With E&P companies focusing on optimizing cost by direct-sourcing frac sand and the associated logistics using “next-gen” last-mile solutions, it is easy to forget where the industry was five years ago. In September 2014, only a few E&P pioneers were direct-sourcing sand, and the market share of next-gen last-mile solutions was in the single digits.

Over the past five years, a combination of factors has driven much higher volumes of sand being pumped downhole with current averages ranging from 7.9 MMlb per well in the Permian Basin to 8.4 MMlb per well in the Marcellus. The combination of higher proppant volumes and increases in daily pump hours strained legacy sand supply chains, requiring redesigned equipment and rewriting roles and processes to sustain a low-cost structure at a higher base load of throughput.

Pronghorn Energy Services encourages its E&P clients to view this critical component of their completion efforts as a “frac sand warehouse” that needs to be optimized from the well site to the mine origin to deliver the safest, most reliable and cost-effective ton of sand into the blender each day. To accomplish this, operators need to understand how their completion design drives the optimal wellsite and last-mile equipment as well as how it advantages different sand sources. Sand sourcing tends to be the easier aspect of de-bundling the sand supply chain for operators, thus this discussion will focus on equipment selection from both a logistics and wellsite operations perspective.

Analyzing wellsite throughput

The most important part of equipment selection that receives little, if any, focus is segregating each equipment type’s ability to handle a given operator’s average daily wellsite throughput requirement from its peak demand throughput. The throughput capabilities for each equipment type are driven by two primary factors: unload cycle time and last-mile payload. Wellsite equipment types are categorized into three different types: pneumatic-trailer silos systems or sand kings, belly dump trailer-oriented silo systems and container-focused systems.

Unload cycle time is the time a single truck spends on location, which includes getting into position to unload, unloading and departing the unload area. Generally, container systems are capable of the lowest unload cycle time; however, customized belly dump trailers have closed the gap leaving pneumatic focused systems far behind these other two methods of delivery.

Payload capacity is the net weight of the sand being transported in a single truckload to the well site and is influenced by local road weight regulations. Belly dump systems are generally capable of the highest payload capacity while some, but not all, containerized systems on the market have the lowest payload capacity of marketed equipment options.

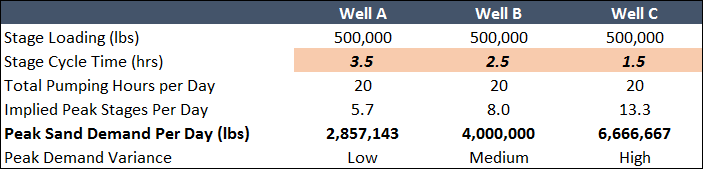

Peak demand is essentially how a “great day” of frac efficiency pressures the supply chain by requiring a surge in sand deliveries to the well site. An average day of throughput is an important consideration when evaluating equipment, but it is just as critical to know if certain systems can handle the additional volumes required by peak demand without becoming constrained and leading to sand nonproductive time (NPT). Figure 1 shows the impact of peak demand in a 24-hour period when stage cycle times are reduced, as is often the case in the back half of a completion.

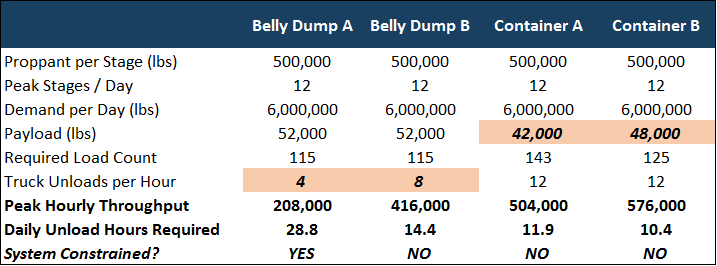

When considering the impact of equipment options on both throughput and peak demand, one must be cautious generalizing performance across different systems within a certain type and service providers. This is illustrated in Figure 2 where Pronghorn Energy Services keeps constant key variables in the comparison between two belly dump systems and two container systems with the exception of unloading cycle time for belly dumps and payload for containers.

Unload cycle time and payload are key points of differentiation among different belly dump and container systems and are driven by service quality and equipment design. Variances in these drivers materially affect peak hourly throughput for the belly dump example and daily load count for containers. Constrained systems will bloat cost as a result of NPT or unnecessary additional deliveries.

Finally, the most difficult component of a last-mile provider’s scope of work is flexing resources for peak demand in a way that prevents the over-resourcing and underutilization of assets during periods of regular demand. When a frac crew ramps up from average stages per day to peak stages per day, the regular cadence of deliveries will fall behind as sand is consumed on location faster than it is replaced. Completion programs that experience major surges in demand require wellsite equipment with quicker off-load cycle times than those programs with a lower ceiling of potential sand pumped in a day.

Considering storage on location

The quantity and type of storage on location is driven by two major challenges: product types and disruption probability. Clients that pump three or more types of proppant products are typically best suited to utilize containerized systems. The modular nature of the container equipment is well suited to balance different wellsite inventory levels without materially impacting wellsite storage potential, which can be a problem with silos that become underutilized when dedicated to an ancillary proppant type. In situations where road outages or terminal/ mine disruptions are a concern, operators are recommended to keep more hours of sand on location, which, without pad restrictions, advantages silo systems.

Evaluating payload

Most equipment payload capacities are advertised reflecting the 80,000-lb gross vehicle weights limitations of interstate highways coupled with day cab trucks and lightweight trailers. Both assumptions often fail to take into account the realities of oilfield operations such as managing legal driver hours in a day cab-only fleet or the durability shortcomings of lightweight trailers continuously subjected to traveling over rutted lease roads. Should a divergence materialize between the advertised payload and the actual payload, it will lead to a material departure between expected savings and realized savings. In many states, the use of overweight permits and/or overweight registrations allows notable increases in the payload. Even in areas with less friendly gross vehicle restrictions such as Texas, designing the sand origin to avoid interstate highways and selecting providers that have the equipment, driver base and trailer resources that can execute overweight permits can reduce truckloads by 10%.

Contemplating other factors

There are additional factors to consider when evaluating equipment that are more subjective in nature. It is important to understand the reliability of the equipment (especially at single points of failure). The importance of HSE performance, particularly regarding silica dust, weather impacts and backing of trucks on location, can’t be overstated, and limited pad sizes can affect equipment options.

Comparing landed cost

After evaluating the items previously discussed, it then comes down to an evaluation of total landed cost for each ton of sand into the back of the blender.

Pronghorn Energy Services believes it is imperative to evaluate not only the sticker price of different options but also to look deeper into potential cost creep driven by equipment failures, truck resource instability and payload underfilling that can wash away projected savings. The frac sand warehouse is not a one-size-fits-all model, and each operator needs to design this critical supply chain across the value chain to optimize for the unique realities of its program.

Have a story idea for Shale Solutions? This feature highlights technologies and techniques that are helping shale players overcome their operating challenges. Submit your story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

enCore Energy Appoints Robert Willette as Chief Legal Officer

2024-02-01 - enCore Energy’s new chief legal officer Robert Willette has over 29 years of corporate legal experience.