(Source: Shutterstock)

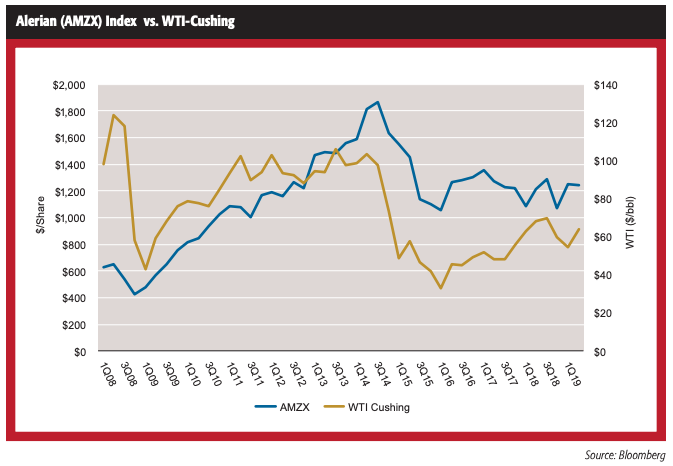

During the past 10 years, the midstream-heavy Alerian MLP Index Trust (AMZX) has traded within a tight correlation with WTI, implying midstream-sector performance dips when prices dip and rises when prices experience uplift.

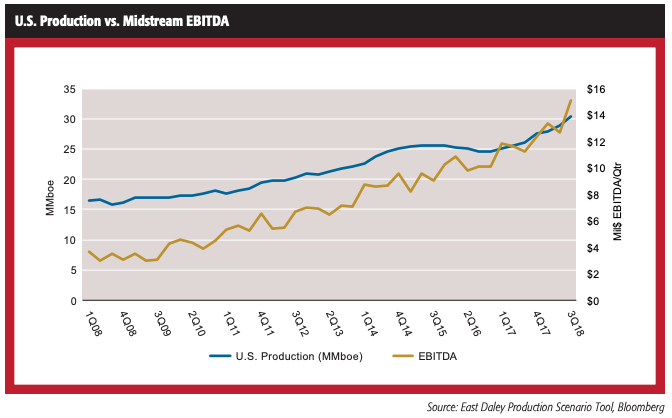

However, this narrative is dangerously oversimplified, considering the steady growth in U.S. oil and gas production during the past decade, regardless of the direction prices fleetingly float.

Earlier this year, East Daley Capital Advisors Inc. published its annual report, “Dirty Little Secrets,” demystifying the disconnect by urging the market to shift its focus back to the basics of midstream fundamentals. So long as there is drilling, volumes must flow. So long as volumes flow, there remains opportunity for midstream growth.

“Dirty Little Secrets” takes a balanced approach to midstream fundamentals by examining industry tailwinds in conjunction with midstream-company treadmills, defined as legacy-asset cash-flow-decline risks.

The report also makes predictions for oil, gas and NGL supply/demand fundamentals out of Cushing, northeastern Pennsylvania and the U.S. Gulf Coast—in addition to the Permian, Bakken and Denver-Julesburg basins as well as the Guernsey, Wyo., hub.

About a fourth of the way into the year, several “dirty secrets” are already becoming market realities, including a shift in outflows of Permian crude volumes and the impending blowout of Bakken basis.

Slide to the Gulf

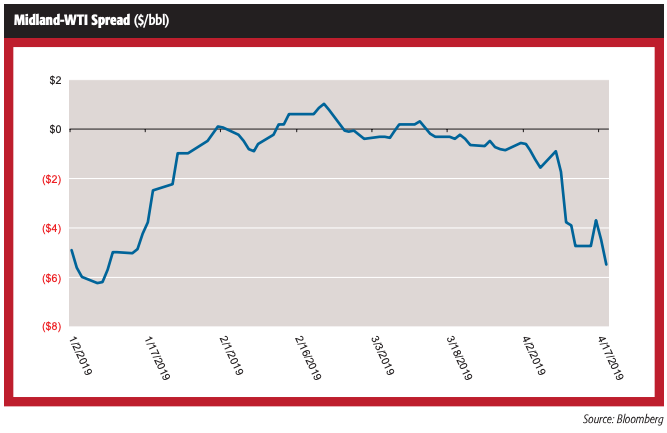

In the “Crude Circus” chapter, East Daley revealed its expectations for the Midland-Cushing and Midland-Gulf spreads to widen in the first half of 2019, followed by a sharp tightening in the second half on the heels of soon-to-be-overbuilt crude-takeaway capacity out of the Permian Basin.

As a result, northbound pipelines, including Basin, Centurion and Sunrise, would experience significant volume declines into 2020, reducing daily flow into Cushing by an estimated 500,000 barrels.

As new pipes come online out of the Permian, namely EPIC, Gray Oak and Cactus II, legacy lines will face the risk of lower re-contracting rates, reduced utilization and, notably, less marketing upside. Nearly five months into the year, the market is already bearing witness to this phenomenon.

The approximately 500,000 barrels a day (bbl/d) of volumes predicted to no longer flow northbound into Cushing will instead flow to the more premium-priced Gulf Coast market. Most of this displacement will occur as EPIC’s 400,000 bbl/d of capacity comes online in the third quarter as line filling is expected to start this month.

