Sendero Midstream was formed in 2014 by members of its management team and Energy Capital Partners. (Source: Hart Energy / Crestwood)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Crestwood Equity Partners LP unveiled on May 25 a series of transactions worth a total of roughly $1.2 billion that more than doubles Crestwood’s natural gas processing capabilities in the Delaware Basin while also exiting its legacy Barnett Shale position.

“I am thrilled to announce this series of strategic transactions that greatly enhance the Crestwood franchise by creating immediate scale and additional runway in the Delaware Basin, high-grading our cash flow mix through the rationalization of noncore assets, and successfully maintaining our conservative balance sheet and financial flexibility,” Robert G. Phillips, Crestwood’s founder, chairman and CEO, commented in a company release.

The series of agreements announced May 26 include the acquisition of Sendero Midstream Partners LP for $600 million in cash, which Crestwood said it “prudently financed” with cash proceeds from the divestiture of its Barnett Shale assets and borrowings on Crestwood’s revolving credit facility.

“Today’s announcement also marks the culmination of our long-term investment and operating footprint in the Barnett Shale,” Phillips said.“The Barnett Shale is where Crestwood started dating back to October 2010 and I want to personally thank our field employees for their hard work, dedication, and loyalty over the past 12 years, as they have fully embodied Crestwood’s core principles with an unwavering commitment to operational safety and performance.”

EnLink Midstream LLC agreed to acquire Crestwood’s legacy, noncore Barnett Shale assets for $275 million in cash. The divestiture of Crestwood’s assets includes the Alliance System, the Lake Arlington System and the Cowtown System, representing a full exit for the company from the Barnett Shale.

“We are excited to pass the torch to EnLink Midstream who shares Crestwood’s commitment to operational excellence and corporate stewardship,” Phillips said. “As we close this chapter in Crestwood’s history, we will continue to focus on building and optimizing our sizeable gathering and processing positions in the Williston Basin, Delaware Basin and Powder River Basin.”

Crestwood will utilize the cash proceeds from the sale to fund the cash consideration for the Sendero Midstream acquisition.

