Diamondback Energy Inc. on Aug. 3 reported a quarterly loss as a result of $2.54 billion impairment charges related to the oil price crash.

The Permian Basin shale producer posted a net loss of $2.39 billion, or $15.17 per diluted share, for the second quarter, from a profit of $349 million, or $2.11 per share, a year ago. The impairment charges were related to the lower average trailing 12-month commodity pricing, according to a company release.

Diamondback is not alone, though. After a historic quarter for the oil and gas industry marked by an unprecedented price crash, many companies in the sector have already reported or are gearing up to report their worst quarterly results in years.

For example, last week, ConocoPhillips Co.—the largest independent producer in the U.S. by market cap—reported a $1 billion loss for the second quarter, which the company blamed on production cuts and weak prices.

Commenting on Diamondback’s quarterly results, CEO Travis Stice said the company’s operated rig count declined rapidly during the quarter from 20 rigs on March 31 to six rigs currently. The company also curtailed 5% of its oil production

“In response to historically low commodity prices, we made the decision to complete as few wells as possible in the second quarter, with zero wells turned to production in the month of June,” Stice said in a statement.

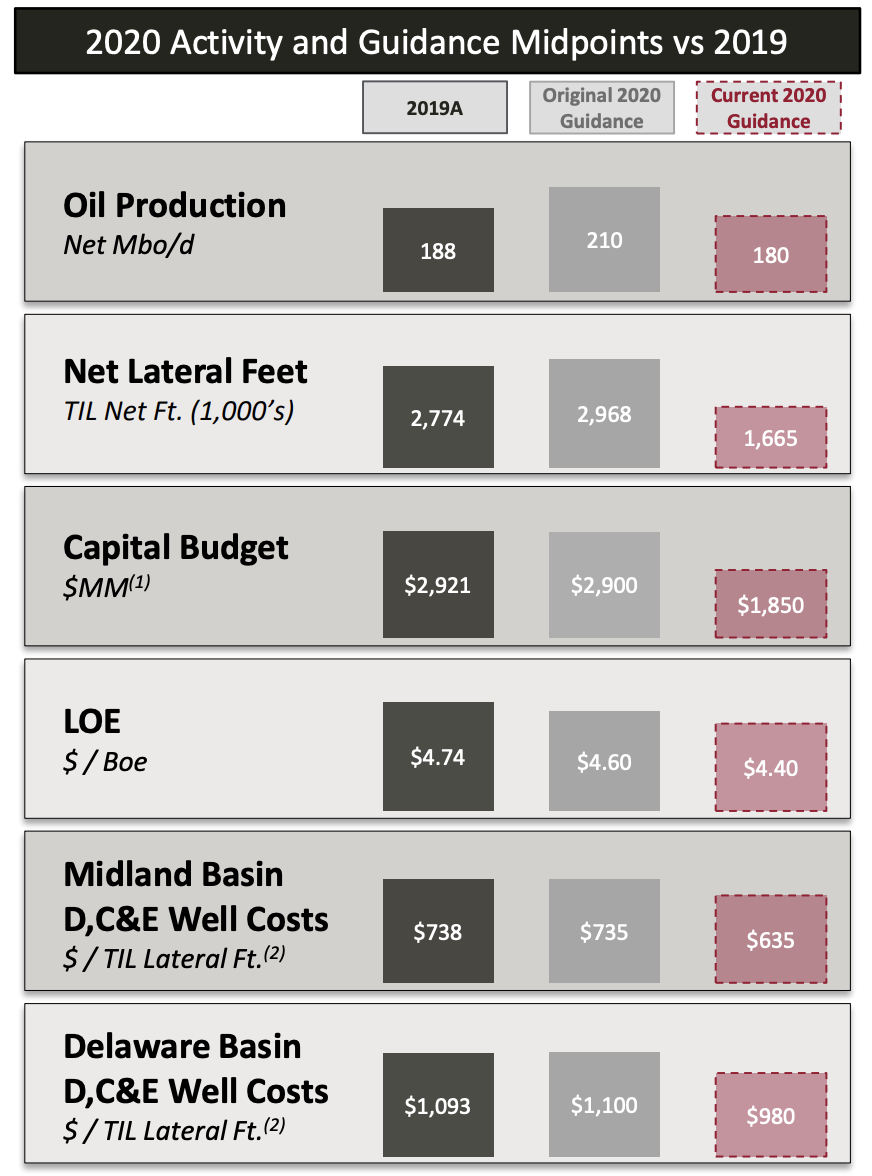

Average realized hedged oil prices fell roughly 35% during the quarter to $35.21/bbl, according to the company release.

