At the White Star Petroleum bankruptcy court hearing, Contango Oil & Gas proposed a transaction on “substantially the same terms” as Mach Resources, but at a higher purchase price, according to bankruptcy documents. (Source: Hart Energy/Shutterstock.com)

Contango Oil & Gas Co. outbid Tom Ward’s Mach Resources LLC in an Oklahoma bankruptcy auction in September to win the assets of White Star Petroleum LLC, court documents of the $132.5 million deal revealed.

The acquisition is the second focused on Oklahoma by Houston-based Contango this year and, if both deals close, will gather an acreage position of more than 450,000 acres for a cost of roughly $155 million.

On Sept. 27, Contango said it entered an agreement to acquire the assets of White Star and certain affiliates as part of the Oklahoma City-based company’s Chapter 11 bankruptcy process. Formerly American Energy-Woodford LLC, White Star Petroleum was founded by the late Aubrey McClendon as an Oklahoma-focused E&P business. Previously, McClendon had co-founded Chesapeake Energy Corp. alongside Ward, who currently is heading his latest Oklahoma venture Mach Resources.

Mach and partner Bayou City Energy Management LLC bid on the White Star assets on Sept. 12 and executed an asset purchase and sale agreement. However, at the bankruptcy court hearing, Contango proposed a transaction on “substantially the same terms” as Mach, but at a higher purchase price. Mach declined to make a matching or higher offer, according to bankruptcy documents.

After deal adjustments, Contango will pay total cash consideration of less than $100 million for White Star’s assets, the company press release said.

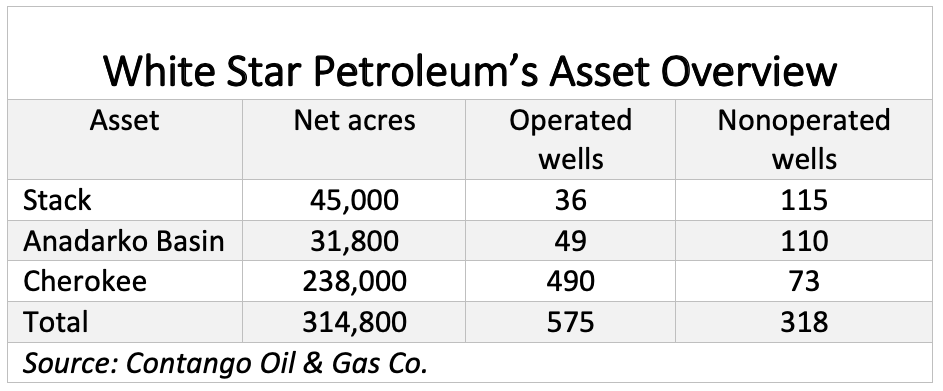

Contango said the deal will add average production of 15,000 barrels of oil equivalent per day (boe/d). Proved reserves were about 20 million barrels of oil equivalent as of the transaction’s July 1 effective date. Contango plans to divide the acreage, totaling 315,000 net acres, into three operating areas in Oklahoma’s Stack, Anadarko and Cherokee plays.

White Star filed for bankruptcy protection on May 28 with disclosed total debt of $343.7 million, according to Haynes and Boone LLP. The company’s production consists of liquids weighted at 63% oil and NGL. The acreage is 80% HBP.

About 65% of the wells are operated by White Star and are mature fields with strong cash flow and significant development potential from proved developed non-producing and proved undeveloped opportunities. The White Star assets also include integrated gathering and saltwater disposal systems, which reduces lease operating expenses and adds third-party cash flow.

Contango’s deal, set to close in fourth-quarter 2019, follows another Oklahoma-centric by the company, despite its reputation as an operator in the southern Delaware Basin, Wyoming and shallow-water Gulf of Mexico.

On Sept. 12, Contango said it would acquire Will Energy Corp. for $20 million and $3 million in stock, adding about 159,872 net acres in Western Oklahoma, the Texas Panhandle and North Louisiana.

Will Energy’s position comprises 147,312 net acres in the Western Anadarko Basin with the remaining acreage located in North Louisiana. The properties, which are about 95% HBP, produce about 1,400 boe/d, including 34% liquids production.

The Will Energy acquisition is also set to close in the fourth quarter.

Wilkie S. Colyer, Contango’s president and CEO, said the White Star deal “fits well from a geographic perspective with our recently announced pending acquisition of the Will Energy oil and gas assets.”

“We expect White Star to add approximately $60 million in asset level cash flow over the next twelve months,” he said. “It increases the company’s production by a factor of almost four times and more than doubles our PDP reserves, all at a very attractive purchase price that is substantially below [proved developed producing] PV-10.”

Haynes and Boone LLP is representing Contango in its acquisition of the White Star assets.

Roughly 35% of Contango’s equity is owned by billionaire investor John C. Goff and affiliates, including the recent investment of about $25 million in the company’s most recent equity offering.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.