Following Contango’s merger with Mid-Con Energy, the combined company will be headquartered in Fort Worth, Texas, but will continue to maintain a presence in both the Houston and Oklahoma markets. (Source: Hart Energy)

Contango Oil & Gas Co. agreed on Oct. 26 to acquire Tulsa, Okla.-based Mid-Con Energy Partners LP in an all-stock merger that continues Contango’s consolidation strategy.

The transaction, which implies an enterprise value for the combined entity in excess of $400 million based on the closing price on Oct. 23, amplifies Contango’s ability to play offense amid the dislocation in the sector, while providing Mid-Con’s unitholders with greater liquidity, financial stability and opportunities for growth on a larger platform, the companies said in a joint statement.

“This combination increases our exposure to long-lived oil reserves and is accretive to Contango shareholders,” Wilkie Colyer, Contango’s CEO, said in the statement. “Our definition of accretive, by the way, is that it increases the intrinsic value of Contango on a per-share basis, and this transaction certainly fits that bill.”

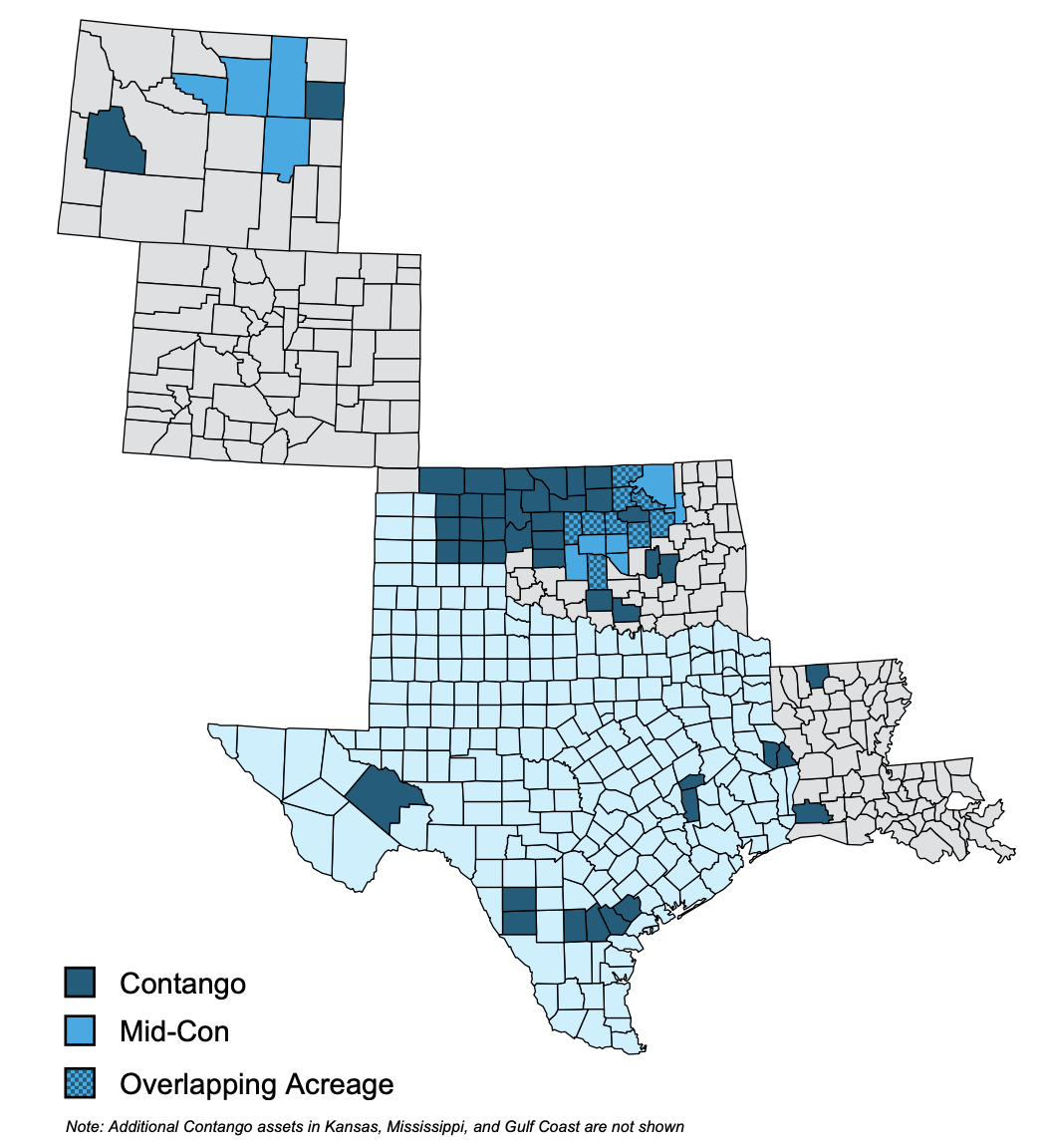

Formed in 2011, Mid-Con Energy is an upstream production company focused on conventional assets in Oklahoma and Wyoming. The company completed a strategic recapitalization transaction in June that included the resignation of CEO and Chairman Randy Olmstead, who had led the company since its predecessor was founded in 1986.

Concurrently with the restructuring, Contango agreed to take over as operator of Mid-Con’s properties, effective July 1, through a management services agreement.

In the joint release on Oct. 26, Contango CEO Colyer said the management services agreement had “meaningfully enhanced Contango’s expertise.” He added that the merger with Mid-Con is “simply the next step, and certainly not our last, in our stated goal of consolidating a sector that is in dire need of it.”

Contango is a Houston-based independent oil and gas company with both offshore and onshore assets. In late 2019, the company closed a duo deals that added 450,000 acres to its portfolio across Oklahoma, Texas and Louisiana for a cost of roughly $155 million. One of the deals included assets of Oklahoma-focused White Star Petroleum LLC through a bankruptcy auction.

Following the strategic merger with Mid-Con, the combined company will be headquartered in Fort Worth, Texas, but will continue to maintain a presence in both the Houston and Oklahoma markets. Contango’s senior management team will run the combined company, and Contango’s board of directors will remain intact.

The transaction, which is expected to close late 2020 or early 2021, has been unanimously approved by the conflicts committee of Mid-Con’s board and its full board of directors as well as by the disinterested directors of the Contango board.