In his statement, Stice said the company is now receiving significantly higher realized prices than it would have received when the decision was made to curtail.

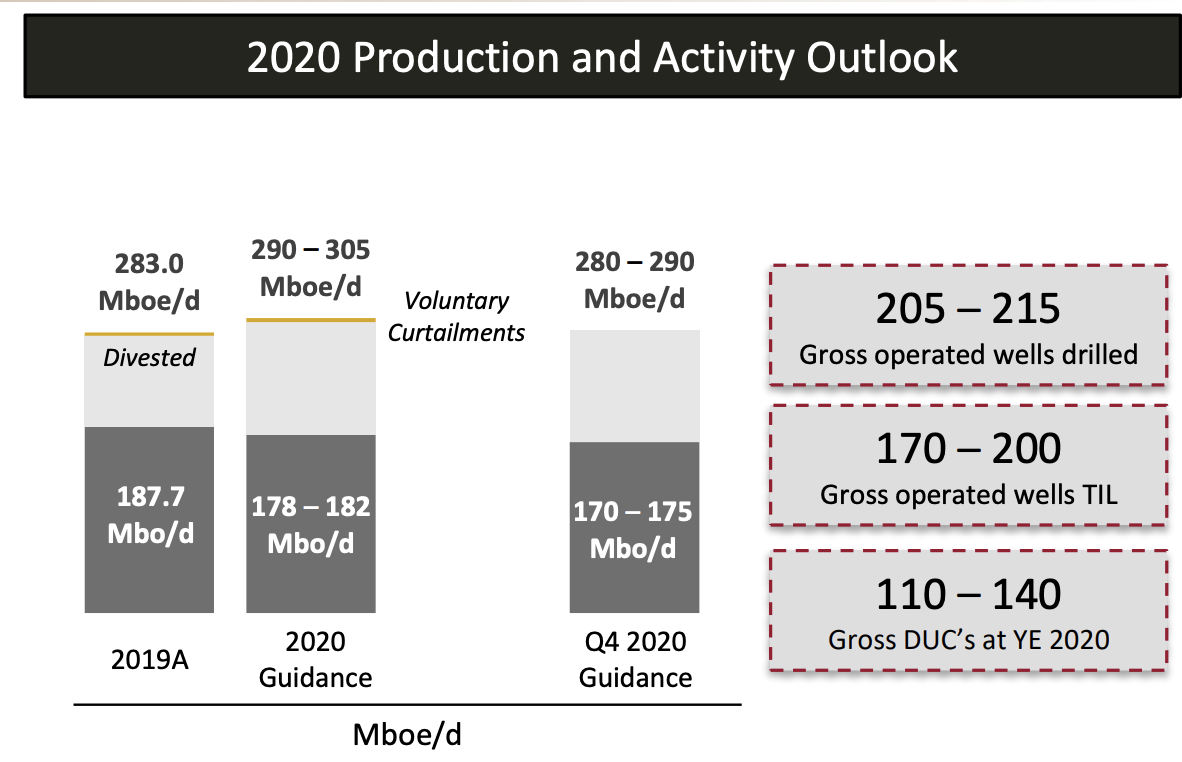

“Curtailed production has been restored ... We have three completion crews working to stem production declines to meet our fourth quarter production target of between 170,000 and 175,000 barrels of oil per day,” he said.

Diamondback averaged 294,126 boe/d of production during the second quarter, including about 176,300 bbl/d of oil.

The company also decreased its cash operating costs “dramatically” in the second quarter, according to Stice, some of which he expects to become permanent.

“Under a maintenance capital scenario next year, should that become the base case operating plan, Diamondback can hold expected fourth-quarter 2020 oil production flat while spending 25%-35% less than 2020’s capital budget, including lower midstream and infrastructure budgets,” he said.

