Offshore wind developers continue to face headwinds, coping with cost inflation and rising interest rates like others in the energy business, but projects are moving forward according to executives leading some the biggest wind projects in U.S. water.

The push to develop offshore wind comes as the United States targets 30 gigawatts (GW) of offshore wind energy capacity by 2030. The clean energy source is considered key in lowering emissions to slow global warming.

So far, there are only two wind installations operating in federal waters off the U.S.—the 29-megawatt (MW) Block Island Wind Farm off Rhode Island and the 12-MW Coastal Virginia Offshore Wind pilot project. However, nearly 20 projects—mainly off the East Coast—have reached the permitting phase, according to the U.S. Department of Energy, and more could be on the horizon as developers move into deeper water aiming to jumpstart floating wind.

Here are updates on some U.S. offshore wind projects under development based on executive comments shared during recent earnings calls and news releases.

Coastal Virginia Offshore Wind, Virginia

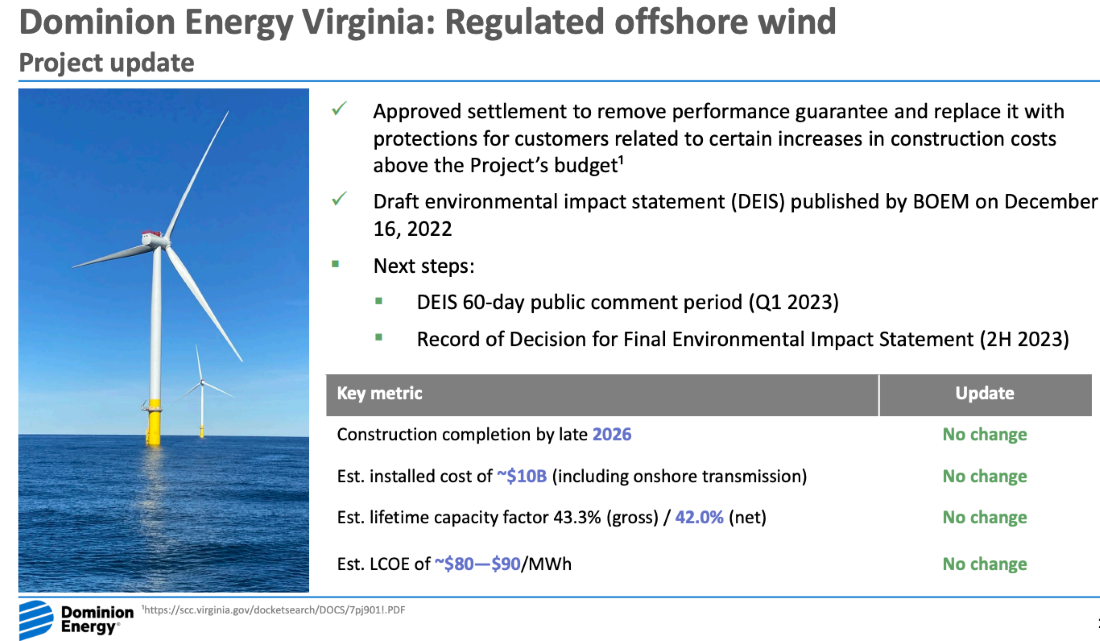

Developer: Dominion Energy

Planned capacity: 2.6 GW

4Q2022 Update: The $9.8 billion project remains “very much on track and on budget” as the company continues to work with the U.S. Bureau of Ocean Energy Management (BOEM) and other stakeholders, Dominion Energy CEO Bob Blue said Feb. 8 on the company’s fourth-quarter 2022 earnings call. The public comment period for the project’s draft Environmental Impact Statement (EIS) is set to close later in February with a record of decision expected by the end of October.

“Advanced engineering and design work, which has allowed us to release major equipment for fabrication in advanced procurement and other preconstruction activities for the onshore scope of work,” Blue said Feb. 8. “Project costs, excluding contingency, are currently 80% fixed, and we continue to expect about 90% of the project costs, excluding contingency, will be fixed by the end of the first quarter.”

