“We are clearly living in the era of the failure of the petrostate [economies],” Ed Morse, global head of commodity research for Citigroup, told attendees of the recent A&D Strategies and Opportunities conference. (Source: Shutterstock.com)

DALLAS—While multiple variables are typical in many commodity forecasts, the current outlook for oil carries a much greater risk than usual of being whipsawed in one direction or another. What will prove to be the greatest force? Will it be tit-for-tat tariffs in a trade war? Or maybe geopolitical risks, fundamental factors or a tightening of the diesel market?

“There is an unbelievable amount of uncertainty in this market,” said Ed Morse, global head of commodity research for Citigroup, at Hart Energy’s recent A&D Strategies and Opportunities conference.

The oil market’s uncertainty is reflected in Citi’s multi-scenario outlook, in which “near-term risks are skewed to the upside, but longer-term to the downside.” For example, Citi’s base case forecasts Brent averaging $79 per barrel (bbl) in the fourth quarter of this year—and thus moving up to more than $80 at times in the quarter—but then sliding down to average $62/bbl in the fourth quarter of next year.

But the probability given to its base case is not high at 55%. Its bull case (35% probability) forecasts Brent averaging $91/bbl in the fourth quarter of this year and then dropping to $83/bbl in next year’s fourth quarter. Its bear case (10% probability) predicts Brent prices of $61/bbl and $49/bbl in the fourth quarters of 2018 and 2019, respectively.

Part of the heightened uncertainty is “a result of trade tantrums that are in existence between the U.S. and its major trading partners. We don’t know where they will go,” Morse said. “Potentially, they could lead to a serious acceleration of a decline in economic growth, shaving maybe even 0.5% off growth from this year into next year—not a fun market to think about.”

At the same time, “we anticipate that an awful lot of oil is going to come off the market from Iran as a result of the resumption of sanctions in less than two months on Nov. 4,” he said.

Morse also pointed to the concern about how many barrels will be lost from Venezuela. “Is it going to be 200,000, 300,000, 500,000 bbl/d or more?” he asked. “And who has the capacity to put oil back into the market?”

Wide swings in crude price might seem alarming, but Morse said it’s the current nature of the world.

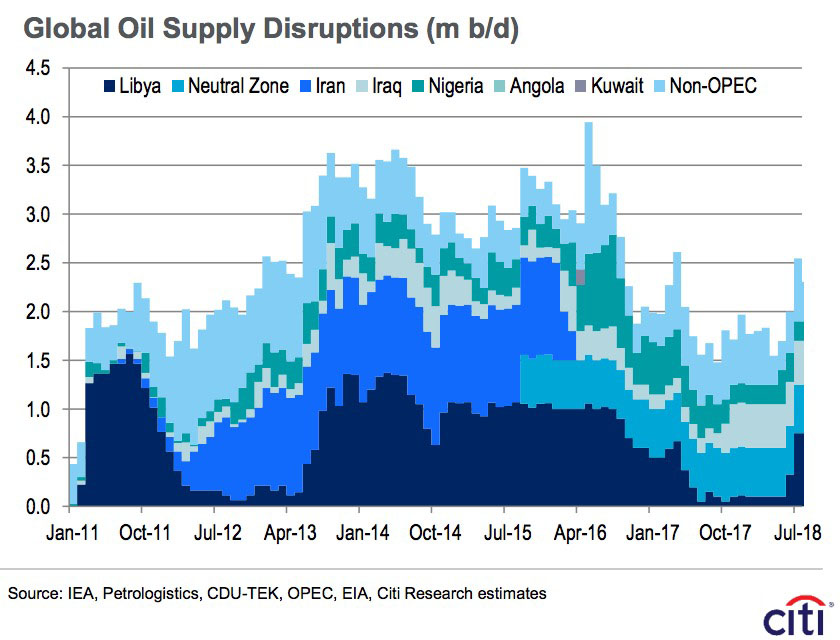

“We are clearly living in the era of the failure of the petrostate [economies], and that gives rise both to market volatility and the type of market tightness that would suggest that oil prices have to be going up,” he said. “We don’t know if, in addition to more barrels lost from Venezuela, there’ll be more barrels lost from Libya, from Nigeria, potentially from Iraq.”

However, other things being equal, Morse predicts that supply will overwhelm demand, inventories will start to build, and by the end of 2019, Brent will fall to the low $60s. While some forecasters hold the view that “a supply gap is emerging,” he said, Citi expects any such gap to be “well met by OPEC, non-OPEC and shale over the next five years.” The market could even be “crowded.”

Morse acknowledged recent factors pointing to market tightness: declining capex trends in the wake of the 2014 oil crash; less than plentiful discoveries; and effective spare capacity held by OPEC plus Russia of 1.2 million barrels per day (bbl/d) vs. nominal capacity of 3.5 million bbl/d. Still, efficiency of capex has been rising, finding costs have been coming down, and discoveries have been accelerating, he noted.

