Crescent Energy Co. on March 30 closed its acquisition of Uinta Basin assets in Utah previously owned by EP Energy for $690 million—several hundred million dollars less than originally announced.

“We are excited to close this highly accretive transaction and expand our Rockies position,” Crescent CEO David Rockecharlie commented in a company release.

Houston-based Crescent Energy had previously announced the agreement in February to acquire the Uinta Basin assets in an all-cash transaction from Verdun Oil Co. II LLC, an EnCap Investments LP-backed firm formed in 2015. At the time of the transaction’s announcement, the company said total cash consideration was approximately $815 million.

“The Uinta transaction clearly demonstrates Crescent’s competitive strengths and ability to deliver shareholder value through accretive acquisitions,” Crescent Chairman John Goff said in the release on March 30.

“We continue to see significant opportunity in today’s market to create long-term value for our shareholders through consolidation,” Goff added.

The Uinta transaction was funded on Crescent’s revolving credit facility. At closing, Crescent’s lenders increased the borrowing base under the credit facility to $1.8 billion with an elected commitment amount of $1.3 billion, an increase of $600 million from the prior elected commitment amount of $700 million.

“We were able to acquire these assets at a compelling valuation while maintaining our financial strength and flexibility,” Rockecharlie also said. “The transaction adds significant cash flow and a multiyear inventory of high-quality oil-weighted undeveloped locations to our existing asset base.”

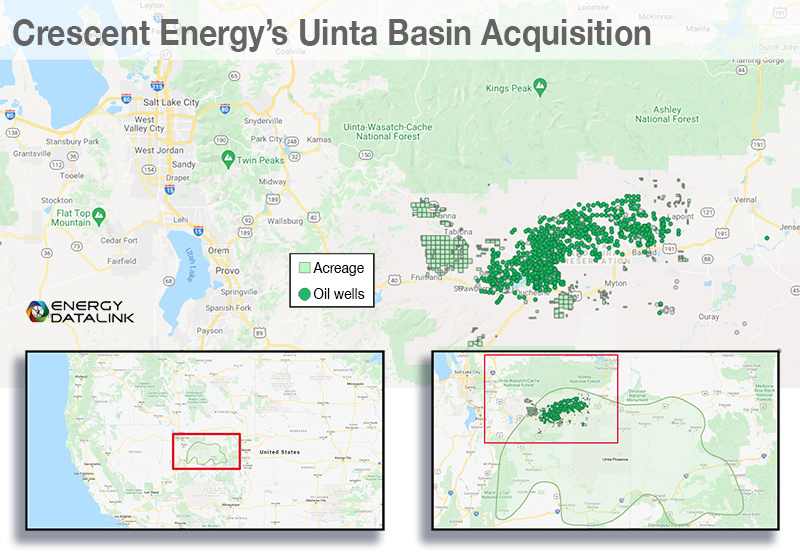

The Uinta acquisition included approximately 145,000 contiguous net acres in Utah producing about 30,000 boe/d, roughly 65% oil. EP Energy had previously owned the assets, according to the Crescent Energy release on Feb. 16.

In August 2021, EnCap Investments had agreed to take over EP Energy’s assets in the Eagle Ford and Uinta basins in a $1.5 billion deal, less than a year after EP Energy emerged from a bankruptcy process that handed control to its creditors.

However, U.S. antitrust regulators had threatened to block EnCap’s takeover of the EP Energy assets, citing concerns about the private equity firm’s dominance in the Uinta shale play.

On March 25, Reuters reported that the U.S. Federal Trade Commission (FTC) approved EnCap’s $1.5 billion takeover of EP Energy on the condition that the firm sell EP Energy’s entire Utah oil business.

The FTC said the deal without the sale of the assets in Utah would have left just three significant producers that sell Uinta Basin crude oil to refiners in Salt Lake City, and led to higher prices for consumers, according to the Reuters report.

Crescent Energy formed in December through the all-stock combination of Contango Oil & Gas with a KKR-backed team. The company, which remains partnered with KKR, currently operates a portfolio of assets across the Lower 48 with Contango as its operating subsidiary.

Following closing the Uinta acquisition, Crescent Energy plans to operate two rigs on the Uinta assets for the remainder of the year.

The company also reiterated on March 30 its previously announced 2022 capital investment plan as well as production and cost guidance. The $600 million-$700 million 2022 capital program is allocated 80%-85% to its operated assets in the Eagle Ford and Uinta basins.

Including contribution from the acquired Uinta assets, Crescent’s pro forma year-end 2021 proved reserves totaled 598 million boe, of which 83% were proved developed and 55% were liquids, and proved PV-10 was $6.2 billion utilizing SEC pricing. The first year decline rate of Crescent’s proved developed producing reserves is 22%, based on production type curves used in the company’s third party reserve reports.

Consistent with its risk management practices, the Company added additional oil hedges in conjunction with the Uinta transaction. Inclusive of expected Uinta volumes, Crescent now has derivatives in place on approximately 60% of expected 2022 total production.

Recommended Reading

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

US Drillers Add Most Oil Rigs in a Week Since November

2024-02-23 - The oil and gas rig count rose by five to 626 in the week to Feb. 23

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.