Erratic oil prices have weakened the A&D asset market during the final quarter of 2018 leading to smaller, scattered deals so far into the New Year. (Source: Hart Energy/Shutterstock.com)

Despite oil price volatility late last year leaving oil and gas producers struggling with A&D, a few operators in Colorado and the Permian Basin have managed to strike deals.

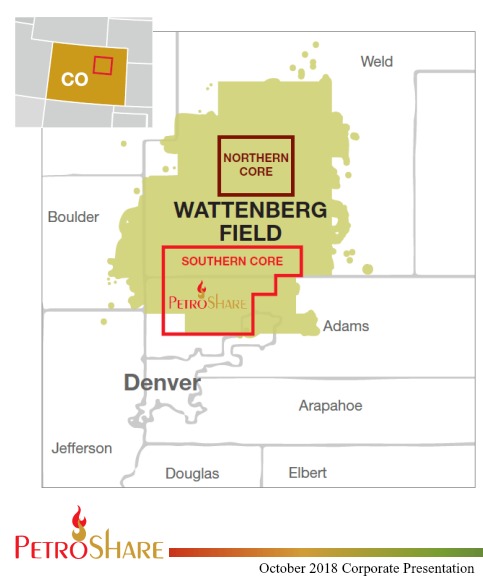

PetroShare Corp. recently agreed to sell nonoperated interests in the Wattenberg Field within the Denver-Julesburg Basin in Colorado, the company said in Jan. 15 filings with the U.S. Securities and Exchange Commission (SEC).

The Englewood, Colo.-based company entered a purchase and sale agreement in January to sell all its nonoperated interest in horizontal wells in the Wattenberg. The sale does not include any of PetroShare’s operated interest in its Shook Pad, where it has 14 producing wells and 88 permits in process.

The buyer, an undisclosed independent third-party, will purchase the assets from PetroShare for $16.5 million cash.

The transaction is notable for being one of the few publicly announced upstream A&D deals in the U.S. so far in 2019. Smaller, scattered deals include the Jan. 18 purchase by Amazing Energy Oil and Gas Co. of working interest in Lea County, N.M., from Wyatt Energy LLC. The $2 million transaction includes 56% working interest on two leases in the Permian Basin.

Nearly a month into 2019, Talos Energy Inc.’s (NYSE: TALO) U.S. Gulf of Mexico acquisition is so far the leader of the pack among deal makers. The Houston-based independent E&P said it acquired a roughly 9.6% nonoperated working interest in the Gunflint producing asset in the company’s Mississippi Canyon core area on Jan. 11 from an affiliate of Samson Energy Co. LLC for $29.6 million.

Erratic oil prices have weakened the A&D asset market during the final quarter of 2018. West Texas Intermediate crude futures ended the year down nearly 25% from 2017 at about $45.15 per barrel (bbl) after reaching a four-year high of $77.41/bbl in June 2018.

In 2018, more than $52 billion in upstream deals closed, according to Hart Energy, though weak oil prices and faltering stock prices wreaked havoc on December deals.

Craig Lande, managing director of RBC Richardson Barr, said he counted only four deals in December valued at more than $100 million during a presentation on Jan. 24 at the Independent Petroleum Association of America’s Private Capital Conference in Houston.

Still, Lande believes many assets are headed to the market in 2019, driven in large part by the billions of dollars in transactions last year. The logical buyers for most of the assets will be private equity, he said, adding firms have raised about $95 billion of dry powder dedicated to the E&P sector.

“There’s a lot of money [and] that’s not the problem—the money,” he said. “It’s obviously the timidness right now of pulling the trigger on deals.”

PetroShare is a core Wattenberg operator with a position covering roughly 34,000 gross (10,000 net) acres in Weld and Adams counties in Colorado, according to a company investor presentation from October.

The company has about 300 gross (65 net) horizontal Niobrara/Codell locations across its position, based on predominately two-mile lateral length wells.

The aggregate consideration payable to PetroShare for the sale is subject to purchase price adjustments, including but not limited to adjustments for certain title, environmental defects and casualty losses asserted prior to the closing.

The sale has an effective date of Jan. 1, and closing is scheduled for Feb. 25, the SEC filing said.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.