The purchase of the Big Sand Draw and Beaver Creek oil fields from Devon, expected to close first-quarter 2021, includes associated surface facilities and the 46-mile CO₂ transportation pipeline. (Source: Stephen Collector/Hart Energy)

Denbury Inc. entered an agreement on Dec. 29 to acquire a pair of CO₂ EOR fields in Wyoming from a subsidiary of Devon Energy Corp., boosting the Plano, Texas-based company’s low-carbon footprint in the Rocky Mountain region.

As part of the agreement, Denbury will pay the Devon subsidiary up to $20 million in cash for a nearly 100% working interest (approximately 83% net revenue interest) in the Big Sand Draw and Beaver Creek oil fields located in Wyoming’s Freemont County. Net production from the acquired fields was about 2,800 boe/d for third-quarter 2020, of which roughly 85% was oil production.

Denbury described the acquisition in a Dec. 29 company release as a bolt-on in a key operating area that supports its CO₂ EOR-focused strategy, which the independent oil and natural gas company adopted after completing a financial restructuring and emerging from bankruptcy in September.

“Big Sand Draw and Beaver Creek are exciting additions to Denbury’s Rocky Mountain region footprint, and we believe they are an ideal operational fit for Denbury’s differentiated CO₂ EOR-focused strategy,” Chris Kendall, the company’s president and CEO, said in a statement.

In July 2020, Denbury—whose CO₂ EOR-focused operations are based in the Rocky Mountains and Gulf Coast—joined a growing wave of E&P companies to voluntarily file for Chapter 11 bankruptcy protection this year following the oil market crash caused by the coronavirus and a Saudi-Russia price war. When the company filed for bankruptcy in late July, Denbury was the fifth largest oil and gas producer to seek bankruptcy protection so far in 2020.

Through the “pre-packaged” plan under its restructuring support agreement completed on Sept. 18, Denbury said it restructured its balance sheet and eliminated $2.1 billion of bond debt. The company also entered into a reserve-based revolving credit facility with a $100 million commitment amount and an initial borrowing base of $575 million upon emergence from bankruptcy.

The purchase price of the Wyoming CO₂ EOR fields includes a $12 million cash payment to Devon plus two cash payments of $4 million each contingent on the price of WTI. The first continent cash payment will be payable if WTI oil prices average at least $50/bbl in 2021 and the second one will be payable if WTI averages at least $50/bbl in 2022.