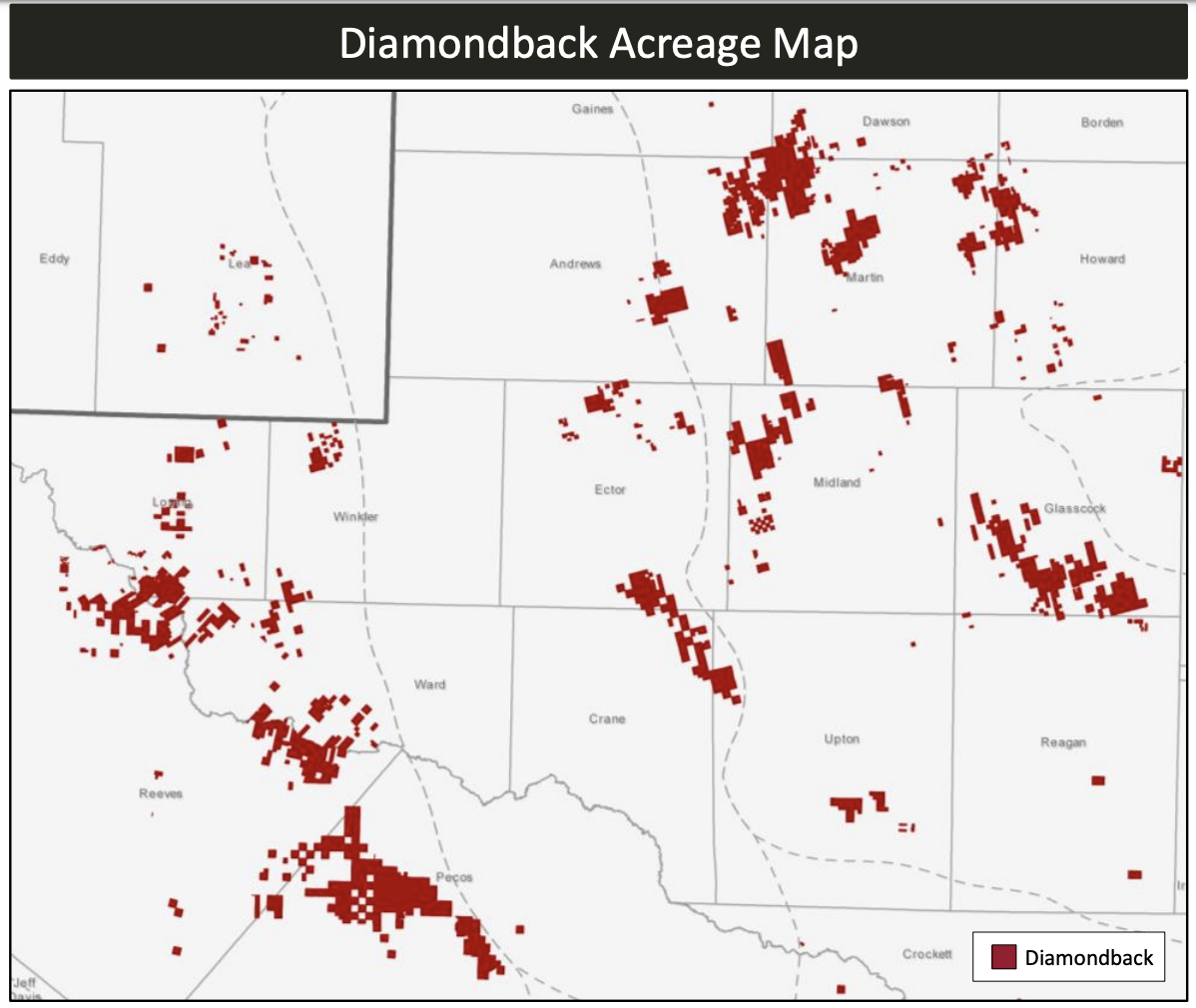

Diamondback is a pure-play Permian Basin operator. The company position includes about 348,000 net acres across the Midland and Delaware sub-basins.

During the second quarter, Diamondback drilled 37 gross horizontal wells in the Midland Basin and 21 gross horizontal wells in the Delaware. The company turned 10 operated horizontal wells to production in the Midland and five operated horizontal wells in the Delaware. The average lateral length for the wells completed during the quarter was 11,256 ft.

Assuming a continuation of current market conditions, Diamondback plans to operate between five and six operated drilling rigs and between three and four completion crews for the remainder of 2020, the company release said.

Recommended Reading

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.