(Source: Shutterstock.com)

After a slump in the first quarter, M&A activity in the energy sector reached a record high during the second quarter, according to a recent PricewaterhouseCoopers (PwC) report.

“After an exceptionally quiet first quarter, the oil and gas M&A market roared back to life in the second, racking the biggest second-quarter deal numbers since PwC started tracking transactions in 2002,” said Kyle West, a director of deals for PwC, during a July 25 webcast discussing the report.

RELATED:

US E&P A&D Deal List (First-Half 2019)

Whether the third quarter will mirror either prior quarters depends on the outcome of a number of factors such as U.S. monetary policy, tensions in the Strait of Hormuz and weather. Additionally, any significant volatility in cash flow driven by a “sustained decline in commodity prices or an improved sentiment from higher prices is likely to drive more deal activity,” West added noting focus is expected to remain on capital discipline and operating within cash flow.

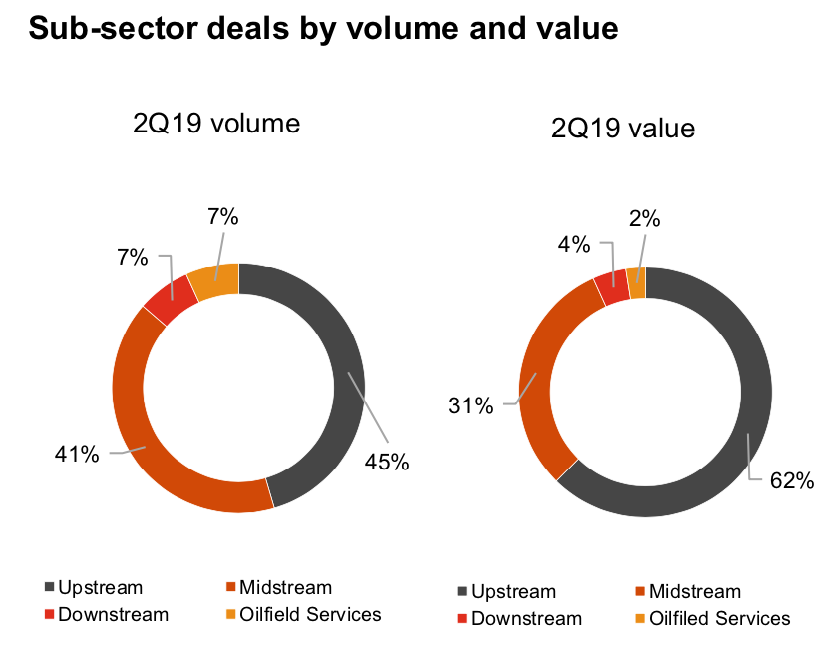

In the second quarter, PwC counted 44 energy deals totaling roughly $118.7 billion. Out of those, the firm noted three megadeals—a transaction worth over $5 billion—representing a total of $89.2 billion. Just two deals in the second quarter alone totaled $75 billion—the massive acquisition of Anadarko Petroleum Corp. by Occidental Petroleum Corp. and the private takeover of Buckeye Partners LP.

“We think [the Anadarko takeover is] a game-changer not only due to its size but also because of the scale it brings to the sector,” said Andy Robinson, a director of deals at PwC specializing in providing financial diligence to corporate and private equity clients.

Record-Breaking

The number of deals and their valuations in the energy industry rose in the second quarter. There were a record number of them—an increase of 13 deals or by 50%, which generated another $9 billion in value consisting of $6 billion from the upstream sector and $3 billion from the oilfield services industry.

The deal value over the past 12 months is “considerably higher” and a substantial improvement compared to June 2018, according to Robinson.

“This is a story of megadeals,” he said.

Upstream

The majority of second-quarter transactions were in the upstream sector, driven by Occidental’s Anadarko acquisition which represented the bulk of the quarter’s deal value.

Upstream assets are largely being acquired by strategic buyers who are dominating the market and now consist of 80% of the acquisitions. Strategic companies are now focusing their attention on improving return and more companies will turn to private capital or form joint ventures to fund new projects, Robinson said.

“This was becoming more prevalent in the second quarter,” he said.

Midstream

But financial buyers should not be overlooked since there is now a shift to deals in the midstream sector.

