The deal adds 182,000 net acres and 7,500 boe/d (55% liquids) of production where Contango Oil & Gas already has existing operations, according to the company release. (Source: Hart Energy)

Contango Oil & Gas Co. recently agreed to acquire a bundle of oily, low decline assets at what Contango CEO Wilkie S. Colyer described as an “attractive valuation.”

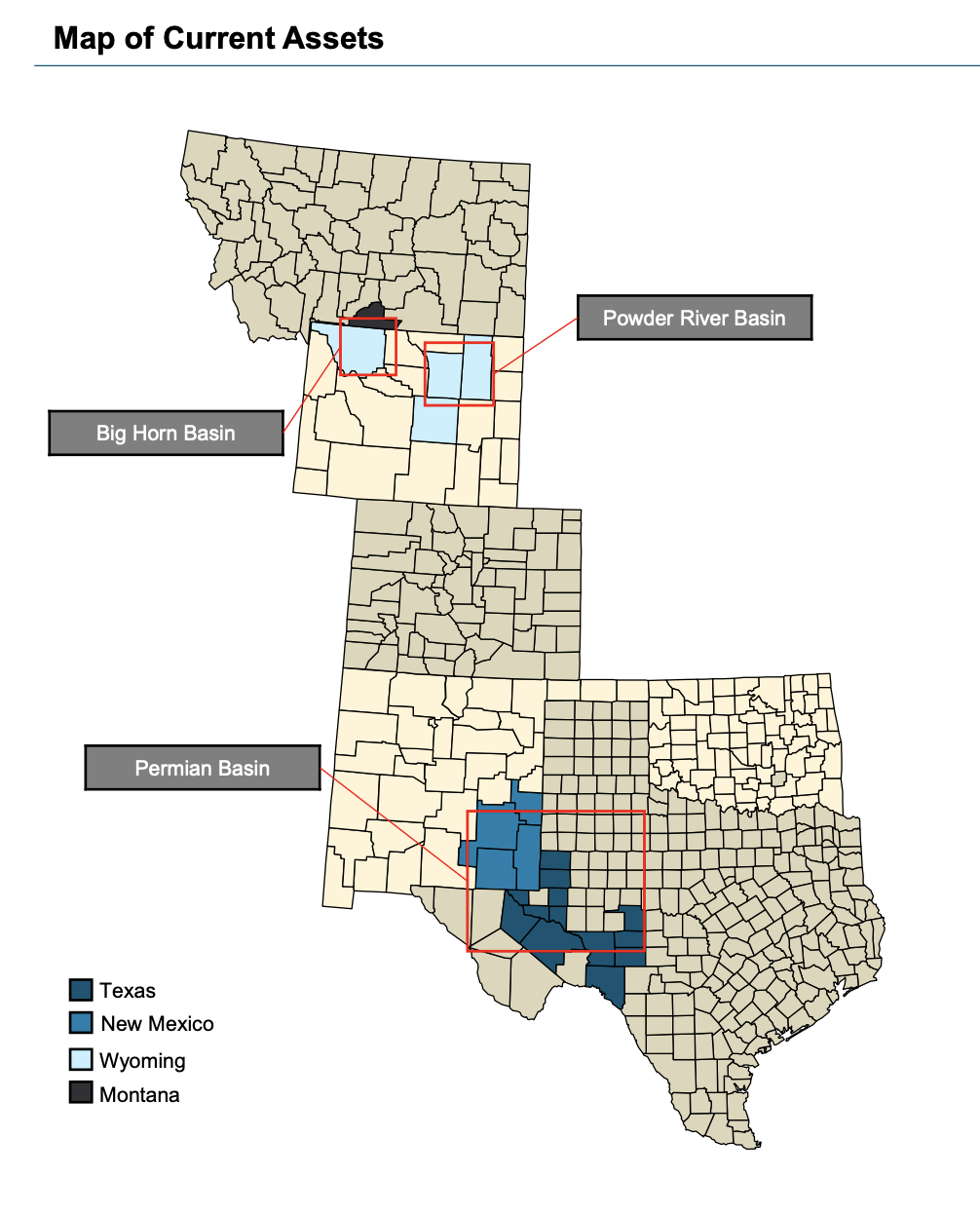

The Fort Worth, Texas-based company will pay $58 million in cash for the acquisition of PDP heavy reserves located in in the Big Horn, Permian and Powder River basins made via a bank-owned liquidation of assets. The transaction represents more than a 50% discount to producing reserve value, according to a company release from Nov. 30.

“This opportunity became actionable as a result of our proprietary pipeline of assets owned by non-natural owners, and our hope is that, as in this case, sellers view us as a solution provider as much as they do a counterparty in looking for a new home for stranded assets,” Coyler said in a statement.

The deal adds 182,000 net acres and 7,500 boe/d (55% liquids) of production to Contango’s portfolio in the Big Horn, Permian and Powder River basins, where the company already has existing operations. Contango paid about $7,700 per boe/d for the acquisition, according to estimates made by analysts with Enverus.

The largest property in the package, the Elk Basin Field within the Big Horn Basin, is a conventional asset which has been producing from multiple horizons for over 100 years. The field currently produces approximately 2,000 boe/d (87% oil and 100% liquids), having exhibited low single-digit decline rates for several decades, according to Contango.

The second largest asset in the portfolio, located on the Central Basin Platform and Northwest Shelf areas of the Permian Basin, currently produces 3,800 boe/d (40% oil and 59% liquids).

Contango estimates unlevered payback period on the mature conventional assets to be 2.7 years at Nov. 27 strip. Further, Coyler believes Contango has the expertise to maximize the value of the assets via its technical staff formerly at Mid-Con Energy Partners LP, which the company is in the process of acquiring through an all-stock deal announced in late October.

“This is another step for us in consolidating upstream assets in a difficult environment for the industry as a whole,” Coyler added in his statement on Nov. 30. “We will continue to be on the lookout for transactions accretive to our shareholders, defined as ones which increase intrinsic value per share, whether they be cash purchases, M&A, reorganizations, or distressed debt acquisitions in what continues to be a target-rich environment for us.”

On Nov. 30, Contango also announced a private equity capital raise with a select group of institutional and accredited investors. The company said it plans to use the expected approximately $22 million of proceeds from the sale of about 14.2 million shares of its common stock to fund the acquisition of assets in the Big Horn, Permian and Powder River Basins from an undisclosed seller.

The bank-owned liquidation transaction is expected to close Dec. 31 and have an effective date of Aug. 1.

Contango expects its acquisition of Mid-Con Energy to close by early 2021.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.