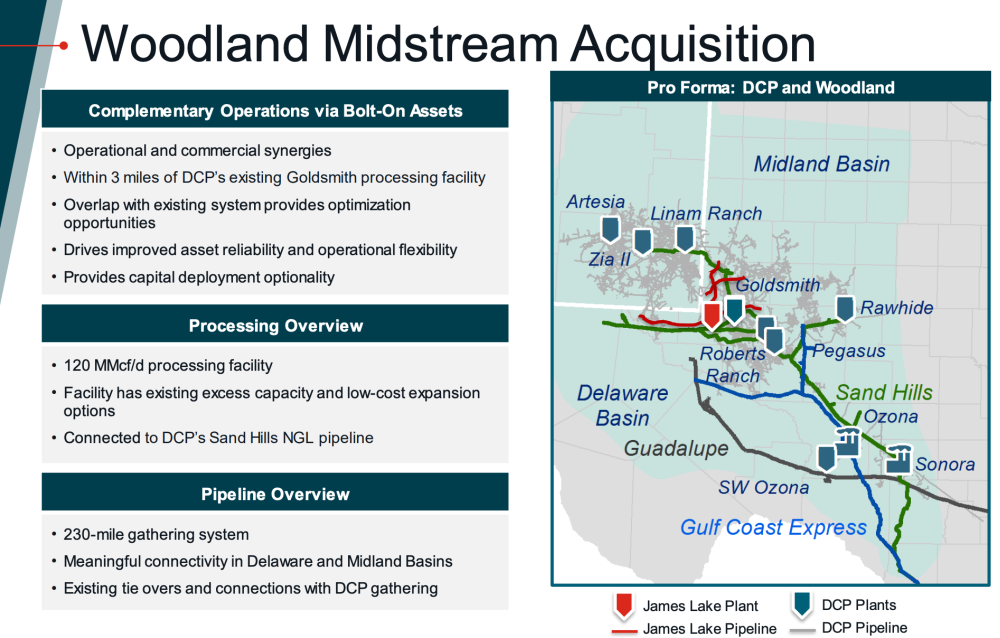

The James Lake System, located within three miles of DCP’s Goldsmith processing facility in the Permian Basin, includes about 230 miles of gathering pipe and a 120 MMcf/d cryogenic processing facility. (Source: Hart Energy)

DCP Midstream LP recently agreed to acquire Woodland Midstream gathering and processing assets in the Permian Basin in a bolt-on transaction valued at $160 million.

“We are very pleased to announce the agreement to expand our Permian gathering and processing business with assets that have connectivity to DCP’s existing infrastructure and fit our long-term strategy of securing incremental volumes for our downstream assets,” Wouter van Kempen, chairman, president and CEO of DCP Midstream, commented in a company release.

As part of a definitive agreement announced June 14, DCP Midstream will acquire the James Lake System from Woodland Midstream II, a portfolio company of EIV Capital. DCP expects to fund the bolt-on acquisition using cash on hand and borrowings under the company’s existing bank facilities.

The James Lake System is located within three miles of DCP’s Goldsmith processing facility in the Permian Basin, creating the opportunity for significant synergies and reducing the acquisition multiple over time, according to the company’s release.

“After our record first quarter performance and recent investment grade rating, we consider this an exciting next step in strengthening our operating model, creating additional value for our stakeholders and driving improved reliability for our customers,” van Kempen added in the release.

DCP said the bolt-on acquisition of the James Lake System is an immediately accretive transaction representing a roughly 5.5 times EBITDA multiple.

The James Lake System includes about 230 miles of gathering pipe and a 120 MMcf/d cryogenic processing facility, increasing DCP’s capacity and providing significant synergies with the company’s Goldsmith processing facility in Ector County, Texas.

Previously, Woodland Midstream II had acquired the James Lake System from a privately-owned seller for an undisclosed amount in October 2019. The transaction represented Woodland’s first operating asset since forming its partnership with EIV Capital in February 2019, which included a substantial capital commitment from EIV Capital.

The James Lake System serves producers within the Permian’s Central Basin Platform in Ector, Andrews and Winkler counties, Texas.

As part of the Woodland transaction, DCP said it also secures approximately 250,000 dedicated acres. Additionally, James Lake System cash flows are underpinned by primarily fee-based, long-term contracts with a diverse group of independent operators and investment grade public companies.

The transaction is expected to be completed in the third quarter.

Holland & Hart LLP provided legal counsel to DCP during the transaction. Intrepid Partners, LLC is financial adviser and McDermott Will & Emery LLP is legal advisor to Woodland Midstream II in connection with the transaction.

Recommended Reading

Scout Signs Agreement with AdventHealth for Texas Wind Farm

2024-02-01 - Scout Clean Energy will supply a portion of its Heart of Texas wind farm to support 40% of AdventHealth’s electricity needs.

RIC Energy Sells 20 MW of Solar Plants to Luminace

2024-03-04 - RIC Energy says the facilities are expected to provide 100% clean energy to more than 5,000 homes participating in the utilities’ community solar programs.

CERAWeek: NextEra CEO: Growing Power Demand Opportunity for Renewables

2024-03-19 - Natural gas still has a role to play, according to NextEra Energy CEO John Ketchum.

Energy Transition in Motion (Week of Feb. 2, 2024)

2024-02-02 - Here is a look at some of this week’s renewable energy news, including a utility’s plans to add 3.6 gigawatts of new solar and wind facilities by 2030.

Energy Transition in Motion (Week of Feb. 16, 2024)

2024-02-16 - Here is a look at some of this week’s renewable energy news, including the outlook for solar and battery storage in the U.S.