Presented by:

It’s been roughly a year since Devon Energy announced the $5.75 billion all-stock combination with WPX Energy. Clay Gaspar, the company’s executive vice president and COO, who made the move from Tulsa to Oklahoma City due to the merger, said everything is coming along nicely but that a combination of such magnitude takes time if you want to get it right.

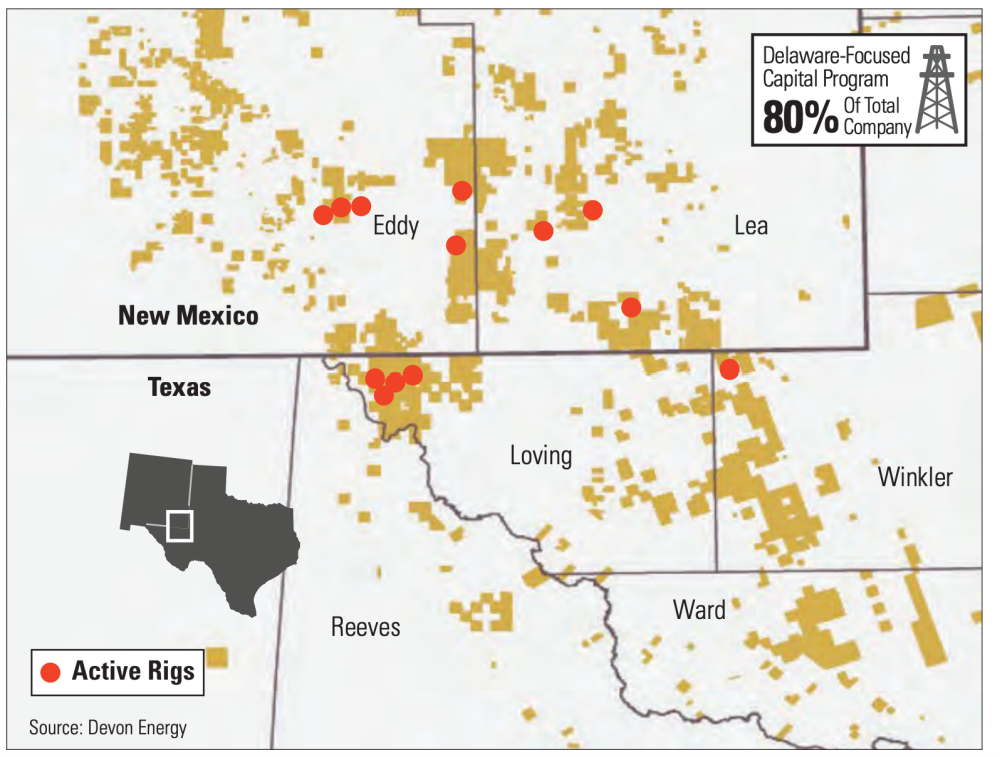

The merger was one of the first to be announced in late 2020, when most industry watchers were keeping an eye on the inevitable consolidation shale E&Ps following the demand distress and price perils of 2020. The combination of WPX and Devon made the new company even more of a power player in the Delaware Basin, where it now holds approximately 400,000 net acres.

Following his keynote address at the Executive Oil Conference in Midland, Texas, in November, Gaspar gave Oil and Gas Investor a one-on-one extended interview to explore the merger, Devon’s future direction, its cash flow priority, the energy transition and carbon capture possibilities.

Investor: One year into the merger, have you realized the opportunities that were envisioned?

Gaspar: What we do is challenging, complex work that affects people, companies, investors—all stakeholders. There are a lot of moving parts and we are taking the knowledge from both legacy companies and looking for the best opportunities.

We blended the two companies from the board level, all the way through the organization with high expectations of extracting the best ideas from both organizations.

Investor: Of course, the merger creates a dominant Delaware position now for you. What kind of value does that combo now create for Devon in the Delaware?

Gaspar: We’re a 600,000 boe per day organization, and about two thirds of that comes from the Delaware Basin. Certainly, with the price realizations and commodity prices today, it’s a tremendous cash-generating business, which was ultimately one of the five criteria we set out before the merger.

A sustainable business model of generating free cash flow and a multifaceted ability to return that cash to shareholders are core attributes of our business strategy.

“As long as we’re exceeding the cost of capital, we’re doing what the investor is ultimately asking for. And that’s beneficial to our business.”

