Pioneer’s Delaware Basin position will complement Continental’s existing deep inventory portfolio in the Bakken, Oklahoma and, most recently, the Powder River Basin, says Continental Resources CEO Bill Berry. (Source: Hart Energy)

After roughly a half-century operating as a leading U.S. oil and gas producer, Continental Resources Inc. is entering the country’s top shale basin.

The Oklahoma City-based company struck an agreement with Pioneer Natural Resources Co. on Nov. 3 to acquire all of Pioneer’s assets in the Delaware Basin portion of the Permian in an all-cash transaction valued at approximately $3.25 billion.

“Continental’s foundation has always been built upon a strong geology-led corporate strategy,” CEO Bill Berry commented in a company release. “This continues today and has directly led us to our new strategic position in the Permian Basin.”

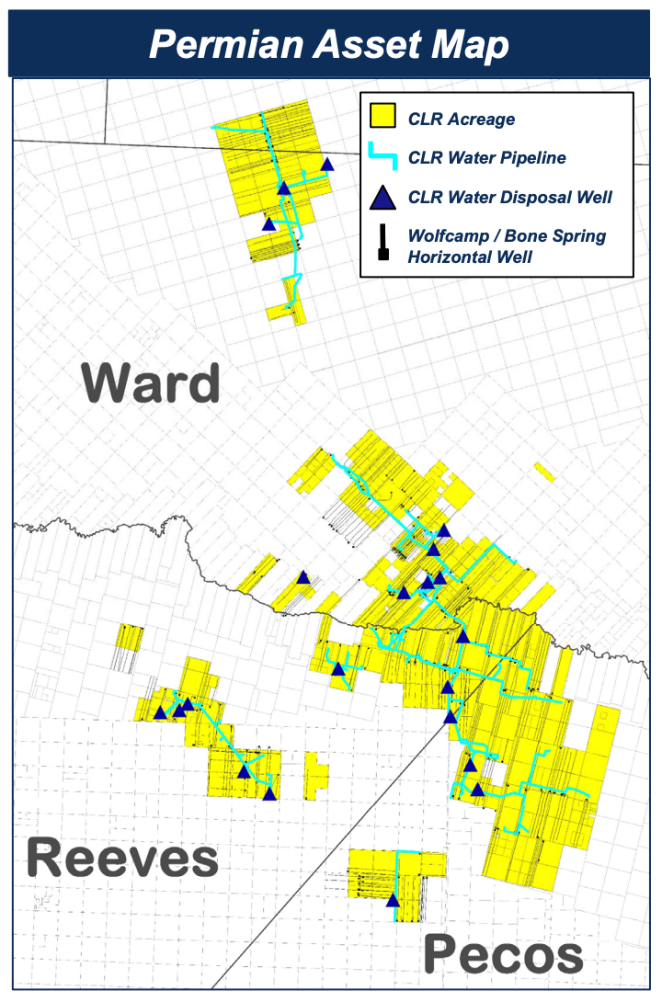

Pioneer’s Delaware Basin position covers approximately 92,000 net acres with net production of approximately 50,000 boe/d, which Berry said will complement Continental’s existing deep inventory portfolio in the Bakken, Oklahoma and, most recently, the Powder River Basin.

“In addition to the competitive geologic attributes,” he said, “this transaction is accretive on key financial metrics and supports our long term target of 1.0x net debt to EBITDAX by year end 2022 at $60 WTI.”

According to Continental, the transaction includes over 650 gross operated locations in Third Bone Spring/Wolfcamp A and B, totaling more than 1,000 locations when including additional zones producing in the basin. Further, the company expects the acquisition to be accretive to cash flow per share, earnings per share, cash margin and return on capital employed with PDP representing roughly 75% of transaction price.

“These Permian assets contain the key strategic components common to all of our assets with significant untapped potential to enhance performance through optimized density development, wellbore placement, operational efficiencies and further exploration,” added Jack Stark, president and COO of Continental.

For Pioneer, the transaction marks the Irving, Texas-based company’s exit from the Delaware side of the Permian Basin.

“This transaction returns Pioneer to being 100% focused on its high-margin, high-return Midland Basin assets, where we have the largest acreage position and drilling inventory,” CEO Scott D. Sheffield said in a separate company release.

Pioneer expects to recognize a pretax loss of $900 million to $1.1 billion associated with the divestiture. Proceeds will be used to strengthen the Pioneer balance sheet including supplementing the company’s “industry leading base and variable dividend program,” Sheffield said.

The transaction is expected to close toward the end of the fourth quarter, subject to the satisfaction of customary closing conditions, including regulatory approval.

Citi Global Market Inc. is Continental’s financial adviser and White & Case LLP is the company’s legal adviser with respect to the transaction. Pioneer retained BofA Securities Inc. as a financial adviser and Vinson & Elkins LLP as legal advisor for the transaction.

Recommended Reading

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.