Devon Energy Corp. and WPX Energy Inc. completed the previously announced all-stock merger, the U.S. oil and gas producers said in a joint release on Jan. 7.

The transaction, announced in September 2020, was described by the companies as a “merger of equals” and gives Devon a premium acreage position in the economic core of the Delaware Basin. The all-stock deal was valued at about $5.75 billion, which includes the assumption of $3.2 billion in net debt.

“I want to thank employees for their determined work to complete a transaction of this size and scale in basically just three months,” said Rick Muncrief, who will serve as president and CEO of the combined company. Muncrief previously served as WPX’s chairman and CEO.

The combined company will operate under the name Devon Energy and be headquartered in Oklahoma City.

“This paves the way for our integration to pick up even more steam and establishes Devon as one of the strongest energy producers in the U.S.,” Muncrief added in his statement.

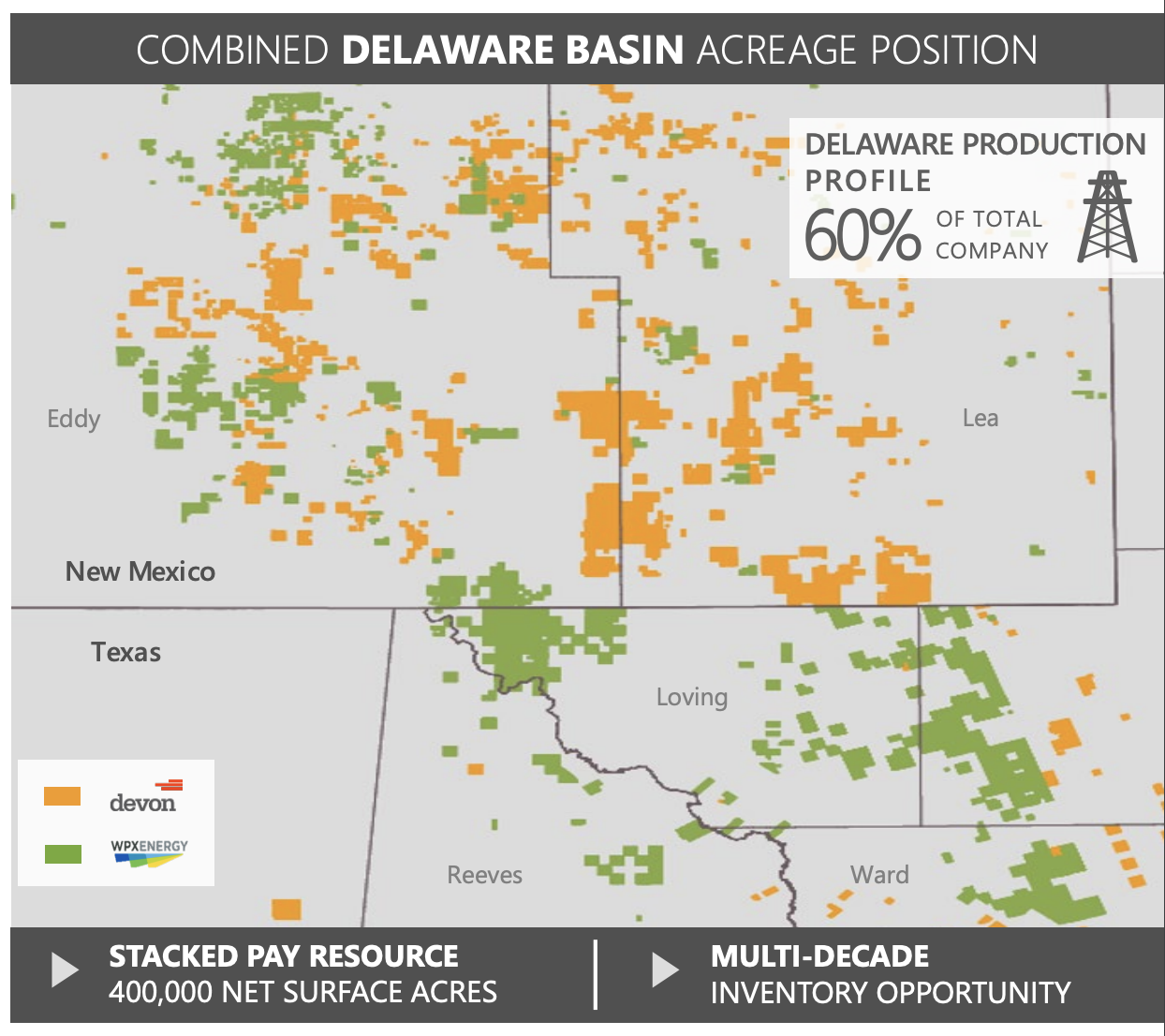

Upon closing, Devon Energy becomes a leading unconventional oil producer in the U.S. with a dominant Delaware Basin acreage position totaling 400,000 net acres. The companies expect to produce 277,000 bbl/d of oil with the Delaware Basin accounting for nearly 60% of the combined company’s total oil production.

In addition to its assets in the Permian, Devon also operates in the Anadarko, Eagle Ford Shale, Powder River and Williston basins.

The companies have previously said they expect capital activity plans of the combined company to focus on maintaining base production with free cash flow will be deployed by the combined company toward higher dividends, debt reduction and opportunistic share repurchases.

“This transformational merger enhances the scale of our operations, builds a dominant position in the Delaware Basin and accelerates our cash-return business model that prioritizes free cash flow generation and the return of capital to shareholders,” Dave Hager, Devon’s executive chairman, said in a statement on Jan. 7. Hager had previously served as president and CEO of Devon prior to the combination.

The combined company’s executive team will also include Jeff Ritenour as executive vice president and CFO and Clay Gaspar as executive vice president and COO.

