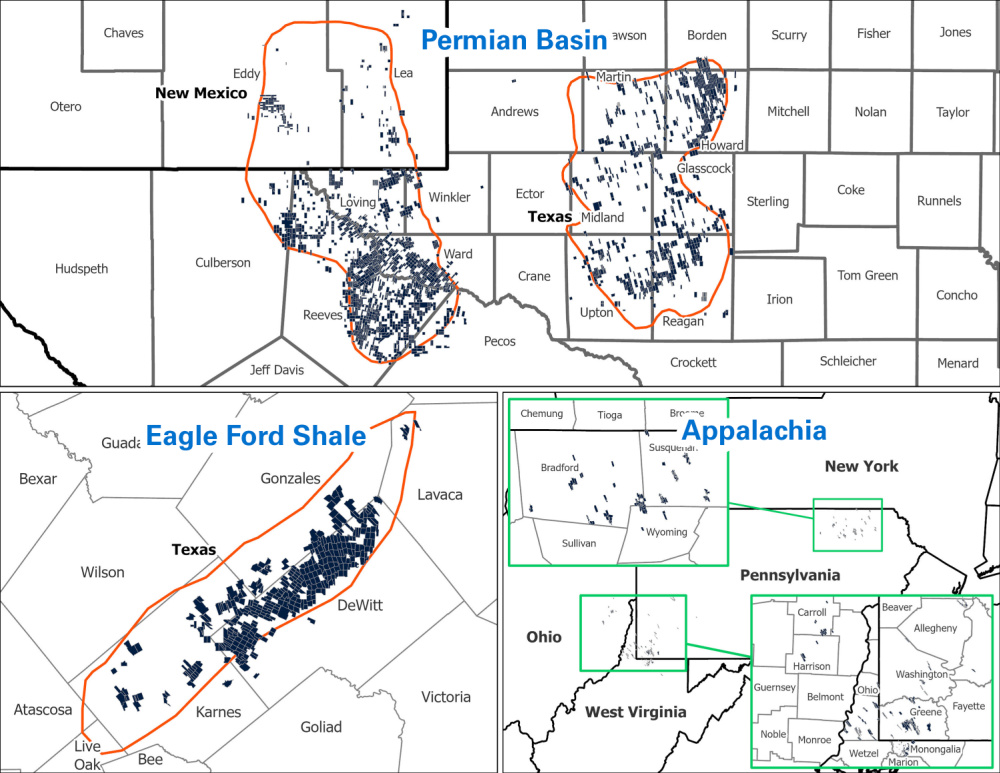

Sitio Resources owns over 140,000 net royalty acres, normalized to a 1/8th royalty equivalent, over 105,000 of which are located in the Permian Basin. (Source: Hart Energy, Sitio Resources, Shutterstock.com)

Desert Peak Minerals and Falcon Minerals Corp. completed their merger on June 7, creating Sitio Royalties Corp.

“Sitio is guided by its commitments to best-in-class leadership and governance standards, capital discipline and a thoughtful approach to value-maximizing M&A,” commented Chris Conoscenti, CEO of Sitio who previously served as CEO of Desert Peak.

Desert Peak and Falcon Minerals had announced the merger agreement earlier this year to combine in an all-stock transaction. At the time of the announcement in January, the combined company was expected to have a significant Permian and Eagle Ford footprint and an enterprise value of $1.9 billion.

The deal also marked the next chapter for Falcon, which formed in 2018 through an $800 million combination involving its predecessor—a blank-check company—and Blackstone’s royalty business.

As part of the merger agreement between Desert Peak and Falcon, Desert Peak became a subsidiary of Falcon’s operating partnership (OpCo). Then, on June 3, Falcon effected a four-to-one reverse stock split of Falcon’s Class A common stock and Class C common stock and formally rebranded as Sitio Royalties Corp.

Desert Peak’s equity holders received about 61.9 million shares of Sitio’s Class C common stock and a corresponding number of common units representing limited partner interests in the OpCo.

As previously announced, Sitio is managed by the Desert Peak team and led by Conoscenti.

Desert Peak—the largest independent Permian Basin pure-play mineral and royalty company—was founded by private investment firm Kimmeridge Energy Management Co. LLC. The company accumulated its 105,000 net-royalty-acre position in the Permian Basin through the consummation of over 175 acquisitions to date, according to a release in January.

With its history of completing large, accretive acquisitions in the Permian Basin, Conoscenti said Sitio will remain focused on large-scale consolidation of high-quality oil and gas mineral and royalty interests across diversified operators.

“Sitio’s distinguished profile as a leading consolidator in the minerals and royalties space will only continue to strengthen over time with the execution of our proven strategy, focusing on large-scale accretive acquisitions across diversified operators,” he said.

Noam Lockshin, a partner at Kimmeridge, Sitio’s largest equity holder, will now serve as the new company’s chairman of the board of directors.

“In line with Kimmeridge’s operating philosophy, Sitio has already adopted a best-in-class governance model that is structured to drive long-term shareholder returns and strong alignment with all its stakeholders,” Lockshin added in the release on June 7.

Sitio Resources owns over 140,000 net royalty acres, normalized to a 1/8th royalty equivalent, over 105,000 of which are located in the Permian Basin. The company is projected to produce approximately 13,500-14,500 boe/d in first-half 2022 on a combined basis.

Additionally, the company will have approximately 20 net wells normalized to a 5,000 ft basis that have either been spud or permitted. The inventory of line of sight wells provides visibility into attractive organic production over the next 12 months, an earlier company release said.

The Sitio board comprises seven members with strong independence, diversity and deep expertise across energy, finance and governance. In addition to Lockshin, other Sitio board members include Conoscenti, Morris R. Clark, Alice E. Gould, Allen W. Li, Claire R. Harvey and Steven R. Jones.

”When leadership and directors are incentivized to drive outperformance and to optimize shareholder returns, as they are at Sitio, everyone wins,” Lockshin said. ”We believe this is the backbone of any successful public company, and Sitio is leading the way in this space.”

Sitio’s Class A common stock and warrants will initially continue trading on NASDAQ under the ticker symbols “STR” and “STRDW.”

In connection with the closing of the merger, Sitio entered into a new credit facility with a $300 million borrowing base, according to the release.

Recommended Reading

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

TC Energy, Partner Sell Portland NatGas Transmission System for $1.14B

2024-03-04 - Analysts expect TC Energy to make more divestitures as the Canadian infrastructure company looks to divest roughly $2.21 billion in assets in 2024 and lower debt.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Tallgrass Energy Announces Latest Open Season for Pony Express Pipeline

2024-03-12 - Prospective shippers can review details of the open season, which began March 11, after signing a confidentiality agreement with Tallgrass.