Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Diamondback Energy Inc. agreed on May 16 to acquire all the publicly held common units it doesn’t already own in Rattler Midstream LP in a $575.2 million roll-up roughly three years after Diamondback took its midstream subsidiary public.

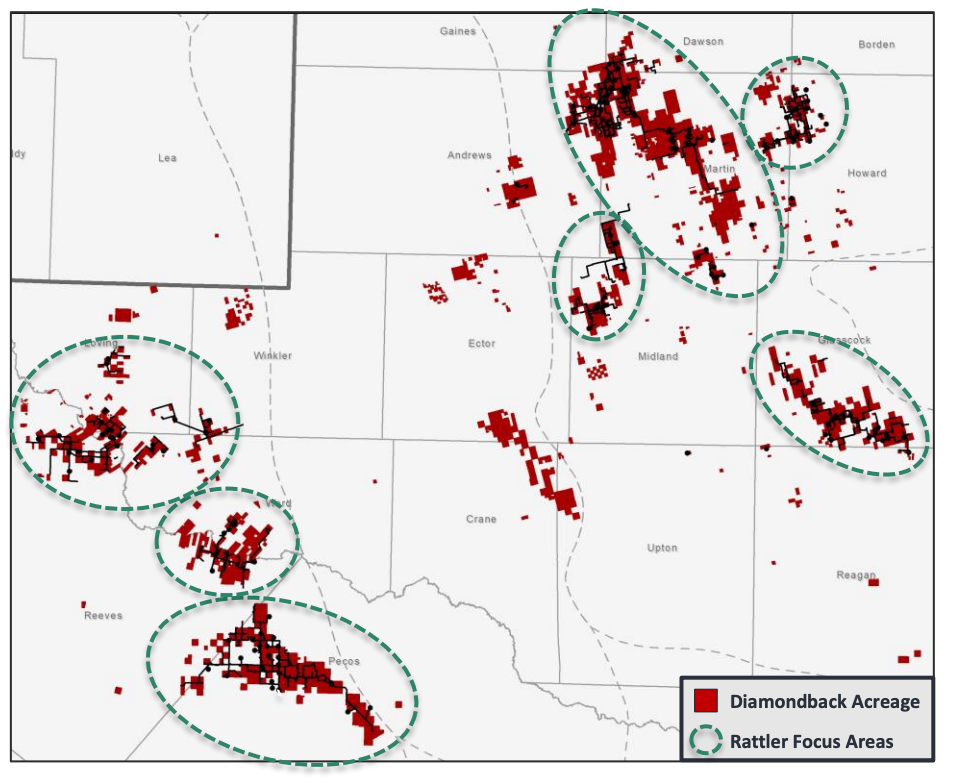

Rattler Midstream is a Delaware limited partnership formed in July 2018 by Diamondback Energy to own, operate, develop and acquire midstream and energy-related infrastructure assets in the Midland and Delaware basins of the Permian, where Diamondback is focused.

“The energy landscape has transformed dramatically since Rattler was taken public in 2019, and we believe this agreement to merge companies is in the best interests of both Diamondback and Rattler stakeholders,” Travis Stice, CEO of Diamondback and of the general partner of Rattler, commented in a company release on May 16.

Diamondback launched the IPO for its midstream subsidiary in May 2019. Rattler’s primary assets span water infrastructure, oil gathering, equity stakes in gas gathering and processing, and equity stakes in long-haul oil and NGL pipelines across the Permian Basin.

“This merger will allow both companies to benefit from the simplicity and scale of the combined entity going forward,” Stice added in the release.

As part of the all-stock transaction, each public unitholder of Rattler is set to receive 0.113 of a share of common stock in Diamondback in exchange for each Rattler common unit owned. The transaction is estimated to be valued at about $575.2 million based on the closing price of Diamondback stock on May 13.

Diamondback already owns about 74% of the roughly 145.96 million units outstanding for RTLR, leaving a balance of 38.1 million common units balance, according to a note by Tudor, Pickering, Holt & Co. (TPH).

“While the deal is more quantifiably positive for RTLR, with the implied $/unit price at ~$15.08/shr and representing a ~17% premium to Friday’s close (release highlights this alongside a ~9% premium based on 30-day VWAP of both entities), we see this as a high-level marginal positive for FANG,” the TPH analysts wrote in a May 16 note.

“While complexity of the FANG-VNOM-RTLR complex has not come up much in the past ~six months,” the TPH analysts continued, “we view this as FANG taking advantage of relative performance (FANG +66% TTM vs. RTLR +19%) to help simplify the overall story.”

According to the company release, the exchange ratio implies a premium of 17.3% for Rattler common units based on the closing prices of Rattler’s common units and Diamondback’s common stock as of May 13, and a premium of 9.3% based on Rattler’s and Diamondback’s 30 day volume-weighted average trading price as of the same date.

The transaction is expected to close in third-quarter 2022, subject to customary closing conditions.

J.P. Morgan Securities LLC is financial adviser and Akin Gump Strauss Hauer & Feld LLP is legal adviser to Diamondback. Evercore is financial adviser and Gibson, Dunn & Crutcher LLP is legal adviser to the conflicts committee of the board of directors of Rattler’s general partner.

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.