Oasis Petroleum, which completed a financial restructuring last year, plans to finance its acquisition of the Williston Basin assets from Diamondback through cash on hand, revolver borrowings and a new $500 million bridge loan. (Source: Hart Energy)

Diamondback Energy Corp. agreed on May 3 to sell certain Bakken assets it acquired through its roughly $2.2 billion all-stock acquisition of QEP Resources earlier this year.

The transaction, with Oasis Petroleum Inc., includes the sale of select Williston Basin assets from Diamondback Energy in a cash transaction valued at approximately $745 million. On May 3, Diamondback also agreed to divest “noncore” acreage from its Permian Basin position, the company main focus, for a combined gross purchase price of $87 million.

Diamondback Energy closed out 2020 with the acquisition of publicly traded QEP Resources and private equity-sponsored Guidon Operating for a combined $3 billion. In addition to adding a foothold in the Williston Basin, the dual mergers helped Diamondback build out its position in the heart of the Midland Basin.

However, Diamondback had planned since announcing the acquisition of QEP to sell the Williston Basin with potential sale proceeds to be used toward debt reduction. The QEP transaction closed in March.

“We continue to be pleased with the seamless integration of both the Guidon and QEP assets, and we are achieving our synergy targets ahead of schedule and in excess of those highlighted during the acquisition announcement,” Diamondback CEO Travis Stice said in a statement in a May 3 company release. “This progress only adds to our ‘exploit and return’ strategy of spending maintenance capital to hold oil production flat, while using free cash flow to reduce debt and return cash to stockholders.”

RELATED:

Diamondback Energy Tops Profit Estimates on Higher Crude Prices

According to its release, Diamondback signed definitive agreements in the second quarter to divest the Williston Basin assets and noncore Permian Basin assets for total consideration of $832 million. The assets being sold have estimated full-year 2021 net production of approximately 28,000 boe/d.

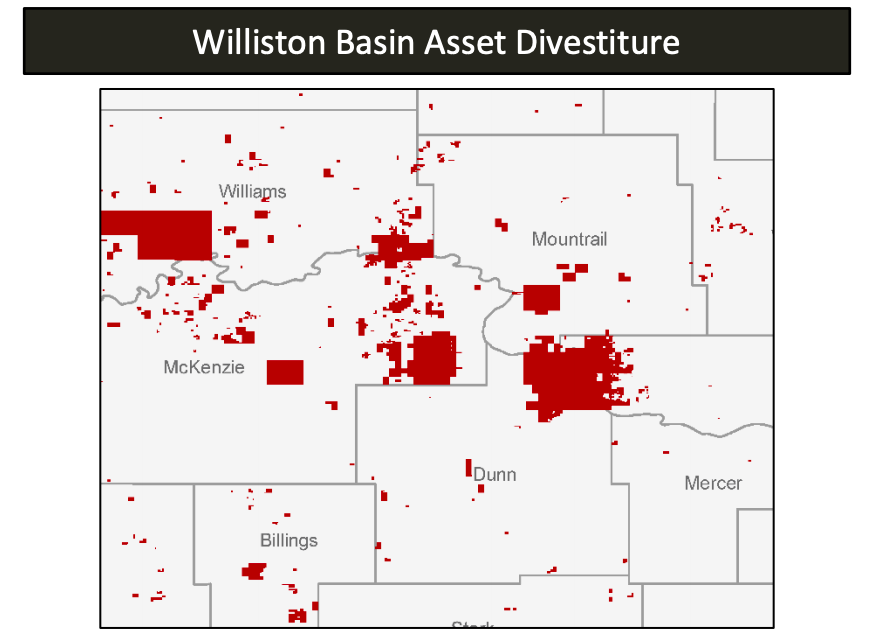

The Williston divestiture to Oasis includes approximately 95,000 net acres with estimated net production of approximately 25,000 boe/d for full-year 2021. Diamondback said the divestiture represents a complete Williston exit.

