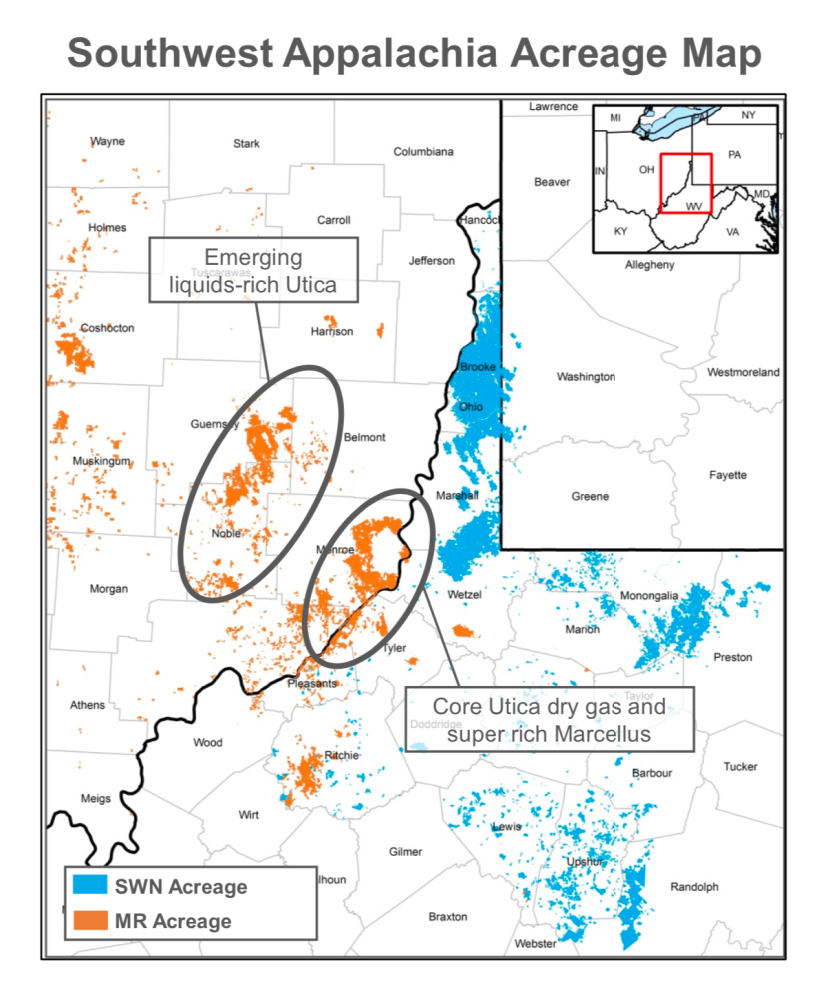

Southwestern Energy operates assets in Northeast Appalachia and Southwest Appalachia. (Source: Southwestern Energy)

Natural gas producer Southwestern Energy Co. said Aug. 12 it has entered a deal to acquire Montage Resources Corp. in an all-stock transaction, growing its position in Appalachia’s Utica and Marcellus shale plays.

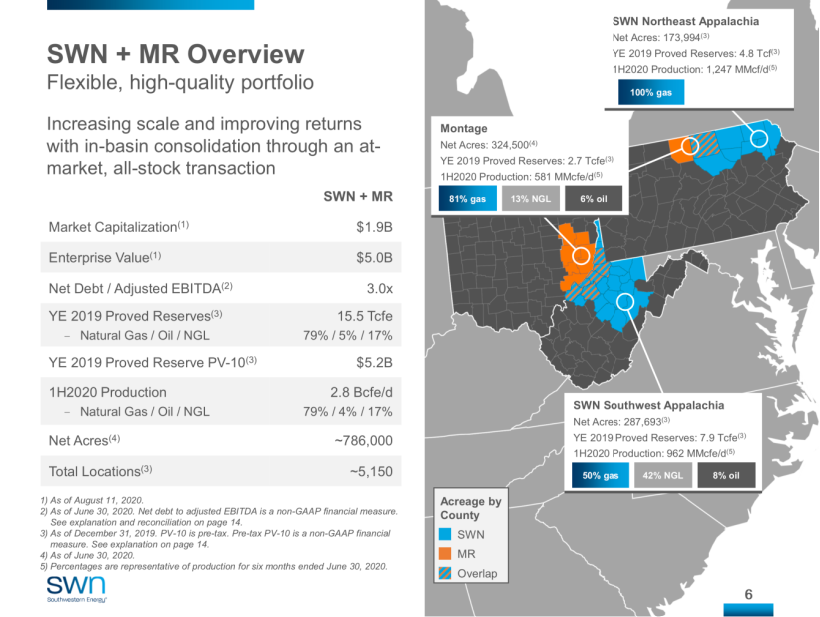

The implied value of the transaction is $213 million based on Southwestern Energy's Aug. 11 per share closing trading price, the company said in a filing with the U.S. Securities and Exchange Commission.

