Diamondback Energy will add top-tier horizontal drilling locations across three zones in the Northern Midland Basin to its portfolio as part of the Ajax acquisition. (Source: Hart Energy/Shutterstock.com)

[Editor's note: This story was updated at 2:26 p.m. CST Aug. 13.]

Diamondback Energy Inc. (NASDAQ: FANG) said Aug. 8 it will acquire Ajax Resource LLC in a cash-and-stock transaction worth roughly $1.25 billion that is set to deepen the Permian operator’s drilling inventory while further consolidating the Northern Midland Basin E&P landscape.

Ajax was formed in June 2015 with backing from New York-based private equity firm Kelso & Co. to acquire W&T Offshore Inc.’s (NYSE: WTI) Permian Basin assets known as the Yellow Rose Field for about $376 million. The company's position covers about 25,493 net leasehold acres in the Northern Midland Basin with production of more than 12,100 boe/d (88% oil).

The acquisition of Ajax will add 362 net identified potential horizontal drilling locations with an average lateral length of over 9,500 ft to Diamondback’s portfolio. About 220 of those net potential locations are in the top quartile of the company’s current inventory, generating 100% or greater internal rate of returns at $60 per barrel across three zones, CEO Travis Stice said.

“Credit is due to the Ajax team for displaying impressive results in two emerging zones for the area, the Wolfcamp A and Middle Spraberry,” Stice said in a statement. “These results highlight the value of this acreage in our existing portfolio, and more than doubles Diamondback’s inventory to 680 net pro forma locations in this area.”

Ajax’s acreage position is roughly 89% HBP, which will allow for 12-plus well multizone pad development in the Middle Spraberry, Lower Spraberry and Wolfcamp A, according to the Diamondback press release.

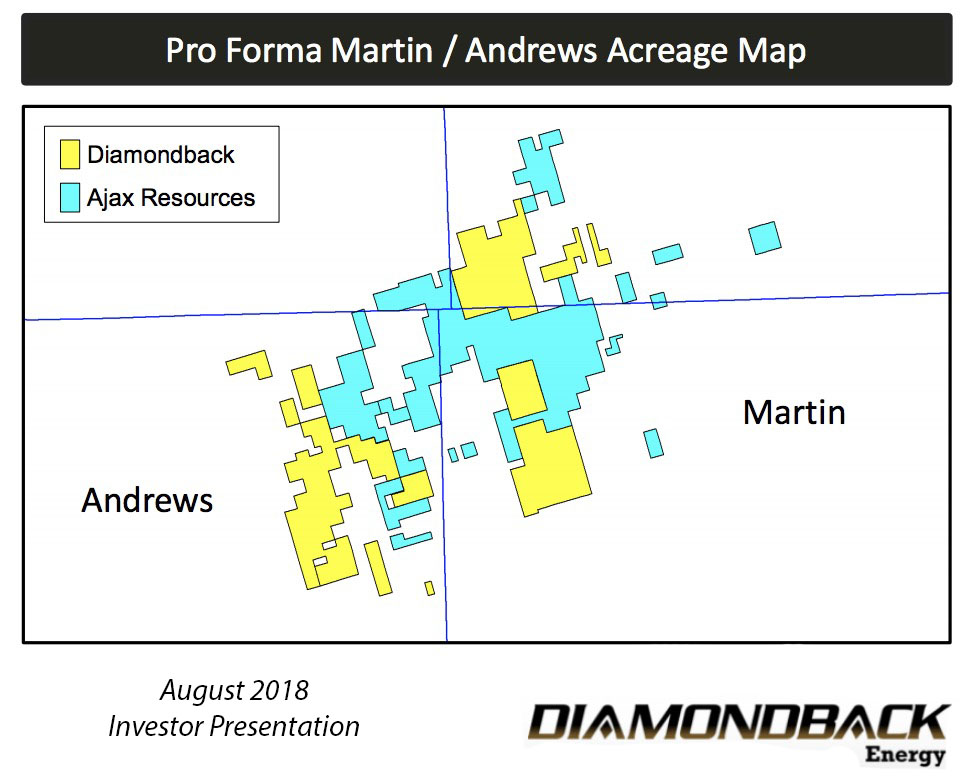

The position includes an average 99% working interest with 23% royalty burden and is roughly 99% operated. About 21,000 net acres of Ajax’s acreage is located in Northwest Martin and Northeast Andrews counties in West Texas.

Diamondback will also pick up midstream infrastructure from the Ajax acquisition including saltwater gathering and disposal plus existing freshwater production and ownership of over 700 surface acres.

“This transaction represents a logical transition for the Ajax asset base, as it complements Diamondback’s acreage position very well and further consolidates the Northern Midland Basin,” Ajax CEO Rich Little said in a statement. “I am extremely proud of what the Ajax team accomplished over the past three years. With the strong sponsorship and support of our private equity partner, Kelso, we were able to deploy the necessary resources and capital to delineate and strategically develop an underexploited asset base.”

Upon completion of the Ajax acquisition, Diamondback’s total leasehold interests in the Permian Basin will grow to roughly 230,000 net surface acres.

Diamondback will purchase Ajax for $900 million cash and 2.58 million shares of common stock valued at $345 million based on the closing price of its stock on Aug. 6.

The company said it plans to finance the cash portion of the transaction either through a combination of cash on hand, proceeds from the recent dropdown to its minerals subsidiary or its existing borrowing capacity as well as potential capital markets transactions, which may include a debt offering.

The Ajax acquisition is expected to close at the end of October and will have an effective date of July 1.

Upon closing of the Diamondback transaction, Ajax said it intends to continue to pursue new acquisition and development opportunities. Jefferies LLC was sole financial adviser to Ajax for the transaction and Thompson & Knight LLP served as its legal adviser.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

Post $7.1B Crestwood Deal, Energy Transfer ‘Ready to Roll’ on M&A—CEO

2024-02-15 - Energy Transfer co-CEO Tom Long said the company is continuing to evaluate deal opportunities following the acquisitions of Lotus and Crestwood Equity Partners in 2023.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

TC Energy's Keystone Oil Pipeline Offline Due to Operational Issues, Sources Say

2024-03-07 - TC Energy's Keystone oil pipeline is offline due to operational issues, cutting off a major conduit of Canadian oil to the U.S.