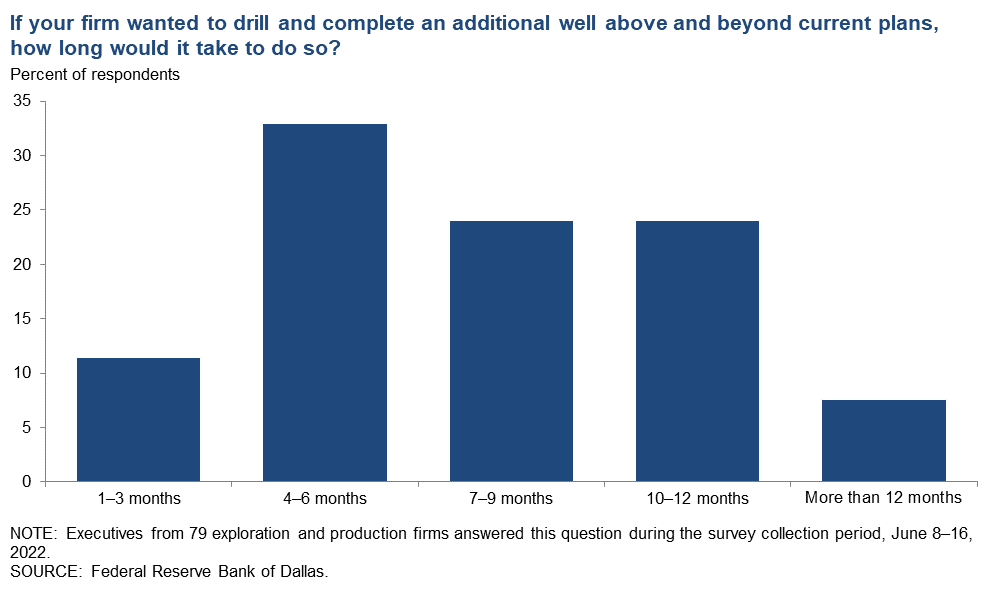

In the Permian Basin, the country’s most active play, the “supply chain seems stretched to the max,” an oilfield services executive said. E&Ps executives added that it would take months or even a year to drill and complete an additional well above and beyond their plans. (Source: Hart Energy)

U.S. E&Ps and oilfield service companies are mired in shortages of equipment and labor.

Executives said they would need months to drill a single new, unplanned well and many believe the health of the economy is deteriorating, according to the June 23 Dallas Fed Energy Survey.

Doubt continues to plague the space.

“The highest uncertainties are no longer below ground (ultimate recoveries, initial production rates, gas–oil ratios, operating expenses), as we’ve gotten very good at forecasting, estimating, and predicting those,” an E&P executive told the Dallas Fed.

Rather, the highest uncertainties are above ground: politics, windfall profits tax, surtaxes, leasing bans, product prices, inflation, supply times, material availabilities, contractor availabilities and capital availability.

“

We will shortly be ceasing investment in any new operations owing to the combination of rising costs, supply-chain slowness and our view that a recession is coming that will drop oil and natural gas prices significantly.”—E&P executive, June 23 Dallas Fed Energy Survey

“We have an expansion project and another new project in West Texas but are stymied by rig availability, electrical submersible pump and other motor availabilities, driller availability and casing and tubing availabilities,” the executive said. “By the time we get our first well producing in our new project, we’ll probably miss the higher oil prices.”

Many blamed President Joe Biden’s energy policies, an ambiguous regulatory environment and favoritism for solar and wind power. Also to blame: a flight of investors and lack of qualified labor.

While respondents said they expect WTI prices to average $108/bbl by the end of the year, those surveyed offered a wide range of prices. These ranged from as little as $65/bbl to as high as $160/bbl. As for natural gas prices, survey participants said they expected Henry Hub prices of $7.55 per MMBtu at year’s end.

During the survey period, WTI spot prices averaged $119.56/bbl, and Henry Hub spot prices averaged $8.38 per MMBtu, according to the Dallas Fed.