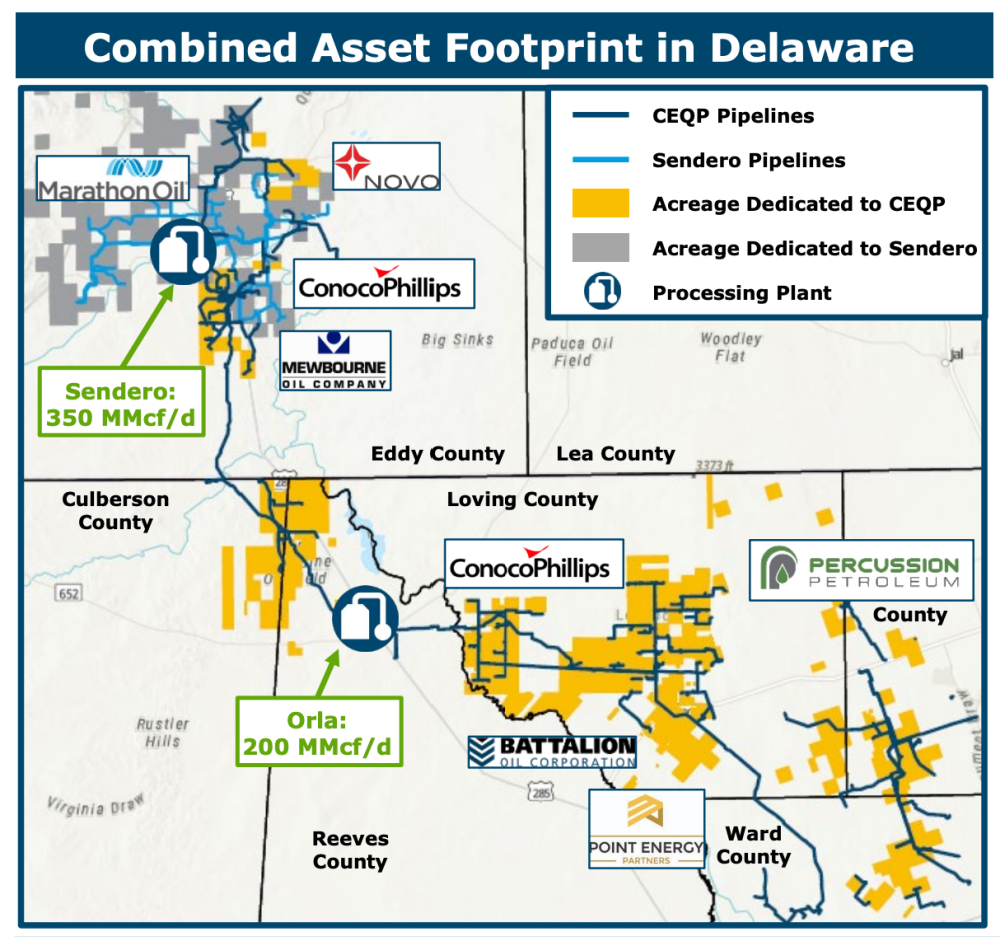

The addition of the Sendero Midstream assets, located in Eddy County, New Mexico, nearby Crestwood’s West Lake System, are set to more than double Crestwood’s natural gas processing capabilities in the Delaware Basin.

“The acquisition of Sendero Midstream is highly complementary to our existing Willow Lake assets, provides excess processing and compression capacity for current and future customer development activity, and solidifies Crestwood’s footprint in the leading North American shale play,”

The Sendero Midstream assets are comprised of 350 MMcf/d of processing capacity, approximately 140 miles of natural gas gathering lines and more than 53,000 horsepower of field gathering compression. The acquisition of Sendero Midstream also adds more than 75,000 dedicated acres with over 1,200 tier 1 drilling locations, long-term fixed fee contracts with commodity price upside, and a diverse and active set of private and public producer customers.

Following the acquisition, Crestwood expects that the Delaware Basin will become the company’s second largest cash flow contributor with 2023E adjusted EBITDA of $190 million to $200 million, representing approximately 20% of total company cash flow. The pro forma system will have total processing capacity of 550 MMcf/d with approximately 100 MMcf/d of unutilized space, which reduces the capital investment necessary to expand Crestwood’s existing Orla plant to meet existing producer customer needs.

Separately, the company announced on May 25 it had also agreed to acquire First Reserve’s 50% equity interest in Crestwood Permian Basin Holdings LLC (CPJV) for $320 million in Crestwood common units, plus the assumption of asset level debt. As part of the valuation and a condition to closing the transaction, First Reserve will fund $75 million into CPJV to paydown asset level debt and support a portion of the cash consideration due to Sendero Midstream.

Pro forma for the transaction, First Reserve will own approximately 10% of Crestwood’s common units outstanding. In addition, Crestwood will assume roughly $75 million in remaining debt outstanding at the joint venture level.

“Furthermore, the consolidation of First Reserve’s equity interest in CPJV simplifies our corporate structure and drives enhanced financial, commercial and operational flexibility,” he said. “Both transactions are highly synergistic and will drive meaningful accretion to our distributable cash flow for many years to come.”

The transactions have been unanimously approved by the board of directors of Crestwood’s general partner, Sendero Midstream and First Reserve, and are expected to close early in third-quarter 2022.

Pro forma for the transactions, first-quarter leverage was approximately 3.8x, and Crestwood expects leverage to return to sub-3.5x in 2023 as the assets are fully integrated and synergies are achieved, according to the release.

Additionally, Crestwood said it will continue to maintain flexibility under its $175 million common and preferred unit buyback program to further enhance returns and cost of capital opportunistically.

RBC Capital Markets was lead financial adviser, Citi was financial adviser and Vinson & Elkins LLP and Locke Lord LLP were legal advisers to Crestwood. Morgan Stanley & Co. LLC was financial adviser and Latham & Watkins LLP was legal adviser to Sendero Midstream. Simpson Thacher & Bartlett LLP was legal adviser to First Reserve. Baker Botts LLP was adviser to EnLink Midstream.

Recommended Reading

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.