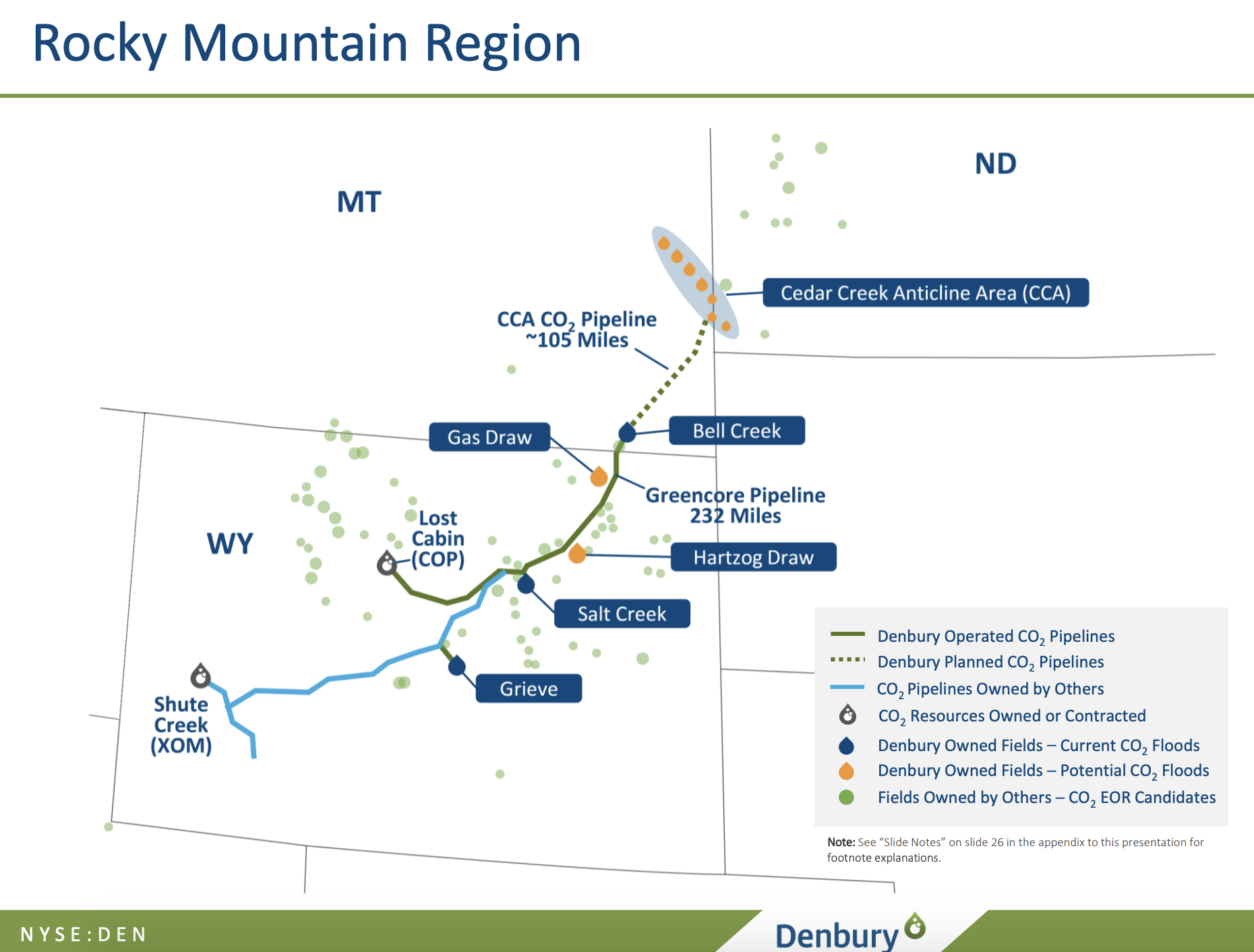

The Big Sand Draw oil field was discovered in 1918 and the CO₂ flood was initiated in 2014. The Beaver Creek oil field was discovered in 1938 and the CO₂ flood was initiated in 2008. The CO₂ used to flood both fields is supplied from Exxon Mobil Corp.’s Shute Creek gas processing plant in southwestern Wyoming, where Denbury owns a one-third overriding royalty interest in all captured CO₂.

The purchase of the fields from Devon, expected to close first-quarter 2021, includes associated surface facilities and the 46-mile CO₂ transportation pipeline to the acquired fields.

“Importantly, by utilizing 100% industrial sourced CO₂, these fields will increase Denbury’s use of industrial sourced CO₂ by nearly 400,000 tons annually, further enhancing the low-carbon footprint of Denbury’s oil production,” Kendall said in his statement.

Based on oil and natural gas futures strip prices from Dec. 1, net proved reserves for the acquired fields, which are 93% oil, are estimated at approximately 13.7 MMboe, including 5.5 MMboe of proved undeveloped reserves which the company estimates can be developed for less than $5 per boe.

”We look forward to applying Denbury’s industry-leading EOR expertise to these fields, which hold meaningful potential for optimization and future development,” Kendall added.

Recommended Reading

Permian Resources Continues Buying Spree in New Mexico

2024-01-30 - Permian Resources acquired two properties in New Mexico for approximately $175 million.

Marketed: Williston, Powder River Basins 247 Well Package

2024-03-11 - A private seller has retained EnergyNet for the sale of a Williston and Powder River basins 247 well package in Sheridan, Montana, Burke and McKenzie counties, North Dakota and Campbell County, Wyoming.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Benchmark Buys Revolution Resources’ Anadarko Assets in $145MM Deal

2024-02-20 - Benchmark Energy II is acquiring Revolution Resources just over four years after Revolution bought out Jones Energy Inc.’s Midcontinent portfolio.

Marketed: Rock Oil Holdings Mineral, Royalty Opportunity in Midland Basin

2024-04-09 - Rock Oil Holdings has retained PetroDivest Advisors for the sale of a mineral and royalty opportunity in Howard County, Midland Basin.