What do you expect the WTI crude oil price to be at the end of 2022? |

|

| Dollars per barrel | Percent reporting |

| <$90 | 12% |

| $90.00-$99.99 | 13% |

| $100.00-$109.99 | 30% |

| $110.00-$119.99 | 13% |

| $120.00-$129.99 | 17% |

| $130.00-$139.99 | 7% |

| >$140 | 8% |

Supply-chain Effects

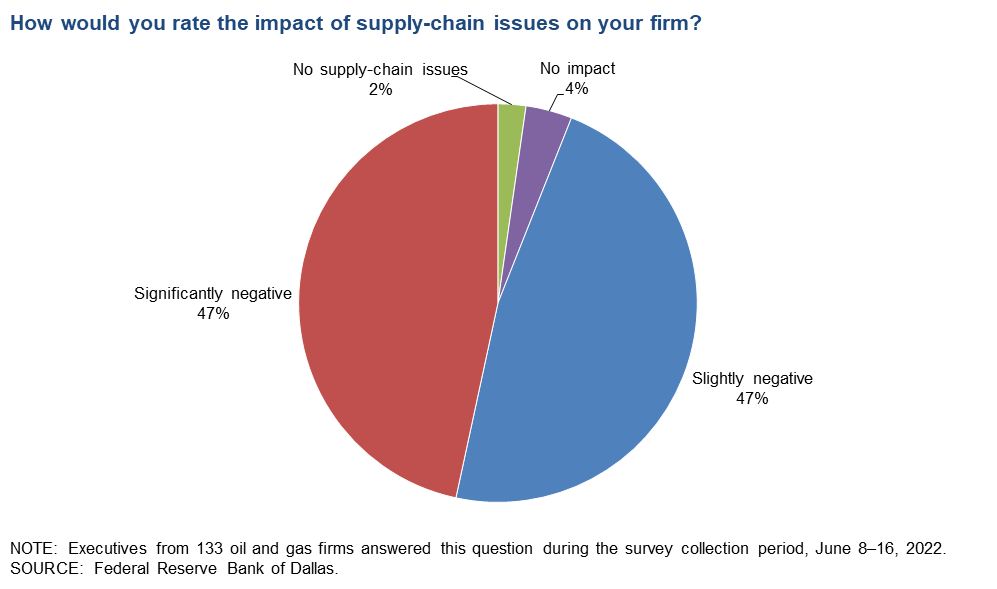

For the June survey, the Dallas Fed asked firms about the impact of supply-chain issues, uncertainties about firms’ outlooks, and the time needed to drill and complete a well. Data was collected from June 8-16. A total of 137 energy firms responded—85 from E&Ps and 52 from oilfield service companies.

Asked about supply-chain effects, only 2% of executives said they hadn’t experienced supply chain problems. Most—94%—reported that supply chain problems had slightly to significantly impacted their firms.

