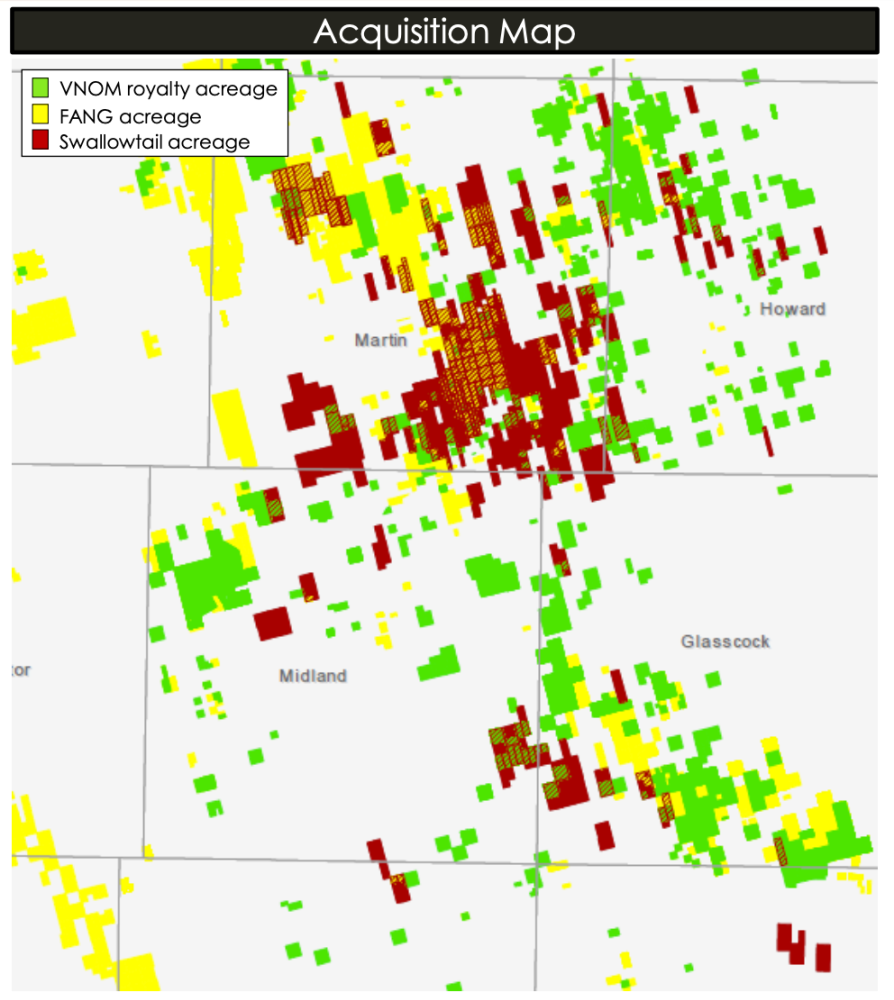

Based in Midland, Texas, Viper is a limited partnership formed by Permian operator Diamondback Energy Inc. to focus on owning and acquiring mineral and royalty interests in oil-weighted basins, primarily the Permian Basin.

In August, Viper announced it had entered an agreement for the acquisition of certain mineral and royalty interests from Swallowtail Royalties LLC and Swallowtail Royalties II LLC, portfolio companies of Blackstone Energy Partners, in exchange for 15.25 million common units representing limited partnership interests in Viper and approximately $225 million in cash.

Blackstone Energy Partners was already a shareholder of Diamondback Energy prior to the transaction with its Viper subsidiary.

“As a shareholder of Diamondback since the closing of their Guidon acquisition in February 2021, we have been very pleased with their performance and are happy to partner with the team again, this time in the royalties business,” David Foley, global head of Blackstone Energy Partners, commented in an August company release. “We look forward to participating in the long-term incremental value creation of these assets under their leadership.”

As a result of the acquisition, Viper said it added approximately 2,302 net royalty acres primarily in the northern Midland Basin, roughly 65% of which is operated by Diamondback.

“This acquisition checks all the boxes in what we look for at Viper,” Diamondback CEO Travis Stice said of the deal in the company release from August. “The acreage is Tier 1 and primarily operated by Diamondback, we expect it to be accretive to near-term financial metrics, and there is significant long-term value to be created based on Diamondback’s expected multiyear forward development plan.”

“The large, contiguous block of primarily undeveloped acreage in the Sale and Robertson ranches will drive oil production growth for Viper, which in addition to the strong current production levels on the third party operated acreage, will support our current strong free cash flow generation for the next several years,” Stice added.

As of year-end 2020, Viper Energy Partners assets consisted of mineral interests underlying 787,264 gross acres and 24,350 net royalty acres in the Permian Basin and Eagle Ford Shale. Diamondback is the operator of approximately 52% of this acreage, according to the company website.

Akin Gump Strauss Hauer & Feld LLP served as legal adviser to Viper for the Swallowtail transaction. Kirkland & Ellis LLP was legal adviser to Swallowtail.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.