Bob Boulware, the chairman of Mid-Con’s board of directors and its conflicts committee of independent, disinterested directors, stated: “This merger was negotiated by our conflicts committee, which determined, with the advice of its financial and legal advisers, that the consideration offered in the merger is fair, from a financial point of view, to Mid-Con’s unaffiliated public unitholders.”

Under the terms of the merger agreement, Mid-Con unitholders will receive 1.75 shares of Contango common stock for each Mid-Con common unit owned. The deal represents a 5% premium based on a 15-day, volume-weighted average price, according to the release on Oct. 26.

“We are pleased to be able to provide our unitholders with the opportunity to transition at an attractive exchange ratio to ownership of shares in a larger, better-capitalized company that is well-positioned for future growth,” Boulware added in his statement.

Contango ended the third quarter with $66 million of debt outstanding on its $75 million borrowing base credit facility and approximately $8 million of liquidity. The company received commitments from its and Mid-Con’s lenders that, effective upon the closing of the merger, Contango’s borrowing base on its revolving credit facility will be increased to $130 million.

Intrepid Partners LLC is financial adviser to Contango for the transaction and Gibson, Dunn & Crutcher LLP is its legal adviser. Petrie Partners LLC is Mid-Con’s financial adviser and Pillsbury Winthrop Shaw Pittman LLP is serving as its legal adviser.

Recommended Reading

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.

High Interest Rates a Headwind for the Energy Transition

2024-04-18 - Persistent high interest rates will make transitioning to a net zero global economy much harder and more costly, according to Wood Mackenzie Head of Economics Peter Martin.

Scotland Ditches 2030 Climate Target to Cut Emissions by 75%

2024-04-18 - Scotland was constrained by cuts to the capital funding it receives from the British government and an overall weakening of climate ambition by British Prime Minister Rishi Sunak, said Mairi McAllan, the net zero secretary for Scotland's devolved government.

Exclusive: Mitsubishi Power Plans Hydrogen for the Long Haul

2024-04-17 - Mitsubishi Power is looking at a "realistic timeline" as the company scales projects centered around the "versatile molecule," Kai Guo, the vice president of hydrogen infrastructure development for Mitsubishi Power, told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

Google Exec: More Collaboration Needed for Clean Power

2024-04-17 - Tech giant Google has partnered with its peers and several renewable energy companies, including startups, to ramp up the presence of renewables on the grid.