Drilling rigs run in Wyoming, home of the Powder River Basin. The basin is also located in Montana. (Source: Jim Parkin/Shutterstock.com)

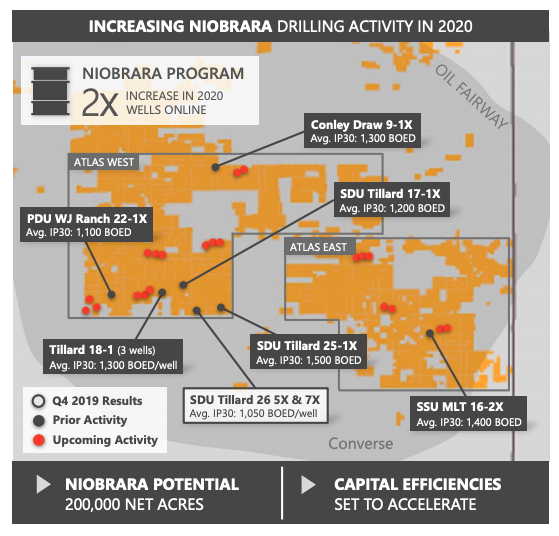

Devon Energy Corp. is planning to double its activity levels to 15 wells in the emerging Niobrara Formation of the Powder River Basin, which is described by industry experts as one of the world’s super basins.

Fresh off a year that targeted development in the Powder River’s Turner Formation, the Oklahoma City-based company is focusing attention on the Niobrara, which lies just above the Turner, following appraisal work last year.

“A key objective in the Niobrara program in 2020 is to derisk and to prepare a portion of our 200,000 net acres for full development by early next year,” Devon Energy CEO Dave Hager said Feb. 19 on the company’s earnings call.

The company reported net production in the basin averaged 27,000 barrels of oil equivalent per day (boe/d) in fourth-quarter 2019, a 54% increase compared to a year earlier. The growth driver, Devon said, was 19 new wells brought online with average 30-day rates of 1,300 boe/d at an average completed well cost of $5.5 million.

The Powder River Basin, which is also known for its plentiful coal supply, is still capturing the attention of U.S. shale players in pursuit of hydrocarbon resources that can be hydraulically fractured and pumped at breakeven prices that translate into profits. Targeted formations in recent years in the basin, which lies mostly in Wyoming and partly in southeast Montana, by companies have also included the Mowry and Parkman along with the Turner and Niobrara-Codell formations.

Devon’s Niobrara position is located in the “core of the play’s chalk window,” and the company believes it “has repeatable resource play characteristics and the potential to be an important growth driver for Devon longer term,” said David Harris, the company’s executive vice president of exploration and production.

Boosting its confidence in potential Niobrara commerciality—for at least three to four wells per section—are results from an initial spacing test brought online last year, he added. “These tests have also confirmed our ability to develop the Niobrara independent of the deeper Turner interval.”

Devon allocated about 20% of its 2020 capex budget of between $1.7 billion to $1.85 billion to the Powder River. Plans are to focus delineation efforts in Atlas West, located in the southwest part of its acreage. But most of the company’s capex, like its production, will be focused in the Permian Basin.

Other players in the Powder River Basin include EOG Resources and Chesapeake Energy Corp., which said in January it recovered from third- and early fourth-quarter production challenges in the basin to average about 21,000 barrels of oil per day in December. In its latest operational update, Chesapeake said four of the five Niobrara wells it turned to sales in the fourth quarter had average peak 24-hour IP rates of more than 2,000 boe/d.

Super Basin

The Powder River was among the basins spotlighted during the American Association of Petroleum Geologists’ recently held Global Super Basins Leadership Conference in Sugar Land, Texas. Steve Sonnenberg, professor and Charles Boettcher chair at the Colorado School of Mines, described the Powder River Basin as a super basin, or perhaps a Tier 2 super basin—meaning it has either produced 5 Bboe from conventional fields or it has 5 Bboe remaining and proven.

He spoke about how oil and gas development in the basin has evolved from the conventional to unconventional with horizontal drilling and hydraulic fracturing bringing to light the basin’s tight oil and what he called “carrier beds” or “halo plays” like the Turner/Frontier sandstone. Carrier beds, like sandstones and carbonates, allow hydrocarbons from source beds to move through the more permeable carrier bed’s wider pores.

The Powder River Basin has produced more than 2 billion barrels of oil and more than 90 trillion cubic feet of natural gas, he said, with some of the first oil dating back to the 1890s. The two main source bed intervals are the Upper Cretaceous Niobrara and Lower Cretaceous Mowry, he said.

Of the Niobrara’s three benches—A, B and C—the latter is receiving the most attention nowadays with volumes similar to those seen in the Turner sandstone: “several thousand barrels a day and several million cubic feet of gas for some of the newer wells currently being drilled,” Sonnenberg said.

The Niobrara ranges in thickness from 600 ft to less than 200 feet, he said, with “some dramatic thinning to the northeast and east across the basin.”

Sonnenberg compared the Powder River, with its stacked pays, to the Permian Basin.

However, “Keep in mind, there’s only 19 active rigs running in the Powder River Basin currently, nowhere close to being something like the Permian Basin with 400 rigs,” Sonnenberg told conference attendees. “But in some ways, we think of the Powder River Basin being like a small Permian Basin with all its attributes, stacked pays and [the] large conventional potential that’s present.”

Sonnenberg said the Powder River Basin has a large resource potential remaining with its multiple unconventional plays, which include tight oil, tight gas and carrier bed systems. “We have world-class petroleum systems which generate overpressuring, and it’s very much a technology-driven basin,” he said.

Recommended Reading

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.

Global Oil Demand to Grow by 1.9 MMbbl/d in 2024, Says Wood Mac

2024-02-29 - Oil prices have found support this year from rising geopolitical tensions including attacks by the Iran-aligned Houthi group on Red Sea shipping.

Oil Rises After OPEC+ Extends Output Cuts

2024-03-04 - Rising geopolitical tensions due to the Israel-Hamas conflict and Houthi attacks on Red Sea shipping have supported oil prices in 2024, although concern about economic growth has weighed.

Oil Market Shifting Back to Supply/Demand

2024-03-08 - Stratas Advisors' John Paisie forecasts the price of Brent crude to increase during the second and third quarters of this year and move toward $90/bbl.