RimRock Oil and Gas is an independent oil and gas company founded and led by industry veteran Jim Fraser. (Source: Hart Energy)

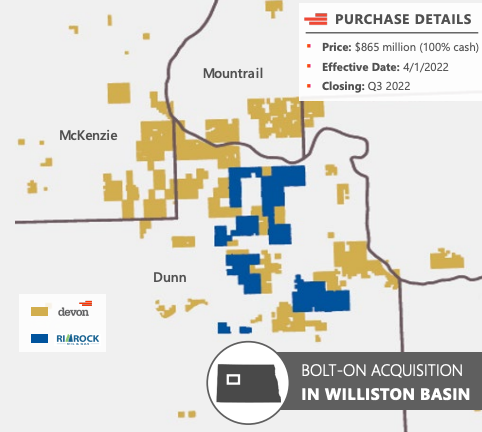

Devon Energy Corp. is adding onto its Williston Basin position through the “bolt-on acquisition” of RimRock Oil and Gas LP announced June 8.

“This bolt-on acquisition is highly complementary to our existing position in the Williston Basin and is immediately accretive to our financially-driven strategy,” Rick Muncrief, Devon’s president and CEO, commented in a company release.

According to the release, Devon agreed to acquire the leasehold interest and related assets of RimRock Oil and Gas, a Warburg Pincus portfolio company focused in the Williston Basin, for total cash consideration of $865 million.

The RimRock bolt-on transaction adds a contiguous position of 38,000 net acres (88% working interest) directly offsetting and overlapping Devon’s existing position. RimRock’s first-quarter production was approximately 15,000 boe/d (78% oil), with volumes expected to increase to an average of 20,000 boe/d over the next year, the release said.

“RimRock’s directly adjacent acreage offers strong operational synergies, adds to our high-quality inventory in the core of the play and positions us to further increase the return of cash to shareholders,” Muncrief added.

Devon expects the RimRock bolt-on transaction to be immediately accretive to all relevant per-share metrics in the first year, including earnings, cash flow, free cash flow and net asset value. The transaction is valued by the company at 2.2-times cash flow with a free cash flow yield of greater than 25% at strip pricing over the next year.

Due to the accretive nature of the transaction to free cash flow, Devon said its board intends to approve a 13% increase to the fixed quarterly dividend following the closing of the transaction, expected in the third quarter. The company also expects the transaction to be accretive to the variable dividend payout in 2022 and beyond.

RimRock Oil and Gas is an independent oil and gas company founded and led by industry veteran Jim Fraser. At the time of RimRock’s launch in 2016, the company received a line-of-equity investment of up to $500 million from Warburg Pincus.

“RimRock was founded with the mission to apply modern technologies to optimize asset performance as a low-cost operator. The current commodity environment, combined with our high-performing assets and the support of our strong team, resulted in an incredible business that I am proud to have led,” Fraser commented in a separate release.

Since its founding in 2016, RimRock operates nearly 200 wells, including 64 drilled wells and over 130 acquired operating wells. Devon said in its release that the RimRock bolt-on transaction adds more than 100 highly economic undrilled inventory locations that it expects will position the company’s Williston Basin assets to maintain “high-margin production and strong cash flow for several years.”

“RimRock successfully acquired and developed large-scale assets with meaningful production in the Williston Basin, leveraging the deep experience and expertise of its management team,” said Peter Kagan, managing director and head of energy at Warburg Pincus, in the release.

“Over the course of our partnership, RimRock built a strategic acreage position with a sizable inventory of core drilling locations, developing a clearly differentiated asset in the Basin. We would like to thank Jim and the RimRock team for their hard work and dedication to create a strong business of scale and value,” added John Rowan, managing director at Warburg Pincus.

The transaction is subject to customary terms and conditions and has an effective date of April 1. Devon said its pro forma leverage metrics will remain relatively unchanged, which it added ranks among the lowest in the industry.

Wells Fargo served as financial adviser to RimRock in connection with the transaction, and Kirkland & Ellis served as legal adviser.

Recommended Reading

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.