“Oil and gas companies in the midstream space have been struggling to return above the cost of capital, therefore financial buyers have the opportunity to come into this space,” Robinson said. “Given the current position we are seeing as shale oil and gas companies improve production, we are seeing continued demand in midstream assets.”

RELATED:

Midstream Investing Remains Robust Despite Drop In A&D Activity

The number of midstream deals in the second quarter grew significantly to 49 deals from 28 deals. The average midstream deal also increased in value to $1 billion from $600 million.

OFS

The number of deals in the oilfield services sector fell flat, although there was a $1 billion difference due to an increase in the average price that was offset by a slightly lower deal volume, Robinson said.

The sector’s largest transaction during the quarter was the combination of C&J Energy Services Inc. and Keane Group Inc. in an all-stock merger worth about $745.7 million. The transaction, expected to close in the fourth quarter, is set to create one of the largest completion services company with an anticipated $4.2 billion revenue.

During the past few years, the oilfield services sector chose to pay for deals with 100% cash, but now the sector has shifted to more stock to stock deals, plus some cash. This trend is likely to continue, Robinson said.

Shale

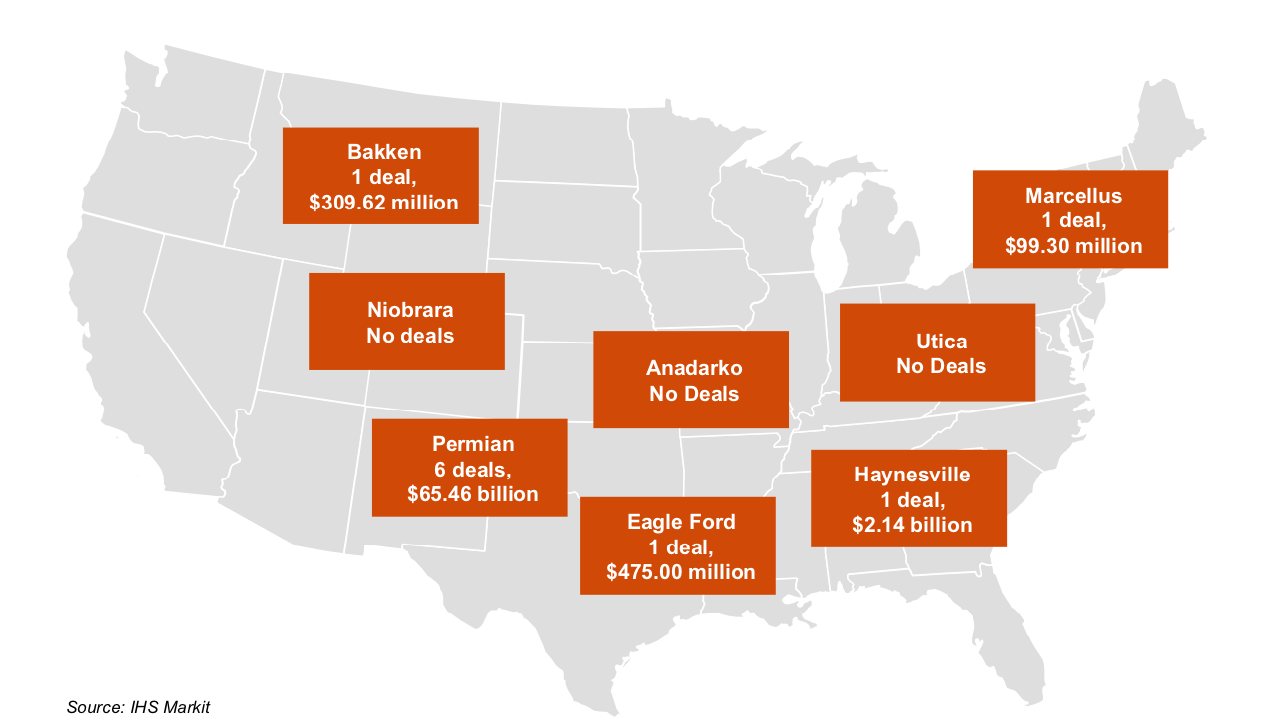

Shale deals regained momentum during the second quarter, with 17 upstream transactions averaging $5.1 billion for each deal.