The Cactus II expansion begins operations in September with an initial capacity of 400,000 bbl/d and Gray Oak comes online in the fourth quarter with 900,000 bbl/d.

Party Crashers

Enterprise Products Partners LP crashed the 2019 expansion party early with its Seminole NGL-to-crude conversion (Midland-to-ECHO II), bringing 200,000 bbl/d online ahead of schedule in the first quarter.

What’s more, Enterprise, with some molecular magic of its own, managed to also expand its existing Permian crude-takeaway pipe, Midland-to-ECHO I, by an incremental 45,000 bbl/d, from 575,000 to 620,000.

The combined 245,000 bbl/d of additional egress connecting Midland to the Gulf Coast tightened spreads significantly in the first quarter, with Midland trading at a premium to Cushing at times.

Meanwhile, East Daley’s forecast for northbound volumes shifted from mere prophesy to reality as Sunrise-expansion daily barrels dropped by some 90,000 from November 2018 to February 2019.

Plains All American Pipeline LP, the company behind the Sunrise project, has about a third of the space on the expansion reserved for its own marketing arm. Plains has managed to keep its own barrels relatively flat since November, despite the tighter spread between Midland and Cushing, likely a result of strategic hedging.

The spread between the supply hub—Midland—and the storage hub—Cushing—has once again widened, as was anticipated in “Dirty Little Secrets” and as would have likely been the case sans Enterprise’s early, incremental 245,000 bbl/d of capacity.

As the spread tightens once more into the second half of 2019, East Daley anticipates the volume-shift trailer previewed in the first quarter to become a full-fledged feature film by year end.

Bakken BYOB

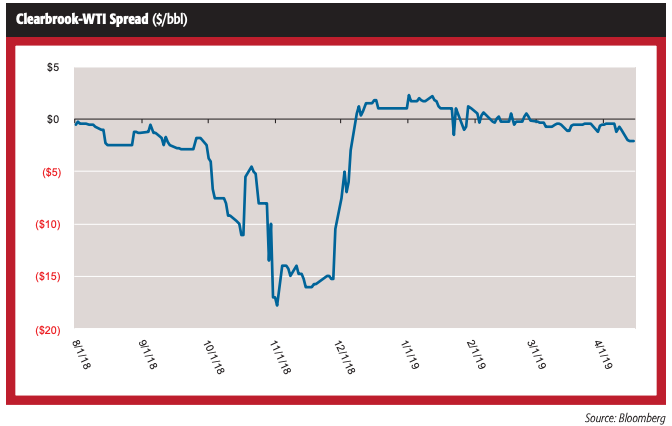

While spreads out of the Permian induce a shift in strategy favoring fee-based midstream revenues over large quarterly swings in marketing, Clearbrook basis (the proxy for Bakken crude prices) faces the opposite problem as incremental production and already-tight effective capacity make this basin ripe for another price blowout—blowing your own basis.

In “Dirty Little Secrets,” East Daley cleared many of the misconceptions enshrouding this prolific basin by calculating a true effective capacity for Bakken egress rather than relying on outright pipe capacity, which is also what equipped the firm to successfully predict the 2018 Clearbrook blowout.

Using that same methodology, East Daley continues to believe incremental Bakken production, combined with northbound takeaway constraints into Canada, will put significant pressure on Clearbrook basis, particularly in the second half, risking a blowout close to rail economics—assuming an expansion project does not come to the basin’s rescue in the interim.

The basis has not yet reached the wide spreads witnessed in November 2018, but the Bakken is well on track for downward price movement during the course of the year.

Energy Transfer LP confirmed in the first quarter that it plans to expand the Dakota Access Pipeline (DAPL), one of the largest egress pipes out of the basin, from 525,000 bbl/d to 570,000. However, the latest reported volumes for DAPL indicate the pipe averaged 565,000 a day in fourth-quarter 2018, well above its original stated capacity.

This implies that either Energy Transfer’s marketing arm is benefitting from the additional barrels or the expandable capacity for the pipe is greater than the stated 570,000—or both.

What most market participants miss about the Bakken is the effect that spreads between WTI and the Gulf Coast can have on Clearbrook.

Another Whistle

As additional Permian egress tightens prices between the Permian triangle—Midland, Cushing and the Gulf Coast—rail out of the Bakken becomes uneconomic, as spreads farther down the tracks no longer justify the long haul from the Dakotas/Montana to Houston.

The result is even tighter egress out of the basin and yet another whistle from the Clearbrook pressure-cooker.

Indeed, the story of crude flows between price hubs is far more complex and interconnected than meets the eye. There is, however, upside for midstream companies already on the Bakken playing field, including Energy Transfer, which is arguably best equipped to commission a brownfield expansion on DAPL and its Energy Transfer Crude Oil Pipeline.

Kinder Morgan Inc.’s Double H Pipeline could also benefit from a brownfield expansion and/or increased rate stability. True Oil LLC’s Butte and Belle Fourche pipelines could witness increased flows and TransCanada Corp.’s Keystone XL Pipeline could add a much-needed argument to its beleaguered greenfield expansion endeavors.

Justin Carlson is vice president and managing director of research at East Daley Capital Advisors Inc.

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.