The deal comes about a year and a half after Montage was formed by the combination of Eclipse Resources and Blue Ridge Mountain Resources. For Southwestern Energy, the definitive agreement is another step toward growing its Appalachian business since exiting the Fayetteville Shale in 2018 to become an Appalachian pure-play E&P.

“The transaction is expected to build on our financial strength and flexibility and is expected to be accretive to all per share metrics, delivering increased value to our shareholders,” Southwestern Energy President and CEO Bill Way said on a call Aug. 12.

“With the complementary nature of Montage's high-quality assets, we expect to unlock additional value through increased scale, our demonstrated operational excellence and the benefits of our vertical integration all building upon the strong foundation montage has built with this diverse portfolio.”

The transaction, expected to close in the fourth quarter, starts a new chapter for Southwestern Energy, he said. The deal will add about 325,000 net acres to Southwestern’s portfolio, boosting its total net acreage to nearly 787,000.

With the acquisition, the company said its total production will rise to 251 Bcfe with about 3 Bcfe/d of production, of which about 80% is natural gas, making it the region’s third-largest producer.

In a news release, Way called the transaction value-adding for shareholders of both companies.

It’s expected to bring about $100 million in annual free cash flow based on current strip pricing starting in 2021 and about $30 million in annual G&A savings, Southwestern said in the release.

The “transaction value highlights the industry’s emphasis on low-to-no premium combinations,” Tudor, Pickering, Holt & Co. said in a note, which the analyst estimates “likely continues thematically in the space.”

As part of the deal, Southwestern commenced a registered underwritten public offering of 55 million shares of its common stock. Proceeds, the company said, will be used to retire a portion of Montage Resources’ 8.875% senior notes due 2023.

TPH pointed out that the exchange ratio of 1.8656 Southwestern shares for each outstanding Montage Resources share implies about $5.67 per share for Montage based on Southwestern’s Aug. 11 close, which the analyst said is about a 5% discount to Montage Resource’s close of $5.97 per share.

“This transaction creates a compelling opportunity for both Southwestern Energy and Montage Resources shareholders to benefit from the strength of the consolidated company,” Montage Resources President and CEO John Reinhart said in a news release. “The combination creates a company of substantial scale with capabilities to enhance cash flow generation and a strong balance sheet that provides opportunities for enhanced shareholder value creation.”

The transaction is subject to approval by Montage Resources shareholders and customary closing conditions.

EnCap Investments, which holds 39% of Montage’s outstanding common stock, has already signed a support agreement, Way said on the call.

Based in Irving, Texas, Montage Resources’ operating areas span more than 300,000 acres covering the Utica and Marcellus shales in southeastern Ohio, West Virginia and North Central Pennsylvania.

“The assets have exposure to natural gas, NGL and condensate, including the proven high return Marcellus, super rich and Utica dry gas windows,” Way said. “The 2.7 Tcf of proved reserves and 520 remaining locations increase our already deep inventory and add additional portfolio optionality to complement our current diversified portfolio.”

The acquisition news was delivered less than a month after Montage divested its noncore Ohio Utica wellhead gas and liquids gathering infrastructure in exchange for a cash payment of $25 million to an international third-party. That deal is also expected to close in the fourth quarter.

Spring, Texas-headquartered Southwestern Energy solely operates large-scale assets in Northeast Appalachia, where it is focused mostly on the Marcellus Shale, and Southwest Appalachia, where it’s focused on the Marcellus as well as the Utica and Upper Devonian reservoirs.

The combined enterprise will also have over 15 Tcfe of proved reserves and more than 5,000 remaining locations as of year-end 2019, according to Way.

“The increased scale resulting from this acquisition is expected to improve the company’s free cash flow sustainability, allow for greater capital investment optionality and facilitate further optimization of existing midstream commitments, offering a relevant and resilient value proposition for our shareholders,” he added.

Citi and Goldman Sachs & Co. LLC serves as financial advisors on the deal with Skadden, Arps, Slate, Meagher & Flom LLP acting as legal advisor for Southwestern. Barclays serves as financial advisor with Norton Rose Fulbright LLP acting as legal advisor to Montage Resources. Vinson & Elkins LLP is acting as legal advisor to EnCap Investments LP.

Recommended Reading

Par Pacific Asset-based Revolving Credit Bumped Up by 55%

2024-03-25 - The amendment increases Par Pacific Holdings’ existing asset-based revolving credit facility to $1.4 billion from $900 million.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Baytex Prices Upsized Private Placement of Senior Notes

2024-03-15 - Baytex intends to use the proceeds to pay a portion of outstanding debt on its credit facilities and general corporate purposes.