Investor: You mentioned prioritizing free cash flow over production growth [at the Executive Oil Conference]. We’re in the days of free cash flow; the days of just producing that in cost are gone, but why is that?

Gaspar: I hear people use the phrase ‘produce at any cost,’ but I challenge that sentiment. Not that long ago investors placed a premium on companies that had a growth trajectory. That’s what they wanted and then rewarded growth with higher share prices.

Companies were incentivized to grow production, not at any cost, but definitely with a growth mindset. That way of thinking about growth and capital spend was beneficial to the near-term business, but as production outpaced demand, prices fell and the investment in growth destroyed value.

The external challenge and pressures have changed. Now, investors want to know how we will generate sustainable cash and then return it to shareholders rather than pouring it all back into the business. This quarter, Devon announced a share buyback in addition to our fixed-plus-variable dividend—both are phenomenal shareholder return mechanisms. We are also focused on paying down debt, and are in exceptionally good shape there.

Investor: Seventy percent of your assets are in the Delaware Basin. What are your expectations outside of the Permian?

Gaspar: On our Q3 earnings call [on Nov. 3], we highlighted our other basin activities as well. For example in the Anadarko Basin, we have a joint venture with Dow Chemical and have seen a lot of success. Dow is very encouraged and see investing in oil and gas as a natural hedge to their business costs. They’re carrying about a $100 million of our well cost, while earning about 50% of 133 wells that we drill. This JV is allowing us to invest more in the basin, and is providing great returns for Devon and Dow Chemical.

We also have great positions in the Williston and Powder River basins and in South Texas. While these basins don’t get a lot of airtime right now, they are critical to our strategy and we’ll be talking about them more in the future.

