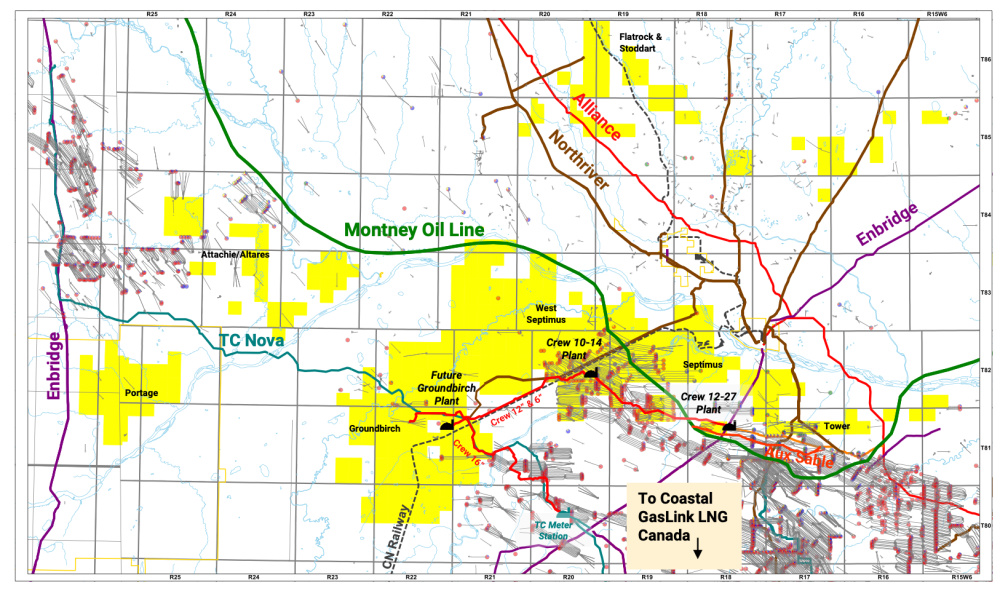

With completion of the disposition, Crew Energy said it has successfully monetized a noncore portion of its asset base to focus on production growth in the Greater Septimus and Groundbirch areas. Pictured, is Crew Energy Montney operations. (Source: Crew Energy Inc.)

Crew Energy Inc. successfully completed the sale of certain noncore assets at Attachie and Portage in northeast British Columbia for gross proceeds of CA$130 million, the Calgary, Alberta-based gas and liquids producer said in an Aug. 18 release.

“With completion of the disposition, Crew has successfully monetized a noncore portion of our asset base to focus on production growth in the Greater Septimus and Groundbirch areas. In concert with the strong adjusted funds flow (AFF) and free AFF realized to date in 2022, the proceeds from this transaction will further contribute to our financial flexibility and form the basis for development of an updated strategic plan that builds on the momentum realized over the past 24 months,” the company said in the release.

Crew Energy is a growth-oriented natural gas-weighted producer operating exclusively in the Montney play in northeast British Columbia. The company holds a large, contiguous land base of over 264,000 net acres (more than 225,000 net undeveloped acres) in the Montney, according to its website.

The divestiture includes approximately 47,025 net acres of Montney rights on land north of the Peace River with no associated production or facilities, total proved reserves of 4.7 million boe, representing 2.3% of total corporate proved reserves. Associated future development capital are $25.7 million. Total proved plus probable reserves are 34.2 million boe, representing 8.5% of total corporate proved plus probable reserves, with associated future development capital of $182.9 million.

The buyer was not disclosed. The net proceeds from the divestiture will be used to redeem $128 million principal amount of the company's 6.5% senior unsecured notes due 2024, of which an aggregate principal amount of $300 million is currently outstanding.

TD Securities Inc. was financial adviser to Crew in respect of the disposition. TD Securities Inc. and National Bank Financial acted as co-financial advisers to Crew in respect of the partial redemption of 2024 notes.

Recommended Reading

EQT Strengthens Appalachian Position in Swap with Equinor

2024-04-16 - EQT, the largest natural gas producer in the U.S., is taking greater control of the production chain with its latest move.

EQT, Equitrans Midstream to Combine in $5.5B Deal: Reports

2024-03-11 - EQT Corp.'s deal would reunite the natural gas E&P with Equitrans Midstream after the two companies separated in 2018.

EQT, Equitrans to Merge in $5.45B Deal, Continuing Industry Consolidation

2024-03-11 - The deal reunites Equitrans Midstream Corp. with EQT in an all-stock deal that pays a roughly 12% premium for the infrastructure company.

EQT Ups Stake in Appalachia Gas Gathering Assets for $205MM

2024-02-14 - EQT Corp. inked upstream and midstream M&A in the fourth quarter—and the Appalachia gas giant is looking to ink more deals this year.

EQT Deal to ‘Vertically Integrate’ Equitrans Faces Steep Challenges

2024-03-11 - EQT Corp. plans to acquire Equitrans Midstream with $5.5 billion equity, but will assume debt of $7.6 billion or more in the process, while likely facing intense regulatory scrutiny.