Despite an already blockbuster quarter of M&A activity, Diamondback snuck in a bolt-on acquisition in the Midland Basin that CEO Travis Stice said was too good of an opportunity to pass up. (Source: Hart Energy/Shutterstock.com)

Diamondback Energy Inc. (NASDAQ: FANG) recently revealed another acquisition that was too good for the Midland, Texas-based company to pass up despite an already blockbuster quarter of M&A activity.

Building on its track record of growth within cash flow, Diamondback said in its Nov. 6 earnings release that the company closed additional tack-on acquisitions in the Northern Midland Basin during the third quarter for $312.5 million.

The additional acquisitions bring Diamondback’s deal-making for the quarter to well over $10 billion worth of transactions.

Diamondback kicked off its buying spree in early August with a roughly $1.25 billion cash-and-stock purchase of Ajax Resources LLC, an E&P backed by Kelso & Co. with leasehold acreage in the Northern Midland Basin. Less than a week later, the company followed up its Ajax deal with an agreement to buy fellow Permian player Energen Corp. (NYSE: EGN) in an all-stock transaction worth roughly $9.2 billion including debt.

The Ajax acquisition closed Oct. 31. The Energen merger is expected to close in late November.

In the meantime, Diamondback will keep busy by digesting assets acquired through its Ajax deal as well as the additional acquisitions, which also closed Oct. 31.

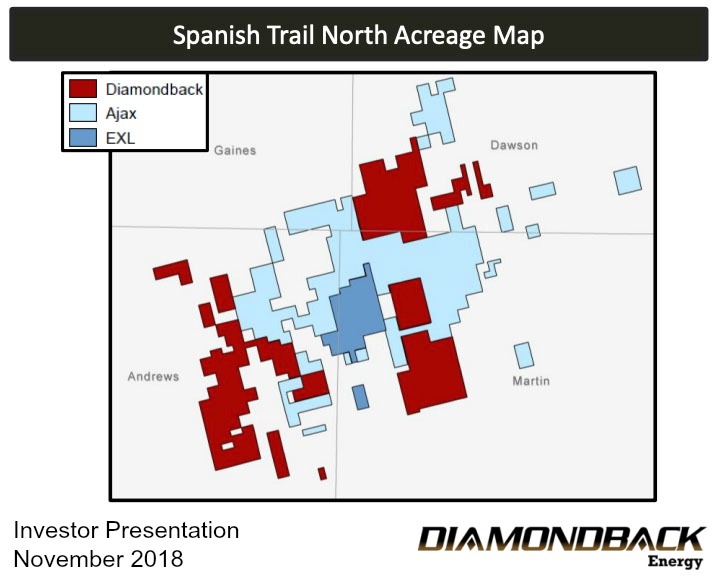

The additional acquisitions comprise 3,646 net leasehold acres and related assets from ExL Petroleum Management LP, ExL Petroleum Operating Inc. and EnergyQuest II LLC. The acquired assets, located in Martin and Andrews counties in West Texas, have roughly 3,500 barrels of oil equivalent per day (boe/d) of estimated current net production.

Analysts with Capital One Securities estimate Diamondback paid roughly $44,000 per adjusted acre for its latest acquisition, which is higher than the $36,000 per acre adjusted vale the firm estimated for the Ajax deal.

Still, the latest acquisition is adjacent and complementary to existing Diamondback and Ajax acreage in an area Diamondback is calling “Spanish Trail North.”

During the company’s third-quarter earnings call on Nov. 7, Diamondback CEO Travis Stice said the opportunity to acquire the additional acreage was too good to pass up. Further, Diamondback maintains a “fortress balance sheet for just these types of opportunities.”

“We felt like we had differential knowledge in the area because of our legacy activity,” Stice said on the earnings call. “We felt like we had willing sellers that they weren't marketing the process broadly. And we felt like we could bring our expertise to wells that could immediately compete for capital right way.”

Stice said the challenge for Diamondback now is execution, specifically on the estimated $3 billion worth of synergies expected from the company’s merger with Energen. As a result, Diamondback will, for the most part, be on the sidelines on the acquisition front, he added.

“We understand that the battle lines are drawn for us to execute on those synergies. ... We’re more or less on the sidelines until we get this merger integrated and start delivering materially on the synergies that we talked about,” he said.

Diamondback operated 13 drilling rigs and five dedicated frack spreads during the third quarter of 2018. The company also assumed operations of one additional operated rig following the closing of the Ajax acquisition, which it plans to maintain for the remainder of the year.

During the third quarter, Diamondback drilled 40 gross horizontal wells and turned 43 operated horizontal wells to production. The average completed lateral length for third quarter wells was 9,638 feet.

With both the Ajax and its latest acquisitions complete, Diamondback now expects to develop the Spanish Trail North position in the Northern Midland Basin with between eight and 12 well pads targeting the Wolfcamp A, Lower Spraberry and Middle Spraberry zones. The company estimates this will generate an internal rate of return of more than 100% under long lateral development.

In total, Diamondback now expects to turn between 170 and 175 gross operated horizontal wells to production for full-year 2018.

Since the beginning of the year, Diamondback has been able to generate $12 million in free cash flow while growing production 45% over the last 12 months. Third-quarter production was 123,000 boe/d (72% oil).

Diamondback’s track record of growth within cash flow is now at 15 quarters in a row, analysts with Seaport Global Securities said in a Nov. 8 research note.

“In a world where capital discipline is now the primary theme across North American energy and companies are discussing what they plan to do, look no further than what Diamondback has done over the past three years,” Stice said. “Our operating philosophy has not changed: Maximize production growth within cash flow, maintain best-in-class operating metrics, low leverage and execute on acquisitions accretive to our current acreage position and per share metrics. All of which, we continue to do in the third quarter.”

Diamondback’s third-quarter 2018 net income was $157 million. Adjusted EBITDA was $372 million, up 60% from $232 million a year ago.

As of Sept. 30, Diamondback had $492 million in standalone cash and no outstanding borrowings under its revolving credit facility.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

McKinsey: US Output Hinges on E&P Capital Discipline, Permian Well Trends

2024-02-07 - U.S. oil production reached record levels to close out 2023. But the future of U.S. output hinges on E&P capital discipline and well-productivity trends in the Permian Basin, according to McKinsey & Co.