The company’s new board of directors consists of 12 members. In addition to Hager as executive chairman, the new board includes:

- Barbara M. Baumann;

- John E. Bethancourt;

- Ann G. Fox;

- Kelt Kindick;

- John Krenicki Jr.;

- Karl F. Kurz;

- Robert A. Mosbacher Jr.;

- Richard E. Muncrief;

- D. Martin Phillips;

- Duane C. Radtke; and

- Valerie M. Williams.

Under the terms of the agreement, WPX shareholders received a fixed exchange ratio of 0.5165 shares of Devon common stock for each share of WPX common stock owned. The exchange ratio, together with closing prices for Devon and WPX on Sept. 25, results in an enterprise value for the combined entity of approximately $12 billion, the companies said in a joint release from September.

Upon completion of the combination, Devon shareholders were expected to own approximately 57% of the combined company with WPX shareholders owning the remaining 43%. Funds managed by EnCap Investments owned approximately 27% of the outstanding shares of WPX and entered into a support agreement to vote in favor of the transaction.

J.P. Morgan Securities LLC is financial adviser to Devon for the transaction. Skadden, Arps, Slate, Meagher & Flom LLP is serving as its legal adviser. Citi is serving as WPX’s financial adviser. Kirkland & Ellis LLP is its legal adviser. Vinson & Elkins LLP is legal adviser to EnCap Investments.

Recommended Reading

One Man's Trash? Treasure of RNG Prospects Available for Waste Facilities

2024-02-21 - About 4.4% of current U.S. fossil gas demand could be displaced by RNG from waste, a new Deloitte report shows.

Energy Transition in Motion (Week of Feb. 23, 2024)

2024-02-23 - Here is a look at some of this week’s renewable energy news, including approval of the construction and operations plan for Empire Wind offshore New York.

Clean Energy Begins Operations at South Dakota RNG Facility

2024-04-23 - Clean Energy Fuels’ $26 million South Dakota RNG facility will supply fuel to commercial users such as UPS and Amazon.

Energy Transition in Motion (Week of April 5, 2024)

2024-04-05 - Here is a look at some of this week’s renewable energy news, including the U.S. Environmental Protection Agency’s $20 billion ‘green bank.’

Energy Transition in Motion (Week of April 12, 2024)

2024-04-12 - Here is a look at some of this week’s renewable energy news, including a renewable energy milestone for the U.S.