IOG Resources LLC acquired producing oil and gas assets in the Delaware Basin in the Permian from Tier 1 Merced Holdings LLC.

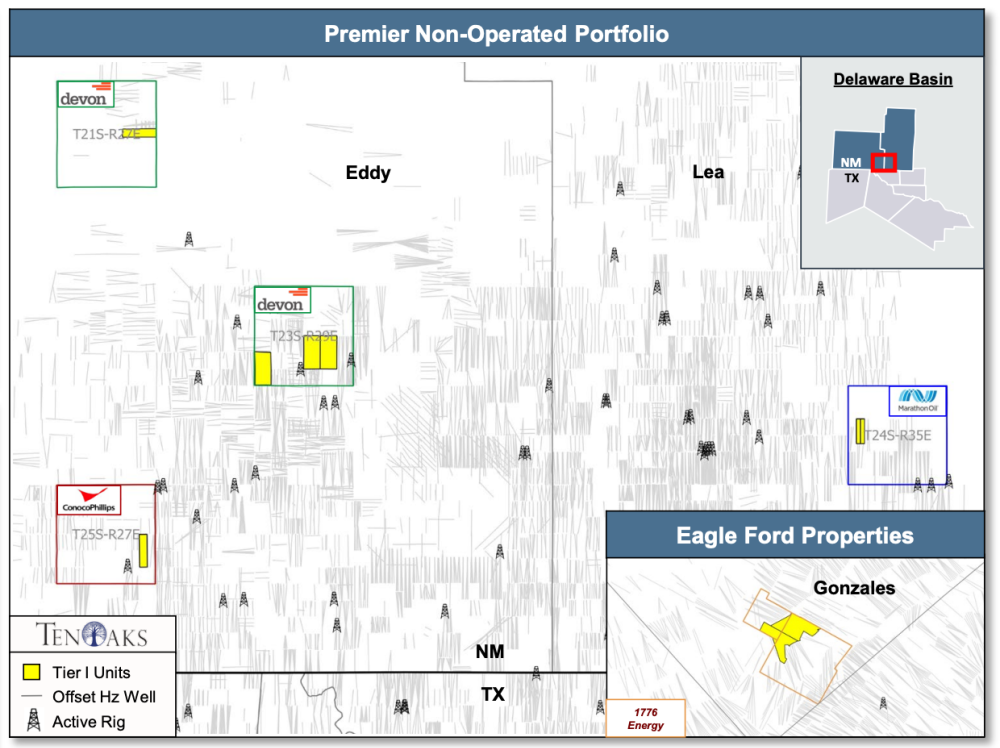

The assets consist of nonoperated wellbores primarily located in New Mexico’s Eddy and Lea counties. TenOaks Energy Advisors had been retained in December by Tier 1 Merced Holdings to market the assets, plus additional properties in the Eagle Ford, for a potential sale.

“With this acquisition, IOGR adds net production of approximately 3,800 boe/d under top-tier operators including Devon, Conoco and Marathon,” IOG Resources said in a company release on March 3.

IOG Resources is a Dallas, Texas-based energy investment platform sponsored by First Reserve. The company was established in 2017 and invests in diversified upstream oil and gas assets as a nonoperated working interest partner.

“Following the transaction, the IOGR portfolio includes 12 discrete investments across six core basins in the U.S.,” IOG Resources said.

Terms of the transaction with Tier 1 Merced Holdings was not disclosed. In conjunction with the transaction, IOG Resources said it also successfully closed a new, upsized revolving credit facility.

Kirkland & Ellis LLP acted as legal counsel for IOG Resources on the transaction. Tier 1 was advised on the sale process by TenOaks Energy Advisors and Holland & Hart LLP acted as legal counsel.

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.