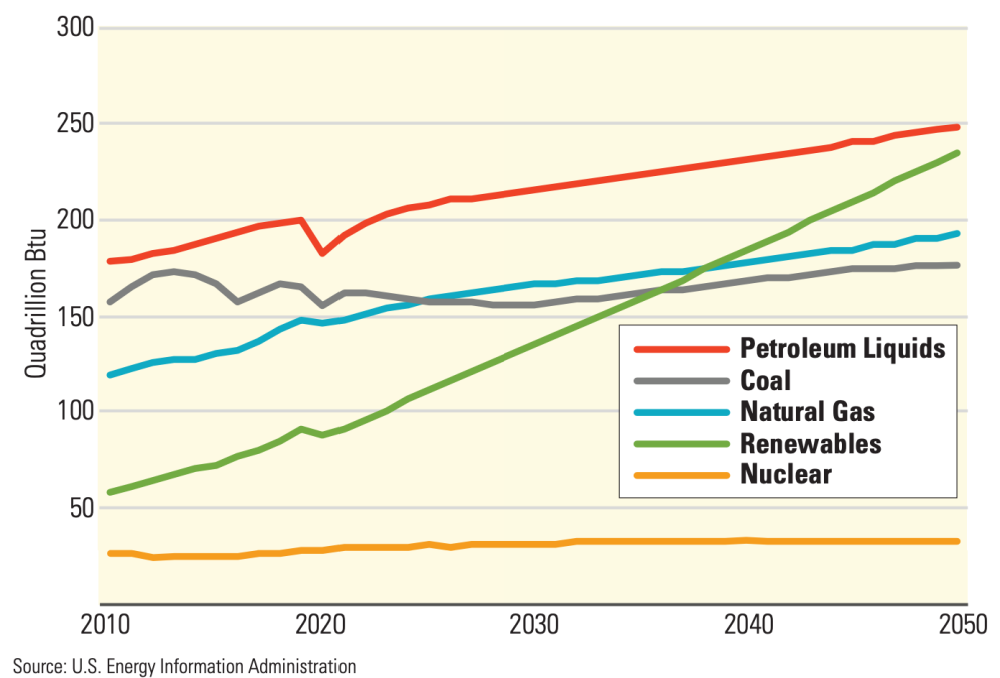

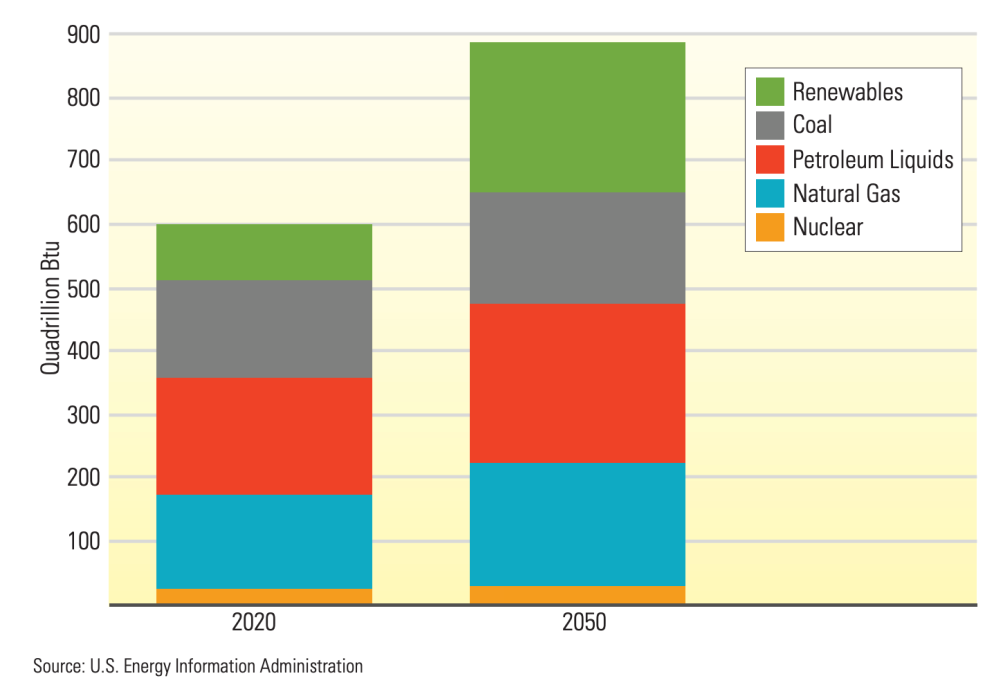

Investor: The projections for oil and gas are that it’s not going anywhere anytime soon. What’s your take on the numbers on consumption and source transition? How do they affect how the industry, and how Devon should plan its future?

Gaspar: I think people, especially outside of the industry, think we should hang up an ‘out of business’ sign, but I don’t see it that way. The world as we know it today and far into our future cannot exist without oil and gas, but that’s not a free pass for us. We do need to get better at providing energy with less impact on the environment, and we will continue getting better. I love a good challenge.

We also need to be thoughtful in our investments. We need to honor the wishes of our investors that ultimately own our company. At the same time, we need to provide energy to fuel the world.

Investor: What is your transition, your emissions strategy?

Gaspar: Here’s what we’re going to do. Top of the order is reducing emissions, overall. It is the biggest opportunity for us to materially move the needle and answer some of the challenges that we have. I’m not shying away from the fact that, in any business, in any industry, there are negative byproducts. We are working to minimize the negatives and still deliver on the very significant positives.

Investor: We talked a lot [at the Carbon Management Forum at Executive Oil Conference] about carbon capture and sequestration. Any thoughts on those?

Gaspar: I’m very excited to see how the technology evolves. Two of the challenges with carbon capture are concentration and pressure. If you can find a pressurized stream that is highly concentrated, then the challenge becomes subsurface, and subsurface challenges are more similar to gas storage.

There are a lot of smart people, companies, and dollars chasing this. I’m very encouraged with the R&D work that’s being done right now, but as an organization, I don’t see anything that I want to lean into from a significant investment standpoint.

Investor: You have said it’s very important to address the values for long-term success. Can you expand?

Gaspar: I’m very passionate about values, and I think too often they are thought about, created, put on the website and quickly forgotten. As I get opportunities to speak to internal and external audiences about our corporate values, especially as a new organization, I think it helps reinforce those values.

As a relatively new company coming together, it’s so important that we repeat them as often as we can. I love when a leader, and that could be anyone in the organization, puts the values into their own context and perspectives when they communicate. It gets me fired up.

Recommended Reading

CERAWeek: Large Language Models Fuel Industry-wide Productivity

2024-03-21 - AI experts promote the generative advantage of using AI to handle busywork while people focus on innovations.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

AI in Oil: Revolution’s Coming, but Tech Adoption Remains Tentative

2024-04-05 - CERAWeek experts say AI will disrupt oil and gas jobs while new opportunities will emerge as the industry braces for an AI-driven workflow transformation.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

Exclusive: Halliburton’s Frac Automation Roadmap

2024-03-06 - In this Hart Energy Exclusive, Halliburton’s William Ruhle describes the challenges and future of automating frac jobs.