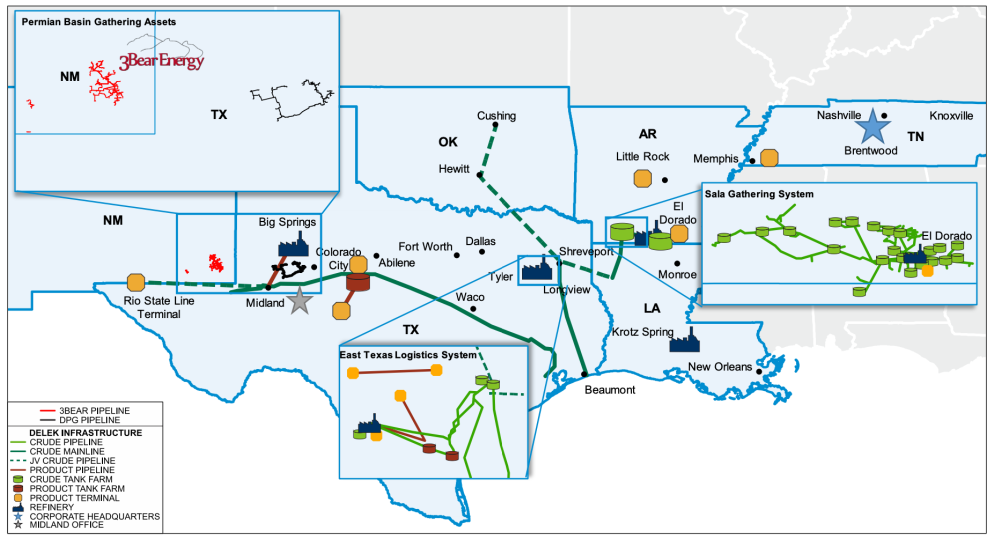

The 3Bear Energy transaction marks Delek Logistics’ entry into the Delaware Basin and includes 3Bear’s crude, gas and water gathering, processing and disposal business. (Source: 3Bear Energy LLC)

Delek Logistics Partners LP agreed on April 11 to acquire 3Bear Energy LLC for $624.7 million in cash, increasing Delek Logistics’ position in the Permian Basin.

“We are witnessing significant growth in our existing Permian Gathering system,” Uzi Yemin, chairman, president and CEO of Delek Logistics general partner, commented in a company release.

Headquartered in Brentwood, Tenn., Delek Logistics Partners was formed by Delek US Holdings Inc. to own, operate, acquire and construct crude oil and refined products logistics and marketing assets.

In 2020, Delek US agreed to the dropdown of the Big Spring gathering system to Delek Logistics for total consideration of $100 million in cash and 5 million common units representing LP interest in Delek Logistics. The system, now known as Permian Gathering, comprises of a 200-mile crude oil gathering system located in the Midland Basin, has seen its average daily volumes jump due to a recent pick-up in Permian drilling activity, according to Yemin.

From the fourth-quarter 2021 to first-quarter 2022, average daily volumes on Delek Logistics’ Permian Gathering system have increased from 83,000 bbl/d to approximately 135,000 bbl/d.

“This level of growth and demand from producers provides us with confidence to move forward with this transaction,” Yemin added.

The 3Bear transaction announced on April 11 includes the acquisition by Delek Logistics of 100% membership interests 3Bear Delaware Holding – NM, LLC, an indirect subsidiary of 3Bear Energy, related to 3Bear’s crude oil and gas gathering, processing and transportation businesses, as well as water disposal and recycling operations in the Delaware Basin in New Mexico.

The transaction marks Delek Logistics’ entry into the Delaware Basin.

“The 3Bear management team has developed strong producer relationships and a world-class asset base in the heart of the Delaware Basin,” Yemin commented. “We are excited to expand our operations in one of the most prolific oil and gas producing basins, providing long-term growth that is highly complementary to Delek Logistics' current asset footprint.”

The acquisition of 3Bear Energy is expected to enhance Delek Logistics’ third-party revenue and further diversify its customer and product mix as well as bolsters ESG optionality through carbon capture opportunities and GHG reduction projects currently underway, according to the company release.

The 3Bear crude, gas and water gathering, processing and disposal business in the northern Delaware Basin includes approximately 485 miles of pipelines, 88 MMcf/d of cryogenic natural gas processing capacity, 120,000 bbl of crude storage capacity and 200,000 bbl/d of water disposal capacity. The 3Bear assets are anchored by roughly 350,000 dedicated acres and long-term fixed fee contracts.

Delek Logistics plans to fund the 3Bear transaction primarily with existing credit facilities and debt financing.

The transaction is expected to be completed around mid-year 2022, subject to customary regulatory approvals.

RBC Capital Markets is serving as financial adviser and Baker Botts is serving as legal adviser to Delek Logistics on the transaction. Tudor, Pickering, Holt & Co. is serving as financial adviser and Vinson & Elkins is serving as legal advisor to 3Bear on the transaction.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.