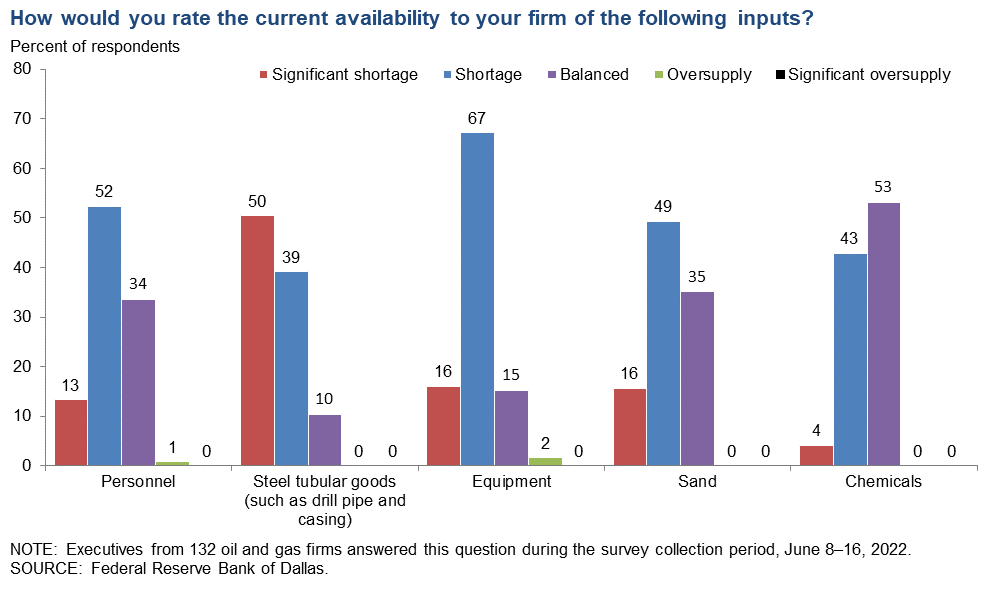

Most executives, about 66%, said it will take more than a year to resolve logistical challenges. Half of respondents cited significant shortages of steel tubular goods such as drill pipe and casing with another 39% reporting some shortages. Firms also reported shortages in personnel, equipment and sand.

“We are experiencing significant delays in obtaining materials and services and costs are substantially increasing,” an E&P executive told the Dallas Fed. “We will shortly be ceasing investment in any new operations owing to the combination of rising costs, supply-chain slowness and our view that a recession is coming that will drop oil and natural gas prices significantly.”

Oilfield service companies had a similar outlook. One firm said that local and global supply chains snafus continue to hamper business.

“The industry is in the position to expand; however, supply-chain issues and employee-hiring issues will dampen the overall ability to expand,” the executive said.

“It may take weeks to get the simplest things done. Experienced employees left the oilfield, and our government is telling us they are not needed or wanted because we are transitioning to clean energy and oil and gas are no longer needed.”—E&P executive, June 23 Dallas Fed Energy Survey

In the Permian Basin, the country’s most active play, the “supply chain seems stretched to the max,” an oilfield services executive said. “There really is not much ability to increase drilling activity.”

Labor shortages, cost inflation and supply-chain bottlenecks are taking their toll on how companies plan, with 46% of respondents saying those factors were driving uncertainty for the firm’s outlook. E&Ps executives said it would take months or even a year to drill and complete an additional well above and beyond their plans. Many said a scarcity of qualified workers was a large factor.

One E&P executive said inflation from oilfield services companies and equipment has far outstripped the 8.5% inflation seen in other areas of the economy. And the quality of the work is “horrible.”

“It may take weeks to get the simplest things done. Experienced employees left the oilfield, and our government is telling us they are not needed or wanted because we are transitioning to clean energy and oil and gas are no longer needed,” the executive said.

Another also cited the availability of qualified personnel.

“The labor shortage is the biggest factor affecting services,” they said. “There is no labor to man the equipment that is available. Work ethic has been destroyed by government handouts. We will not see a huge drilling upturn due to a lack of labor and staff.”

Another E&P executive even cited a paucity of truck drivers that will “impact all components of the supply chain and result in decreased production growth and less finished fuels.”

An oilfield services executive added that labor is affecting every facet of its business.

“Supplier factories in Ohio are short-staffed and underutilized,” the executive said. “There is a significant shortage of technical labor to support oil and gas operations in the field. Seemingly all business activity in West Texas is at capacity, and there is limited room for further growth.”

Who’s to Blame?

Most E&P and oilfield service executives said their industry is also being hampered by regulations and vilified by the White House.

“Our industry is praying for a shift in the mid-term elections so we can prevent the administration [in Washington] from destroying our economy any further,” an E&P executive said, echoing many others. “I love high oil and natural gas prices, but they are really hurting the economy, and citizens are paying the price.”

“Private investors like endowments and foundations are structurally gone for good, and it is actually different this time. ... The administration may be getting blamed, but it is the investors’ fault.”—E&P executive, June 23 Dallas Fed Energy Survey

Another said the federal government's “anti-oil, anti-gas and anti-pipeline stance has caused us to not pursue expansive projects.”

One E&P executive, however, placed more blame on investors.

“Private investors like endowments and foundations are structurally gone for good, and it is actually different this time,” the executive said.

The executive said that pension plans are also hesitant to commit capital despite high prices while public equity investors are still demanding too much. The lack of investors has caused firms to go public via a special purpose acquisition company reverse-merger transactions, “indicating the discount demanded by traditional initial public offering investors is too high to stomach.”

“The administration may be getting blamed, but it is the investors’ fault,” they reiterated.

Recommended Reading

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.