The Permian Basin remained the most active basin with 12 deals. The remaining five deals were split evenly between the Eagle Ford, Bakken, Marcellus and Haynesville regions. The largest of the shale deals occurred in the Haynesville with Comstock Resources Inc.’s $ 2.1 billion acquisition of Covey Park Energy.

Offshore

While the Gulf of Mexico (GoM) still experienced M&A activity during the second quarter, compared to the previous quarter it was relatively quiet with a slight uptick, Robinson said.

Three deals in the GoM totaling $2.5 billion occurred during the second quarter.

Determining whether the offshore sector is poised for recovery is also challenging and will depend on whether stability in oil prices continue or if there is more volatility, Robinson said. The reason the existing players are buying companies is to consolidate and generate scale.

Look Ahead

Estimating whether the number of deals and the value of them will continue in the third and fourth quarters is not easy due to numerous macroeconomic factors, according to Robinson.

“It’s difficult to predict,” he said. “There is always uncertainty in oil and gas prices, interest rates, weather or cash flow consumption.”

The upstream sector has the potential for more deals since a “number of strategic companies have gone on record noting future divestitures, he continued. Financial buyers will remain prevalent in the midstream sector and there will always be transactions in the oilfield services sector.

“The big question will become ‘will we see deals with the magnitude that we have in the first and second quarter continuing like going forward,’” he said.

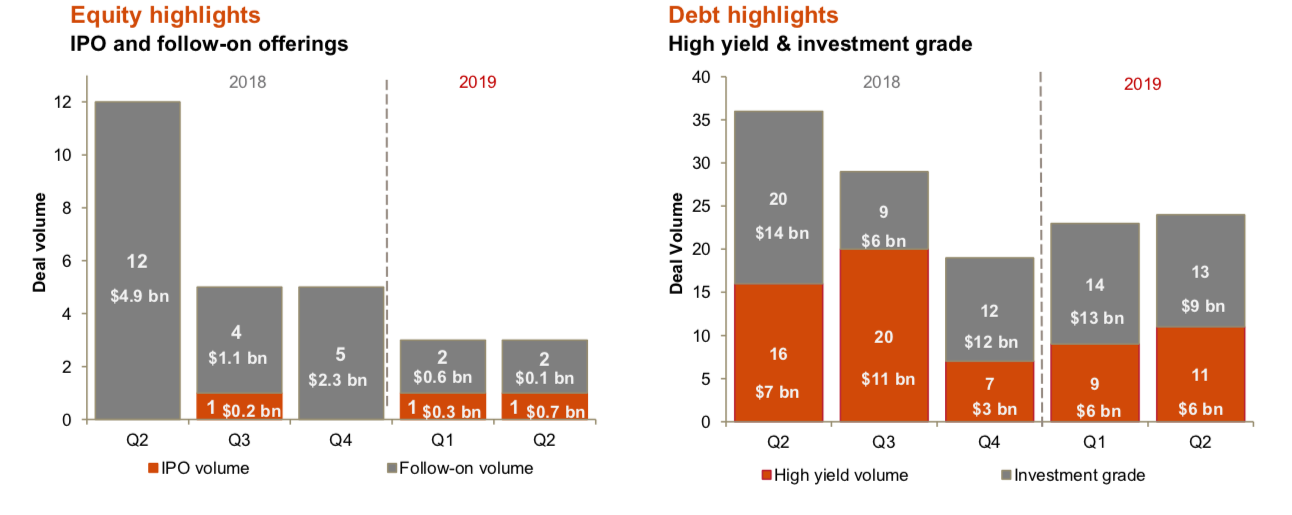

Tracy Hermann, a deals director for PwC based in Texas, said companies are reacting to the inability to access capital by “battening down the hatches.”

Private companies are focusing on maintaining capital efficiency and cutting costs “wherever they can and continue to ride out the downturn since 2014 to the second quarter of 2019,” Hermann said.

Companies are still looking to access capital markets and are utilizing this time period to fix internal processes and prepare to be a successful public company, he added.

West said more companies have turned to strategies involving joint ventures, partnerships, alliances or seeking non-traditional avenues for capital.

Recommended Reading

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.