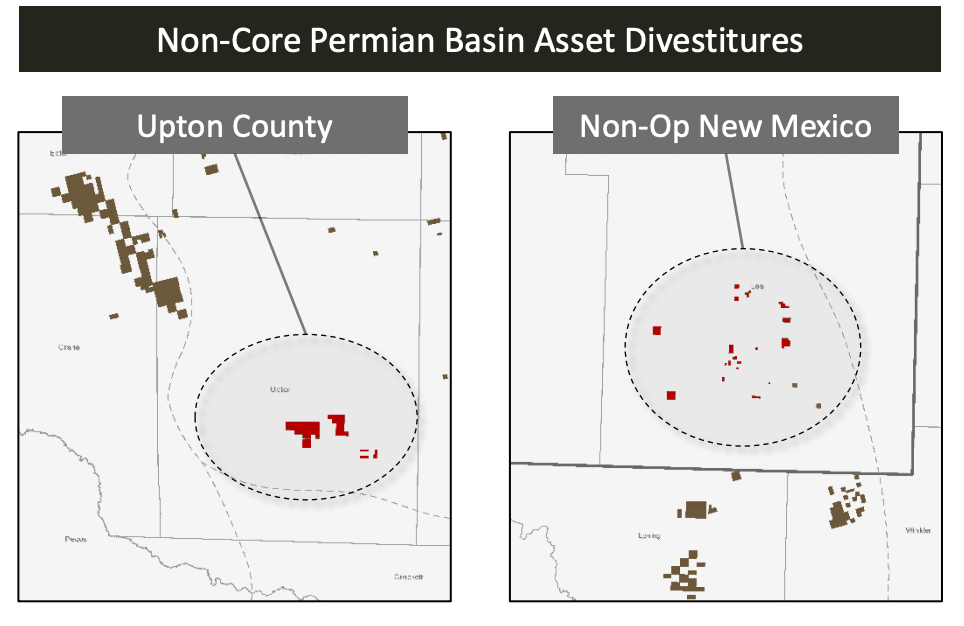

Meanwhile, the Permian asset divestitures, with undisclosed buyers, consist of approximately 7,000 net acres of noncore Southern Midland Basin acreage in Upton County, Texas, and approximately 1,300 net acres of noncore, nonoperated Delaware Basin assets in New Mexico’s Lea county.

Diamondback expects to close its Permian divestitures in the second quarter and the Williston transaction in the third quarter of 2021.

In a separate release, Oasis said it anticipates closing the Williston transaction with Diamondback in July. According to the company, the purchase price represents approximately $28,000 per boe/d on first-quarter 2021 two-stream volumes.

“This exciting acquisition is a great example of how Oasis is addressing the needs of tomorrow, by taking action in our new industry paradigm, today,” Oasis CEO Danny Brown said in statement.

Brown joined Houston-based Oasis last month to fill the CEO role left vacant following the retirement of the company’s co-founder, Thomas Nusz. He has 23 years of experience in the oil and gas industry having spent his career with Anadarko Petroleum and one of its predecessors—Kerr-McGee—until Anadarko was acquired by Occidental Petroleum in 2019.

Oasis is one of the top producers in the Williston Basin, primarily targeting the Middle Bakken and Three Forks formations. The acquisition of the Williston assets from Diamondback are expected by Oasis to significantly boost free cash flow, resulting in a notable bump to shareholder returns.

In anticipation of the increase in free cash flow per share, Brown said he sees Oasis declaring a 33% increase to the company dividend, raising the quarterly dividend to $0.50 per share with its quarterly declaration after the transaction closes later this year.

“This acquisition materially enhances scale in our core Bakken asset at an attractive valuation, with the purchase price almost entirely based on PDP and very little value attributed to the development of the top-tier inventory or potential synergies,” Brown continued in his statement. “When combining the inherently attractive acquisition price with the prudent use of our best-in-class balance sheet this acquisition creates significant accretion for shareholders across all metrics, while maintaining pro forma leverage below target, and well below that of our peers.”

Oasis, which completed a financial restructuring last year, plans to finance the Williston transaction through cash on hand, revolver borrowings and a $500 million fully committed underwritten bridge loan.

In connection with the acquisition, Oasis entered into a commitment letter dated May 3 with J.P. Morgan and Wells Fargo to provide the $500 million bridge facility. Wells Fargo is administrative agent on Oasis’s credit facility. Vinson & Elkins LLP and Kirkland & Ellis LLP are legal advisers on the financing.

J.P. Morgan Securities LLC is strategic and financial adviser to Oasis on the acquisition and McDermott Will & Emery is its legal adviser. Goldman Sachs & Co. LLC is exclusive financial adviser to Diamondback for the Williston deal and Latham & Watkins LLP is serving as its legal adviser for the transaction.

For Diamondback’s Permian Basin asset sales, Tudor, Pickering, & Holt Co. is exclusive financial adviser to the company.

Recommended Reading

Thanks to New Technologies Group, CNX Records 16th Consecutive Quarter of FCF

2024-01-26 - Despite exiting Adams Fork Project, CNX Resources expects 2024 to yield even greater cash flow.

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.