The turbine installation vessel for the project, which will include 176 wind turbines towering some 800 feet tall, is about 65% complete. Dominion expects the vessel to be in service in time for the 2024 turbine installation season.

Project construction is on schedule for completion by year-end 2026, Blue said.

Once complete, the project is expected to generate enough energy to power up to 660,000 homes at peak, helping to displace up to 5 million metric tons of CO2 emissions annually, Coastal Virginia Offshore Wind said on its website.

Ocean Wind 1, New Jersey

Developer: Ørsted

Planned capacity: 1,100 MW

4Q2022 Update: Following its acquisition of Public Service Enterprise Group’s 25% equity stake in Ocean Wind 1, Ørsted said having complete ownership of the project could allow for a potential 50% farm-down.

“We strongly believe it is something that can help us create value. So, we don’t have any strategic concerns around partnerships in the U.S.,” CEO Mads Nipper said. “All of these dialogs are in very good spirit and also very constructive with our existing JV partners.”

Ørsted in 2022 completed a 50% farm-down on the 1.3-GW Hornsea 2 offshore wind project in the U.K. to the AXA IM Alts and Crédit Agricole Assurances consortium for GBP 3 billion (US$3.7 million).

Ørsted expects first power from Ocean Wind 1 by year-end 2024, with full commissioning in 2025

The Danish wind giant is also developing Ocean Wind 2 offshore New Jersey. Construction for on 1,148-MW project is scheduled to begin in 2028.

SouthCoast Wind (formerly Mayflower Wind), Massachusetts

Developers: Shell New Energies/Ocean Winds

Planned capacity: 1,200 MW

Update: BOEM on Feb. 13 made available the draft EIS for the proposed SouthCoast Wind project offshore Massachusetts. Notice of availability is expected to publish in the Federal Register on Feb. 17, opening a 45-day public comment that runs through April 3.

The project, which is designed to provide enough electricity to power more than 8,000 homes, will include up to 147 wind turbines and two export cable corridors—one with cables making landfall in Falmouth and the other in Somerset, Mass.

Public comment, including those gathered during virtual public meetings, will be used by BOEM to guide its preparation of the final EIS.

“In our review of offshore wind projects, we are committed to working collaboratively with our Tribal, state and local government partners, as well as using the best available science to avoid or minimize conflict with existing users and marine life,” BOEM Director Elizabeth Klein said.

Findings from the final EIS will factor into whether SouthCoast Wind’s construction and operation plan is approved and what mitigation efforts are needed.

The Shell New Energies U.S. and Ocean Winds North America joint venture announced the project’s name change on Feb. 1. The new name “better reflects the company’s commitment to the people, businesses and communities of the SouthCoast,” they said.

Developers aim to deliver energy from the project by the end of the 2020s.

Sunrise Wind, New York

Developers: Ørsted and Eversource

Planned capacity: 924 MW

4Q2022 Update: Mads Nipper, group president and CEO for Ørsted, said the offshore wind industry faced “unprecedented cost inflation and rapidly rising interest rates in 2022.” The Sunrise Wind project in development with Eversource has not escaped the trend.

“As previously disclosed, the project costs have increased substantially since we were awarded the bid, and in the past year, it has experienced further acute cost increases, specifically driven by the prices for installation vessels and the associated services,” Nipper told analysts on the company’s fourth-quarter earnings call.

The company announced on Jan. 20 a DKK 2.5 billion (US $360 million) impairment on Sunrise Wind, noting challenges associated with the project were partially offset by increased tax benefit expected from tax legislation.

“We will continue to work to mature and develop the projects with the aim to ensure that we can deliver renewable energy to the states with a satisfactory value creation,” Nipper said. “We continue to explore all the ways in which we can improve the project economics, and similarly, we will continue our constructive dialog with all relevant stakeholders and partners.”

Ørsted said it remains committed to the project and others in its U.S. offshore wind portfolio.

Being one of the later projects in the portfolio, Sunrise took a harder hit on transportation and installation costs, Ørsted CFO Daniel Lerup added.

The company doesn’t anticipate needing to impair more offshore wind projects going forward. “But as you know, this is of course, depending on, among other things, the development in the interest rates,” Lerup said.

Recommended Reading

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.