An emerging gap in supply hasn’t materialized, he said, “largely because we’re not seeing decline rates kicking in, we’re in fact seeing capital efficiency growing, and every year we’re seeing more projects being sanctioned, so the supply gap keeps getting pushed out.” Non-OPEC decline rates (ex-shale) are projected to hold in a range of 5.1%-5.6% for 2018-2020, according to Citi.

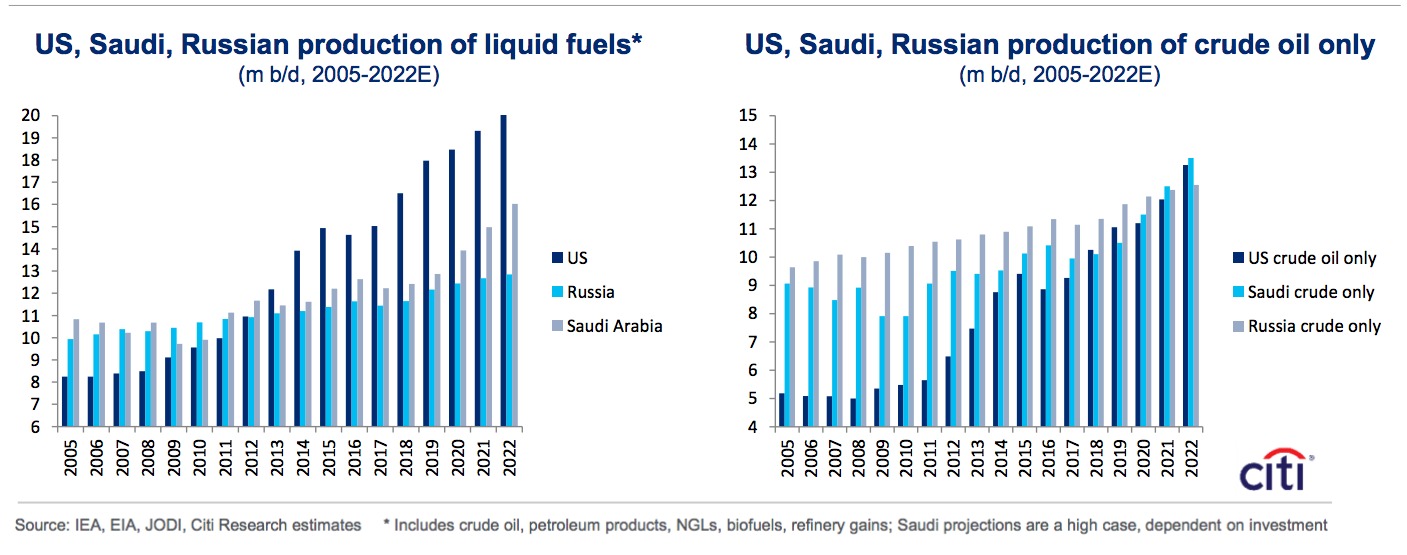

Morse described Saudi Arabia and Russia as “uncommon bedfellows,” who joined together in 2016 to “cut production enough to dry up inventories.” Though, the “commonality of interest has begun to separate.” Taking market share from Saudi Arabia, Russia is now the largest supplier to China, he said and is providing greater supplies to India.

“The Russian ruble had depreciated, its cost of production has plummeted, drilling has been at a record level, and discoveries have been at a record level,” he said. “We project that Russia could bring about 1.4 million bbl/d to the market between now and 2022. And it may be a higher number than that because discovery rates are continuing apace. They’ve already added 300,000 bbl/d this year.”

Morse also pointed to the “scale” achieved by the U.S. industry—now the world’s largest liquids producer—and projected that exports would exceed imports no later than the end of 2019. Already, the U.S. produces 17 million bbl/d of liquids (black oil, NGL, biofuels), and over the next seven years, it is expected to add another 7 million bbl/d to reach 24 million bbl/d, according to Citi.

“We’re currently seeing a combination of U.S. crude oil exports, combined with NGL and petroleum products, hitting the 8 million bbl/d level,” Morse said. “I think it will be 9 million bbl/d by this time next year, and 10 million by this time in 2020. And exports will exceed our imports, at the latest, by the end of 2019.”

As regards the regulations being introduced in 2020 by the International Maritime Organization, called IMO 2020, Morse projected a markedly tighter market for diesel.

“Diesel demand has been growing rapidly at a time when we thought it was flattening out,” he said. “If it continues to grow at anything near the current pace, diesel demand will continue to grow, that will tighten the diesel market just as we get IMO in 2020, and the 5 million bbl/d bunker fuel market will add 1.3 million bbl/d of demand for ultra-low sulfur diesel. I don’t think the refining system in the world will be able to handle that.”

What are signs to look for to take the temperature of emerging market demand, especially in China?

“The world may well be underestimating the fragility embedded in the Chinese economy,” Morse said. “The economy is based on growth in consumer spending, and consumer spending has tailed off. Recent automotive sales aren’t running at the 26 million cars per annum rate that it was one year ago. It’s running at more than two million cars fewer than that. If you look at almost every indicator of consumer spending in the economy, it’s not consistent with a 6% growth rate.”

Chris Sheehan can be reached at csheehan@hartenergy.com.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.